Truly Rich Club Stock Picks: Is ALI’s Growth Rate Better Than FLI And EEI?

If you’re a member of TRC, you’ve probably read that Truly Rich Club’s stock alert last January 24 is recommending a maneuver which they call a “Switch”. Switching means selling a stock at a loss to buy a new stock which has a higher probability of growth.

TRC is mentioning three stocks namely EEI, FLI and ALI. The recommendation is to sell EEI and FLI to buy ALI because TRC believes that ALI’s growth rate is faster than EEI and FLI.

I made a self-analysis if there’s some truth about this recommendation. Since TRC is talking about the stock’s growth rates, then this discussion will focus on that.

Valuations

So looking at the Revenue;

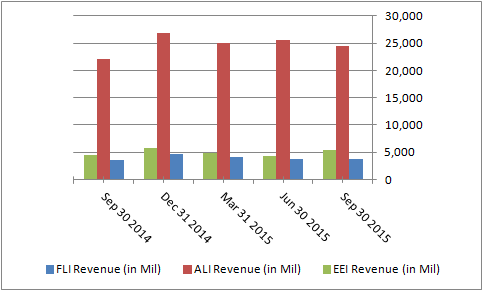

Fig. 1 Revenue for the past 5 quarters

We can see that for the past five quarters, revenue remained almost consistent which we obviously like.

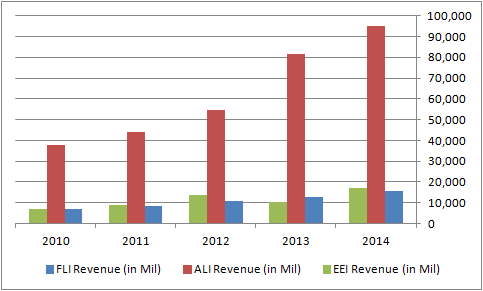

Fig. 2 Revenue for the past 5 years

Now looking at the 5-year revenue, we can see that ALI, EEI and FLI has increased its revenue by 152%, 148% and 119% respectively from 2010 to 2014. With that numbers, it clearly shows that ALI performed better compared to the other two based on the chart.

The Net Income for the last five quarters describes a different view of the company’s performance.

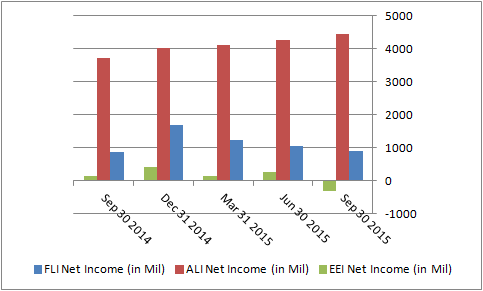

Fig. 3 Net Income for the past 5 quarters

EEI shows a 305.23% decline of earnings. FLI increased by about 3.20%. The highest is ALI which shows an increase of 18.80% on the last five quarters.

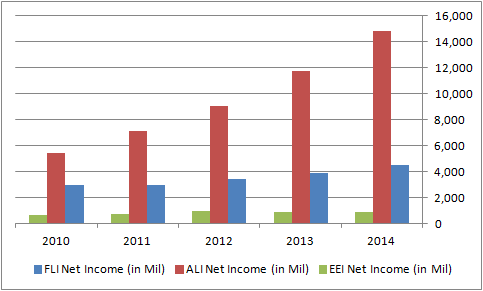

The 5-year Net Income still shows that ALI is the best performer among the three which shows a 171.22% increase in earnings from 2010 to 2014.

Fig. 4 Net Income for the past 5 years

Now that we saw and compared the revenue and net income of the three companies, I can say that I like ALI the most because of the growth performance of the company for the last 5 years.

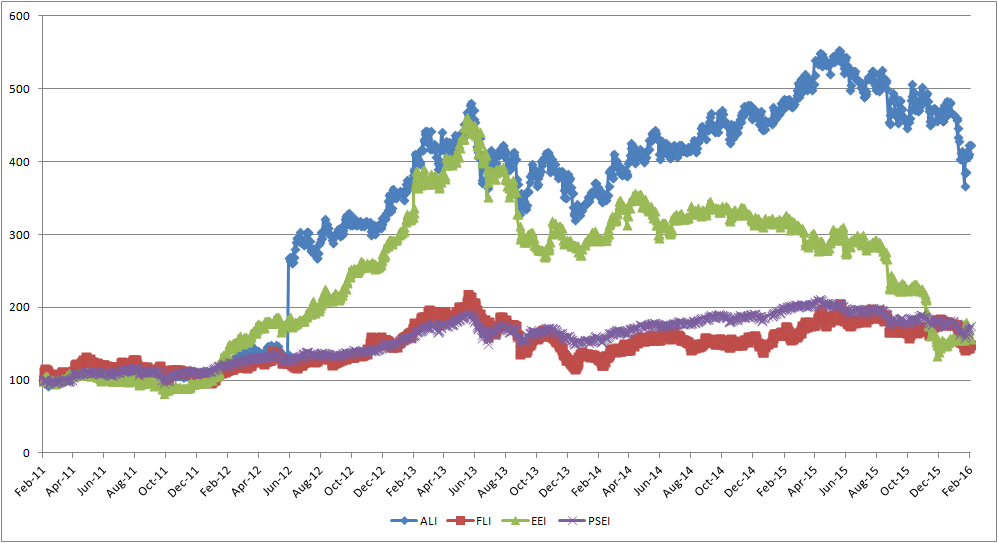

Now I wanted to know if ALI outperformed the PSEI. So what I did is I indexed the three companies to compare them side by side to each other.

Here’s the chart;

Fig. 5 Performance of ALI, FLI and MEG compared to the PSEi

It is clearly seen that ALI has outperformed the two including the PSE Index even if it shows poor performance last April 2015. Also, notice FLI’s slow but steady growth for the past 5 years. It’s performance barely outperforms the index.

And because of oil prices hitting rock bottom, EEI’s construction projects in the middle east were greatly affected. Earnings becomes affected too that’s why the stock also started to perform poorly last April 2015 until now. But still, it outperformed the index before under performing this year.

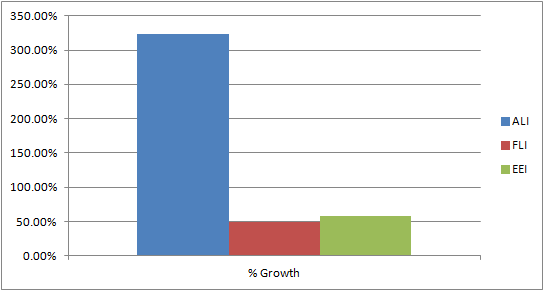

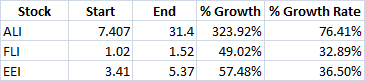

And to summarize, here’s the final growth rate computations I did

Fig. 6 Growth Rate

Fig. 7 % Growth Rate

All of the metrics I’ve shown based on past performance proves that ALI will grow faster than the other two stocks mentioned by Bro. Bo Sanchez.

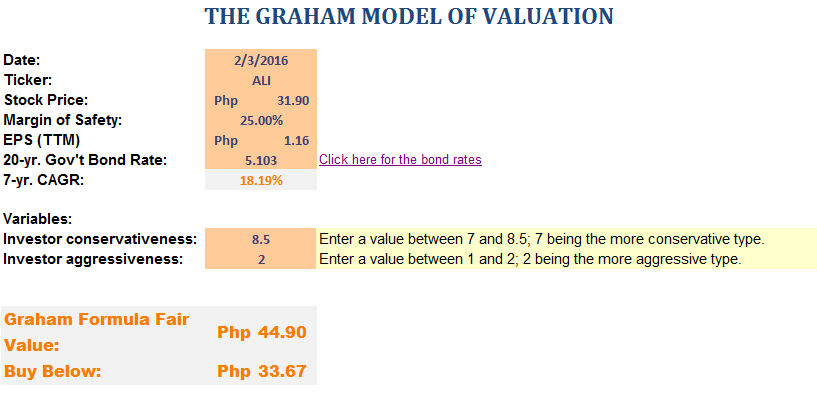

Using Graham’s Formula

TRC recommends buying ALI so I did a quick intrinsic value calculation using Graham’s formula below which I made here;

Fig. 8 Graham Formula

By using a 25% margin of safety, I’ve come up with a buy below price of Php 33.67.

Final Thoughts

My only advise is to please invest intelligently. Make sure to study the company fundamentals before making a decision to buy stocks based on investment guides.

You can learn more about how to get stock advise based on the Truly Rich Club’s SAM table here.

Happy investing!