CEMEX Stock Review: IPO That Aims To Pay Debt

CEMEX (CHP) will be listed on the PSE this coming July 18. Right now, many investors are curious about the company including me. Just like other investors, I’m curious if the company has the ability to sustain growth. If they can, then this will be a good investment.

In this review, I’ll highlight and summarize the important facts found on their prospectus. As responsible investors, we need to be informed right?

Quick Facts About CEMEX

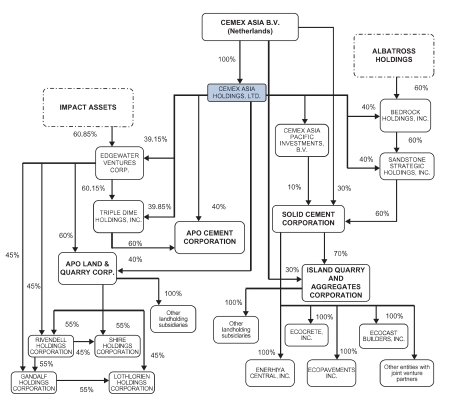

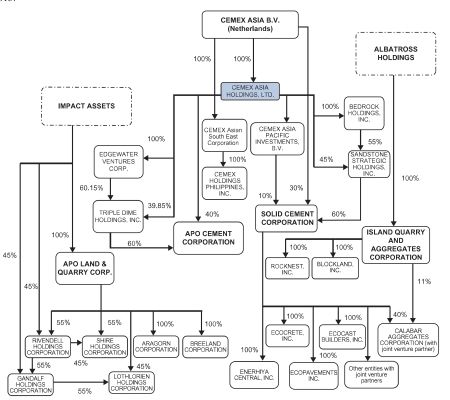

Operating Subsidiaries

Investment Holding Subsidiaries

Solid Cement’s Minority Investments

From the company’s description, it sounds like a good company to invest in right? I mean who doesn’t want to own shares on one of the largest cement producers in the Philippines?

Now let’s take a closer look on why they went public.

Why Is CEMEX Offering Shares To The Public?

CEMEX targets to collect net proceeds of approximately 32,832.6 – 37,757.5 Million Pesos. It seems that the proceeds from the offer will be used to pay a short-term loan worth 23,771.7 Million Pesos and the refinanced BDO loan and as partial payment for a long-term loan worth 16,649.6 Million Pesos with NSH, a subsidiary of CEMEX due to reorganization. The loans were entered last March 16 of this year.

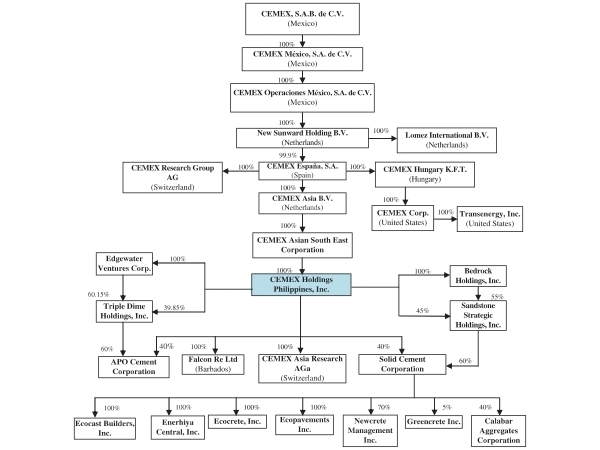

The reorganization summary is illustrated on the following pictures below.

Summary of the organizational and ownership structure prior to the reorganization.

Summary of the organizational and ownership structure as of December 31, 2015.

Summary of organizational and ownership structure as of the date's prospectus.

If the proceeds come short, they’ll refinance the debt to a longer tenor with NSH or refinance with another lender.

What about business expansion or investing? According to the prospectus, no part from the proceeds will be used to acquire other businesses, assets or offered as loans to other subsidiary companies. This means that they don’t aim for any expansion. They just want to pay their debts to NSH.

What About The Dividend Policy?

There isn’t any formal dividend policy yet but they said that they will declare dividends whenever there are unrestricted retained earnings.

According to them, the ability to pay out dividends will depend on whether they received sufficient dividends from the company’s subsidiaries to pay out to shareholders.

If you’re a dividend investor, this is something you should consider about.

Understanding CEMEX’s Debt Structure

I now know that the purpose of the IPO is to pay their loans to NSH because of reorganization. But what exactly is this about? Well this is kinda tricky considering CEMEX’s intricate organizational structure. But nevertheless, I’m here to give the easiest explanation as possible.

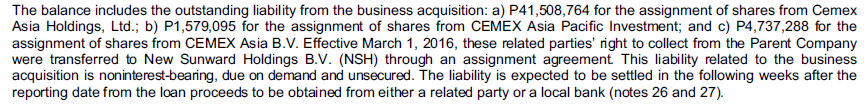

In the 3-month balance sheet as of March 31, 2016, there’s a line that says in the Current Liabilities as Payable To Related Parties amounting to 49,411.364 Million Pesos. One of the current payable comes from New Sunward Holdings BV (NSH) amounting to 47,825.147 Million Pesos. The explanation of this amount is explained below.

Explanation of the current payable to NSH.

Before reorganization, CEMEX had a presence in the Philippines through different affiliates and other companies in which CEMEX had minority equity ownership interests in cement and land & mining companies such as APO Cement, Solid Cement, IQAC and ALQC. We call this the “CEMEX Philippines Group”.

In preparation for the IPO, the group decided to separate the cement companies from the land & mining companies. On September 17, 2015, CHP was incorporated as a holding company for CEMEX’s cement business.

More reorganization took place after that. Companies sold their equity interests to other companies in preparation for the IPO.

Finally, on January 1, 2016, CHP acquired 100% equity interest on Solid Cement and APO Cement. The business acquisition was made possible by the assignment of shares from CEMEX Asia Holdings, Ltd., CEMEX Asia-Pacific Investment and CEMEX Asia B.V.

On March 1, 2016, the related parties’ right to collect were transferred to New Sunward Holdings B.V. through an assignment agreement. For this to be settled, CHP entered into a short-term and long-term loan agreement with NSH on March 9, 2016. the loans amounted to US$857 Million.

To pay for this loan, CHP decided to go public to raise US$535.82 Million.

This is what it’s all about. This is not bad at all in my opinion. The debt incurred is caused by reorganization, not because of management stupidity or what.

Valuations

The prospectus provides combined financial statements of all the company’s subsidiaries. So let’s take a look at it if this is a company worth investing.

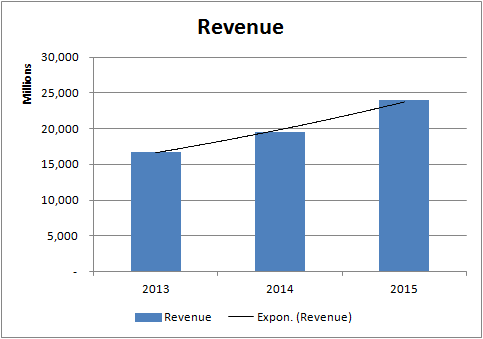

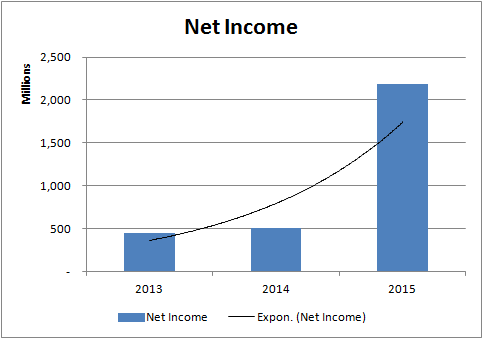

The Revenue and Net Income looks good.

12.58% CAGR.

68.87% CAGR.

Although both seems to be rising, the ratio between them is not a good indicator.

Description | 2013 | 2014 | 2015 |

|---|---|---|---|

Net profit margin | 2.70% | 2.60% | 9.12% |

Tab. 1 Net profit margin.

This would be better if the percentage ratio shows greater than 20%.

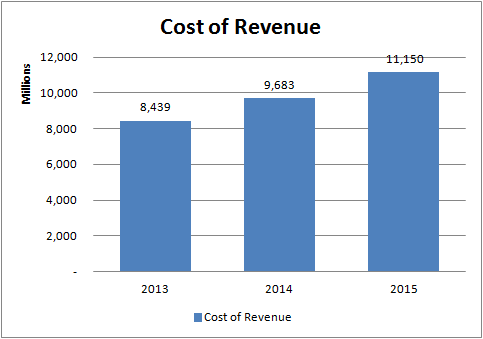

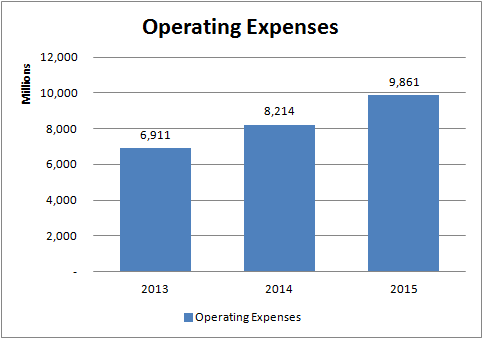

It seems like their Cost Of Revenue and Operating Expenses when added is too high.

It’s evident from these data that the cement industry is not as profitable as it seems. If the real estate and construction industry will boom then significant increase in sales should also be felt in the cement industry.

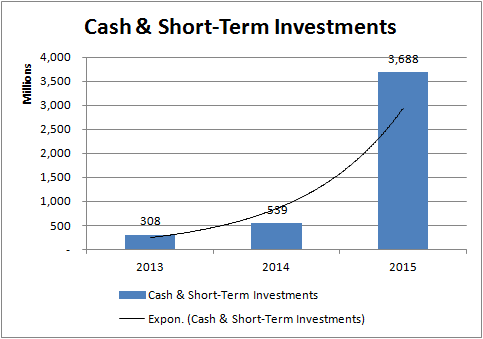

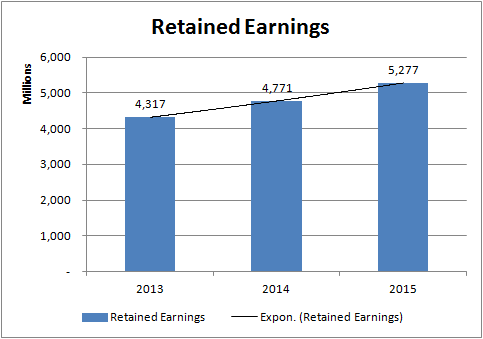

The Cash & Short-Term Investments and Retained Earnings shows an increase every year which is good.

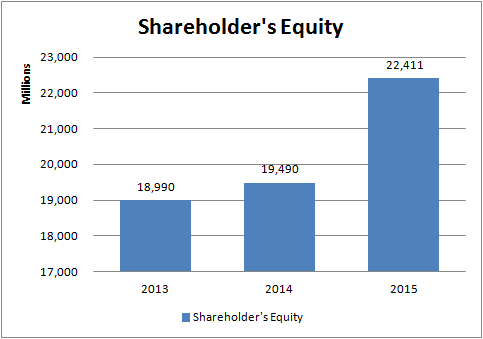

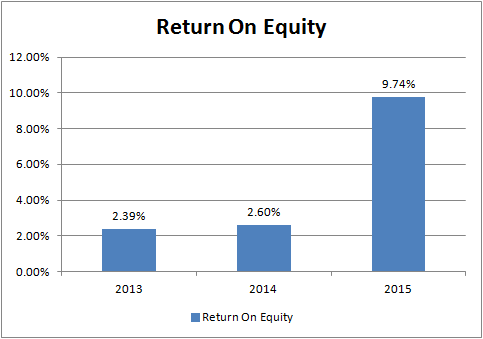

The Shareholder’s Equity is also increasing which is also good but the Return On Equity is not attractive due to low earnings.

Overall, the financial figures failed to impress me. The numbers tell me that cement business is a very tough and competitive business. The high cost of sales and operating expenses eats up almost all the profit. They need to increase sales and to do that, the construction industry must boom in order for the demand for cement to rise. Not only that, they have to find ways to fight competition too.

Final Thoughts

I like companies that has sustainable growth and has a long-term competitive advantage. In the case of CHP, I don’t see that criteria. I might as well invest in other companies that can grow faster or make a lot of money. Since the data provided is only in the 3-year period, I can’t predict for sure how consistent the projections will be 5 to 10 years from now.

The stock may rise and fall on its first listing day due to sentiments so trade with caution and caveat!

This concludes my CEMEX stock review. Be sure to leave a comment for any questions and reactions below.

Happy investing!

very informative sir. tnx a lot for the reseach you have done.

No problem glad it helped! 🙂

thank you so much for this information sir. it helps alot in decision making. more power

You’re welcome. 🙂

Thank you so much for the information

You’re welcome sir. 🙂

Thank you sir for this article. Very informative!

It’s my pleasure sir. 🙂

Daghang salamat Sir! Thank you for sharing your thoughts about CEMEX. God bless!

Walay sapayan ma’am! 🙂

thank you for this factual information and the analysis. i could slow down before taking a leap in the hype.

It’s important that we feel confident in every investing decision we make. Happy investing! 🙂

I thought the short term loans bears interest at 5.2% according to COL.

Yes sir that’s correct. The long-term loans on the other hand bears 7.535% per annum as per the prospectus.

Thanks for the information sir! But Isnt the construction business booming? Given that the duterte administration declared a budget of 3.1 trillion for public infrastructure?

Yes but there’s still competition from other cement companies like Lafarge. Earnings should also meet expectations. The low profit margins are unattractive to me.

Very informative Bro. Keep it up.

Thanks bro. 🙂

daghang salamat and God Bless

Walang anuman sir. 🙂

Great analysis bro…God Bless…

Thanks. God Bless. 🙂

Thanks Sir for this information.

You’re welcome sir. 🙂

awesome, very good info. Bordz

Glad it helped sir. 🙂

Du30’s presidency will catapult businesses like CEMEX because of the massive infrastracture projects. So the potential is promising 🙂 thanks for the historical info…butbthe FUTURE is brighter 🙂

I agree. While there’s a promise of growth, investors should also consider the potential slowdown of these projects in the next couple of years as this will also affect Cemex’s earnings. I also read in COL’s report that imported cement has been historically priced lower than domestic cement. This can also affect their profits.

Thanks so much for selflessly sharing these fact- based insights. I did subscribe online but am now thinking twice whether or not to cancel this.

You’re welcome sir. Glad it helped. 🙂

If you think that the company can make huge profits in the future, then there’s no reason for you to think twice about your subscription. If you think that P10.75 is a price that makes business sense based on what you’ve researched, then that should be fine. Just my 2-cents.

Is it possible that the price of cemex will decrease on its first listing day? Or is it likely to increase because it is oversubscribed?

Both can happen. It depends on how the market will react. People may be bullish on the stock or not.

Oh noh… I should have read this article first before I decided to order. Anyway, I can see my future in you Sir. I’m also an engineer (civil tho) and was a drummer too… And now I am starting to invest in our stock market.. Thanks for sharing.

Wow. Heard of DreamTheater? I’m into prog rock. Nowadays I just do air drumming because I no longer have a drumset and my band has moved on with other aspects of their lives. 🙂

Anyway good luck in your investing journey sir.

Hi sir . How about diversification in your portfolio ? Is cemex good ? Since it will be the only cement company in the market.

If you want to diversify then I suggest you buy companies with strong earnings power.

I computed the average Net Profit Margin of CHP from the 3-yr period and found out to be 4.81%. If you think that a PHP0.0481 profit is high enough for every PHP1.00 of sales, then go for it. In my opinion, I’ll rather diversify into companies that can generate NP Margins of at least 20%.

Good day Engr. What if we will just invest in 2 days after the opening as we are putting our money in firstmetro sec reservation? Do you think that we can earn 5pesos per share? Thanks much.

That would depend on how the market will price the stock after 2 days. If that’s your goal, you’ll have a higher chance of taking profits by looking at the intraday charts once it starts trading. Fundamentals really don’t matter if that’s the timeline that you’re looking at.

Very informative… thanks sir…

Isang concern ko dito ang daming shares na lalarga… ang laki din ang naka float…

Nc article.. 🙂

Wala ako makita na data about sa approx. public ownership percentage pero kung malaki talaga, baka mahirapan pagalawin price nito. 🙂

“It’s evident from these data that the cement industry is not as profitable as it seems.”

Well, I beg to disagree Sir. Based on your presentation, you forgot to remember that as revenue increases, the expense also increases. That’s basic! Do not conclude immediately that this is not profitable.

There are various factors that needs to be considered.

From 2014 to 2015, they have increased net earnings from 331%. That’s really fantastic but if you’ll look at the 2015 operating margin, you’ll see CEMEX only made 8 centavos of profit before interest and taxes for every 1 peso of revenue. Cost of sales plus the Operating Expenses added up to approx. 21 billion compared to revenues of approx. 24 billion.

The 2015 net earnings are approx. 2 billion which translates to only 9% profit margin which is why I thought that the cement industry is not as profitable as it seems because if it did, I would expect at least profit margins of greater than 20%. To me, the 9% profit margin suggests a highly competitive industry. In my opinion, I would just look at other companies/industries where I can put my money and expect a higher growth. In addition, the 2013 and 2014 profit margins are 2.70% and 2.60%. That is way too low.

I haven’t compared the data from other cement players. That should be done if an investor plans on betting in the cement industry. If you find that CEMEX has the highest profit margin compared to Holcim, Lafarge, etc., then I guess CEMEX is the most profitable of them all.

Good insights! good price projection if i may say! so what do make of the price movement of CHP a month later from 10.76 to 12.72? Did we miss something?

Hi, CHP is doing fine. Let’s wait for the earnings report so that we can see where the company is headed. 🙂

you are member of trc, u dont like chp, chp is in SAM, how do you comment

Hi Clarisse,

CHP is an IPO stock; the available financial data is limited. I have yet to see how will it perform. We can see that when they release their first annual report. In short, I don’t want to speculate on IPO stocks.

I invest based on numbers and data and the available figures doesn’t satisfy me.

However, there are other SAM stocks that are attractive to buy. I like MEG by the way. 🙂

I think your prediction on this company is right…..almost a year, there IPO price when down as negative =(….but for new investor this is the bargain price hope they will recover in time focus on the objective of your investment if you are long term…TRC still holding this stock and keep on buying.

Hi Richard,

I’ll sure do a review again about CEMEX. I’m curious to see the future projections and maybe come up with an intrinsic value or least explain TRC’s buy and target prices for this stock.

The industry itself is competitive… just look at the historical margins the company reported. The only reason I think why an investor would bet in the cement industry is the government’s plans on infrastructure.

Yes sir i think also thats the only thing why they are holding this stock….even me im holding this one :(…. just go positive in the long run it will come up but we know this stock is very slow

I’ve just published another article about CEMEX. This time, I projected their financial statements – 5-yr forecast period. You may want to read about it in the link below.

LINK: https://investingengineer.com/chp-stock-review-opportunity-misfortune/

hello

I hope you provide your viewers an analysis for Chelsea IPO

thanks

Hi Mel, yes I will. 🙂

Re: CEMEX

I bought cemex stocks this yr for obvious reasons that build build project of the govt. I should have read their FS to see this.

Am losing money now, what must be the next move? Must i sell now and bear the loses? Or hold till it go up?

Hi Jane,

This is hard to say especially that no one can really predict what will happen. Buying the news is not really a good strategy. The moment a news is released, institutional investors are now selling. You’re basically buying what the institutions are selling. It’s okay if the fundamentals are still fine but we all know that CHPs reports are not looking good . This is why most people lose money in stocks.

Hold if you can stomach the losses, Sell and look for other opportunities if you think that there are other stocks that may win you back the paper losses you now have.

Many thanks for the info. I should have read your article before buying CHP… 54% loss at this stage which is a big impact on my portfolio. ?

Hi BG Tom,

I think CHP’s drop in its stock price was also due to the fact that the PMI (Purchasing Manager’s Index) has slowly declined. If you look at the numbers from Sept. 2016 to Sept. 2017, it peaked at 57.5 then it slowly dropped 1 year after to a low of 50.8 which suggests that growth is slowing down. Right now, it’s sitting at 53.7.

A declining PMI after reaching its peak indicates that growth is already slowing down from the manufacturing/industrial sector as a whole. I believe that this affected CHP in a big way. If one saw this leading indicator before CHP released its disappointing quarterly report in November 2016, an investor might have stayed away not only in CHP but also in other manufacturing/industrial companies as well. CHP’s disappointing earnings only confirmed what the PMI is telling us in the previous months and thus, the institutional investors dumped the stock because of the impending risk. On the other side, the retail traders bought CHP because they saw the price dropping and thought that the stock is getting cheaper. But all they did in reality was to provide liquidity to these institutions. That’s why most got whipsawed.

An increase in the Philippine’s PMI in the coming months/years and a positive earnings growth report by CHP may signal the institutional investors to re-enter CHP. When that happens, you should have the cash to ride the uptrend.

The way I see it, you doubled your risk even without doing anything. You should have reduced your positions back then or totally got out while you had the chance. The only way you can recover those paper losses is to wait it up, or just cut your losses and look for an opportunity to recover it back.

Good luck!

Thanks again for your response. Very much appreciated.

I have to say YOU WERE RIGHT! 😀

Same sentiments with BG Tom. I should have read your article before buying CHP. Thank you sir for the very informative article.

No problem MJ.