Double Dragon Stocks Review: The Dragon That Flew Way Too High

Double Dragon Properties (DD) is right now the most highly chased stock of day traders and investors today. I envy those people who got in early and had taken huge profits.

Just imagine how much money would you make from 5,000 shares at an average price of Php 20.00 if it’s sold at its high of Php 80.00? That would be Php 400,000.00 or a 400% gain in just a matter of hours.

But then again, if there are people who made money, there are also people who lost money and I feel sorry for them.

I observed how the stock rose and fell so fast these past few days making the fundamental and technical analysis almost irrelevant. Some long-term investors also jumped into the rising dragon even if the stock is already trading at 300x earnings exposing them to a very high level of risk.

To put it in a perspective, it’s like you’re buying a food cart business worth 30,000 pesos that only gives a net profit of 100 pesos in a year.

Almost all analysis I see about DD is on the technical side and rarely on what the fundamentals really say.

I did my homework to find out if DD has really sweet fundamentals that can sustain what the market is pricing it today.

So here’s my Double Dragon stocks review.

Facts About Double Dragon Properties Corporation

DD is the real estate investment arm of Injap Investments Inc. established on 2009 and was originally registered in SEC as Injap Land Corporation.

DD is a 50/50 joint venture of between Edgar Sia II’s Injap Investments Inc. and Tony Tan Caktiong’s Honeystar Holdings Corp.

DD has 6 subsidiaries namely Double Dragon Sales Corp., Double Dragon Property Management Corp., DD Happy Homes Residential Centers Inc., DD-Meridian Park Development Corp., Citymall Commerical Centers Inc. and Piccadilly Circus Landing Inc. These subsidiaries are the ones that puts money in the company.

DD is targeting to accumulate 1,000,000 sq. meters of leasable space by 2020 across provincial cities through its “CityMall” mall chain brand and two major commercial projects namely DD-Meridian Park and Jollibee Tower.

Valuations

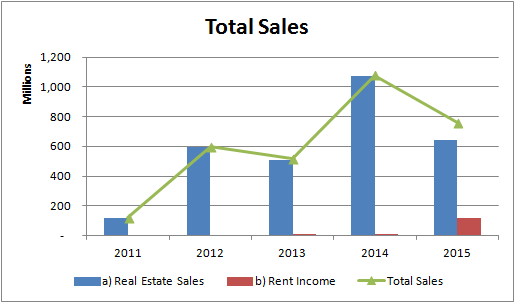

Fig. 1 Total Sales

I want to know the company’s sales performance for the past 5 years so I looked on the total sales they have made through their real estate and rental business.

Total sales grew at a rolling CAGR of 21.85% from 2011 to 2015. The bulk of their sales comes from the real estate inventories.

I also noticed that the rental income is also starting to gain traction. Rent income grew at a rolling CAGR of 114.72%. Overall, even with the ups and downs, the total sales is on a rising trend.

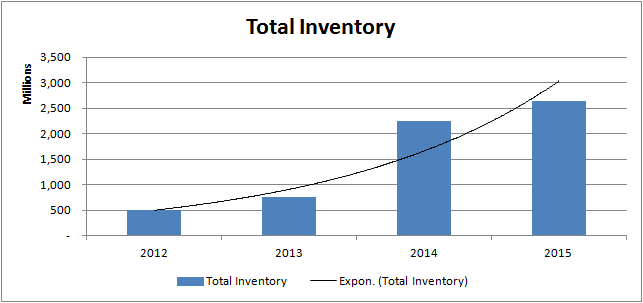

Fig. 2 Total Inventory

As sales continues to grow, so are their real estate inventories. From 2012 to 2015, DD grew its inventory at a rolling CAGR of 50.96%. Increasing sales and inventory means we can expect a higher projected profit in the future.

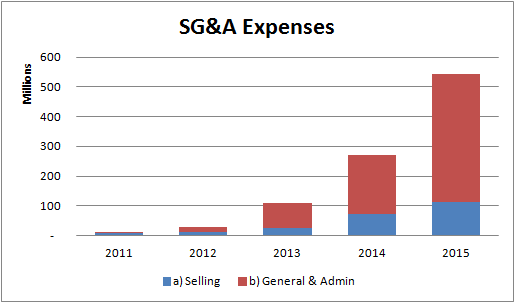

When sales and inventory increase, I would also expect that Selling, General and Admin Expenses would increase. Most of these expenses came from marketing, salaries & wages and from taxes & licences.

It is also notable that SG&A expenses doubles every year and it has grown at a rolling CAGR of 89.65% in the 5-year period.

Fig. 3 SG&A Expenses

I computed the SG&A to Total Sales from 2011 to 2015 and I found out that the expenses is good in relation to the sales from 2011 to 2015. But on 2015, Total Sales amounted to 758 Million compared to SG&A Expenses of 541 Million.

In my opinion, DD should cut down on SG&A expenses or it must increase sales to compensate for the expenses.

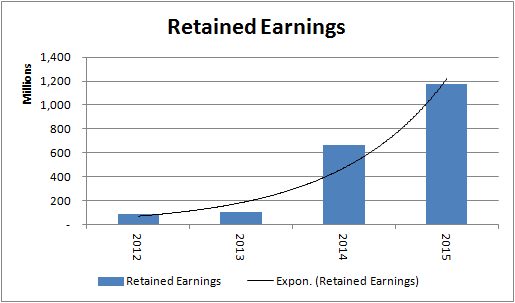

Retained Earnings looks good. It’s increasing at a rolling CAGR of 88.79%.

Fig. 4 Retained Earnings

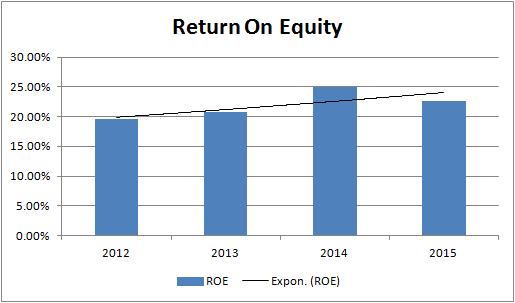

And so does Return On Equity.

Fig. 5 Return On Equity

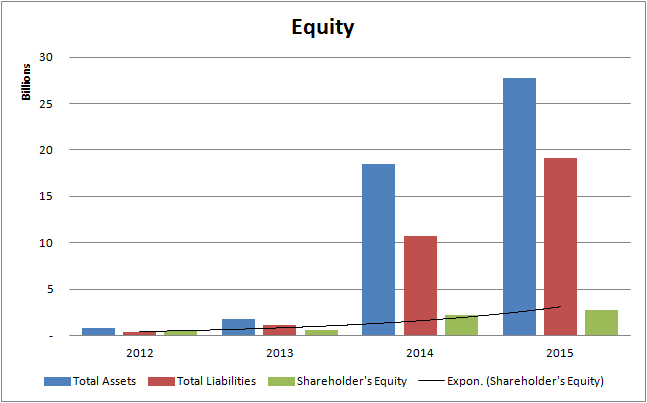

The Shareholder’s Equity is also increasing.

Fig. 6 Shareholder’s Equity

At the end of 2015. Assets have grown to 27.763 Billion pesos while Liabilities has also grown at 19.118 Billion pesos. The Shareholder’s Equity from the Parent Company is now at 2.752 Billion pesos compared to 2012 which has a total of 472.462 Million pesos. That’s a CAGR of 55.37%. It sure has grown so fast.

Analyzing all of these charts and figures gives me the conclusion that the company is doing good. Their increasing sales, retained earnings and consistent high Return on Equities make this an ideal company to invest in. But looking at the cash flow statement, it tells a different story.

Looking At The Cash Flow Statement

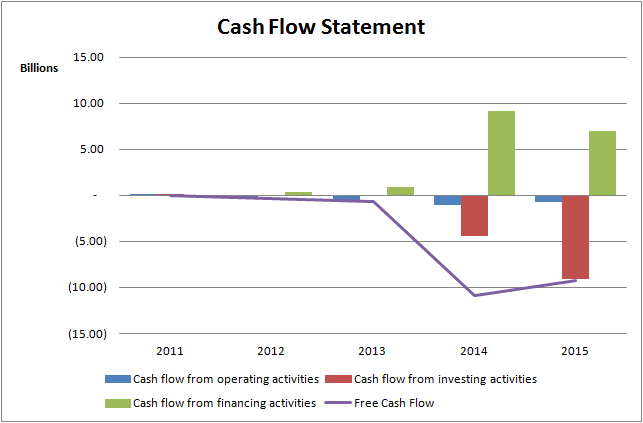

Here’s a chart I made to give a quick view how cash flows from this company.

Fig. 7 Cash Flow Statement

Fig. 8 Free Cash Flow

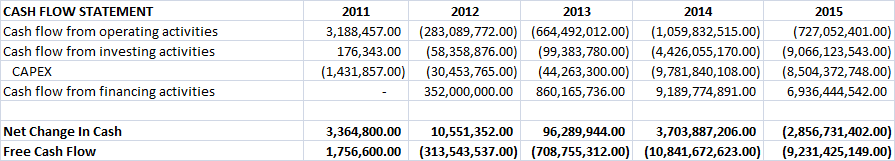

To quickly explain these figures presented, all I can say is that the money raised by the company on its financing activities are being used to fund the operations and investment activities of DD. In short, the company is taking more debt to continuously operate and invest.

I noticed that the cash flow from operating activities is negative from 2012 to 2015. This is bad because this tells me that the company cannot cover operations by just selling and renting out real estate.

Maybe one of the reasons why DD is bleeding cash is because of high SG&A expenses or a poor debt structure. I have shown that SG&A expenses has risen tremendously from 2011 to 2015 so that may be one of the reasons.

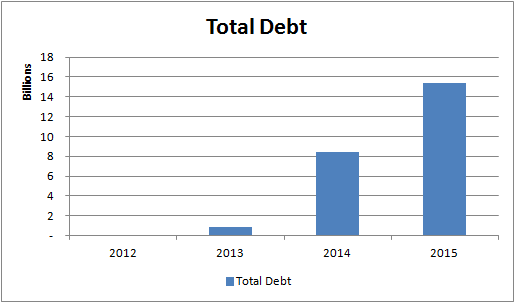

As for the debt, I’ve looked into it and plotted a chart as shown below.

Fig. 9 Total Debt

DD started issuing notes last 2013 and the proceeds from the sale of these notes were used for capital expenditures and operations.

You can also see the cash flow from financing activities from 2012 to 2015 the net cash that came in from the company as a positive figure. This means that they are taking on debt. This is not entirely bad because I also noticed that the cash flow from investing activities is increasing every year.

They are also investing the money they borrowed. So to generate a positive net income, they have to invest that money and they are doing a good job at it.

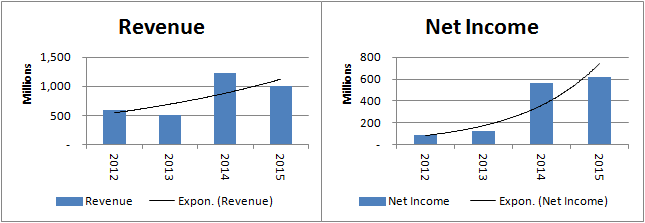

To prove that, look at the Revenue and Net Income, it’s increasing yearly. Their investing on their real estate portfolio to produce inventories. More inventories means more real estate to sell. More sales means higher income.

Revenue is increasing at a CAGR of 13.70% and Net Income by 61.20%.

Fig. 10 Revenue & Net Income

By 2020, we expect all Citymalls to be built at that time. These malls will bring a lot of revenue in the future. Then they can now start paying their debts.

When that happens, I think that’s the time that DD will start to have a positive cash flow but until that time comes, the company will continue to bleed money and take on more debt to finance operations.

Final Thoughts

I can say that DD is no longer trading at an attractive valuation. At Php 58.55 a share as of today, it’s already trading at 230x earnings (TTM). Investors are very bullish on the earnings expectations of DD that’s why almost everyone jumped into the trend.

If you want to ride the momentum, just invest and trade this stock with caution if you don’t mind the risks involved.

Happy investing!

Wow. I’m lucky to have stumbled upon your blog. I bet drafting a post takes a looooooot of time with all the graphs and analysis. Thank you for sharing your work on the internet cause not everybody has the time and knowledge to do such.

Hi thanks for the kind words. I will do a lot of this stuff in the future so be sure to subscribe. I wish you success in your investing journey! 🙂

At this this time, since most stocks are down, what stocks should i invest more on?

Hi Zia,

What I would recommend to buy are stocks that has predictable growth, less debt, good management and has a competitive advantage. If you’re asking for a particular stock, I don’t usually recommend because I believe that one should be responsible for every decision he/she makes. If you’re looking for tips, TRC and PinoyInvestor are a good place to start. Or you may read some of the companies I valuated and let your own judgement decide if it fits your investing profile.

Good luck in your investing Zia. 🙂

Thanks for a fundamental analysis of DD.

You’re welcome Jojo. 🙂

Don’t find it a very compelling argument :\, you basically just looked at their historicals, but this is a growth stock… need a smart projections on earnings. Negative cash flows shouldn’t be necssarily bad, maybe a deeper look at why there are no cash flows? Maybe most of it will prolly come once things are built IDK. Anyway dude please don’t market yourself as a guru, dangerous :\

I agree that this is a growth stock but the way I saw at the current ability of its assets to generate income compared to its stock price doesn’t make sense to me. I may be wrong or right but the way I see it, investors paid more for a company that promises profitability at some point in the future. Sure the cash flow will come but that will take a few years in the future who knows? Well, I don’t know.

I think it’s rational to assume that the risk of buying the stock is very high.

Just to be clear, I don’t market myself as a guru and I don’t claim myself as one. I’m also a student of the markets and love sharing my thoughts on this blog.

Thanks for the constructive criticism. This will drive me to better myself. 😀 Cheers!

He is only sharing some inputs about the company. As an investor one of the criteria to check is the cash flow, return on equity.. etc. i find his comments valid. As an investor are you willing to invest in DD with PE over 300 even if it is a growth stock as you claimed?

So, at under 40pesos/sh, would it be a good buy? What are the prospects of it flying high once more given that it’s just inked a deal with ABS?

Hi CCastillo,

I won’t even consider buying under P40/sh. Just way too overvalued for me. I would find better opportunities elsewhere for now.

But that’s just me. Some think that the valuations makes sense to buy, others don’t. It really depends on your conviction and belief of the management’s capability to deliver those future cash flows. Mall income is not yet that high and yet the market is already valuing the company almost the same as MEG.

They keep on raising money. From the IPO proceeds, preferred shares and then the bonds.. That’s just the way how startups do to fast track growth.. good for the company but in an investment point of view, I believe that we should be mindful of how much we’re paying for a company that doesn’t deliver the promised future cash flows yet.

keep up the good work! i know it takes great pain to write a post, what more something as comprehensive as you have posted. it’s technical but also layman and if one is after long term profit and not quick gains, this website’s a good place to start. i hope you are able to continue with what you are doing.

Thanks for your feedback Sherwin. 🙂

Hi! I found your blog really interesting and I can see valid and solid points from your end. I agree that DD really flew so high in its early years and lucky were those people who took the ride and got off on time. DD actually peaked at around 80-ish and sank as low as 30-ish last year. It actually recovered during the first 5 months of this year but is now slowly degrading as of this writing.

In my point of view, I do believe DD has a lot of potential considering that it is in the real estate business. Real estate businesses technically has slow ROI and I can see DD flourishing by the start of the next decade. This is the trend that I saw with my real estate clients in the past (as an audit manager).

My take is that if you have the stocks, hold it and have patience. It will grow slowly for the next few years. However, if you don’t have them yet then don’t pursue. I don’t think this is the best time to buy their stocks.

Thanks for the valuable feedback Mr. KJ.

I believe that at some point, DD’s stock price will slowly align with its earnings. For me, it’s really a question of when which is hard to predict.

thank you so much for the insight. I am new in stocks and would like to invest long term so I was checking DD. Your insights maybe me double check all the stocks I want to invest in

Good to know Claudia!

Very good insight. My experience with DD had been so traumatic that after I lost more than Php100,000, I never wanted to do stock market again. That time my understanding was not ripe enough. I started on investing when the price was at around 32. Then withdrew when it hit around 40. I was happy with my earnings so reinvested it again. By this time I was reading some books including Bo’s and changed my mindset to being long term investor not a trader. And so I did without realising that I chose a wrong company to trust my long term goal with. So annoyed at myself in believing in DD that it would keep going up. So even at 80 I did not pull out my shares until the time that it sank down to 60, 50… Then one day, DD management applied for a new share offering at PSE and reinstated a new base price, I missed this news because I’m an OFW. So when the new price became around 25, I knew I was f*cked! I withdrew the amount and just swallowed the bitter reality that DD is not for me. So in terms of figures, in a 3-year period, in total I invested Php300k in DD and loss Php100K what a shame! The profit gained the first time was around Php16k. So be careful guys! Know when to exit and not be greedy. Cheers, Francis

Hi pls try DD again i will push it back to 80 and offer more reits