Jollibee Stock Review: To Buy Or Not To Buy?

I always wanted to do a valuation of Jollibee (JFC) because their Chickenjoy and Jolly Spaghetti is so delicious.

But what about its stock? Is it mouth-watering too? If you look at the charts, JFC is bearish right now.

The question is, is it the right time to buy now? I see a lot of investors asking this question. So let's take out our calculators and let the numbers speak for themselves.

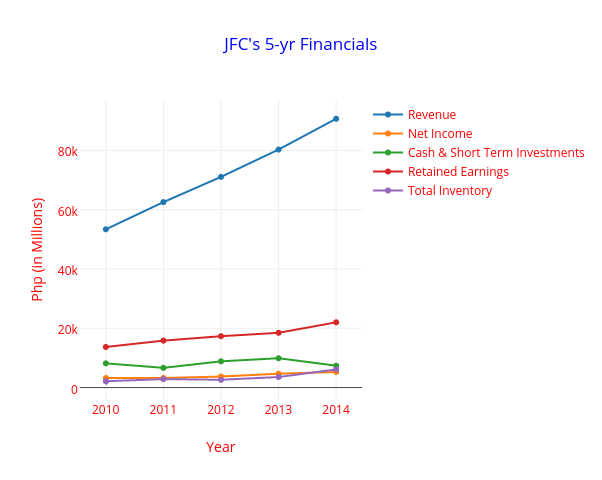

5-Year Historical Earnings Per Share And Financial Figure Chart

We can see that JFC had good EPS and financials for the past 5 years. They were able to maintain consistent growth on their revenues, net income, retained earnings and total inventory. Their cash & short-term investments took a slight dip but overall, they're good to go.

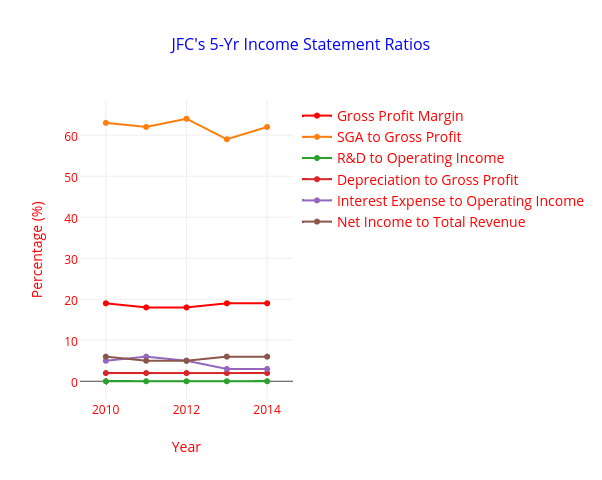

Income Statement Ratio Chart

I noticed that JFC's gross profit margin threads below the minimum of 20% and this suggests that the company is under fierce competition. It's no wonder because a lot of fast food startups are entering the market nowadays so it makes sense. But with that values, JFC would need to find ways to stay competitive in the food industry.

Their SG&A is quite high too almost doubling the 30% recommended valuation. Adding to that, the net income to total revenue is under 10% suggesting a fiercely competitive industry.

With that said, JFC is in a fiercely competitive industry based on its income statement.

What about the balance sheet? Does it agree with the income statement figures?

Let's find out.

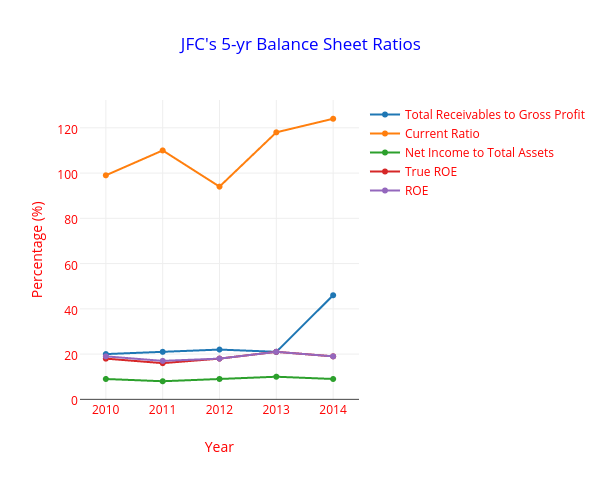

Balance Sheet Ratio Chart

The percentages derived here tells us the exact same message of the income statement. The only good thing I see here is the current ratio which averages above 100% and the ROE which is nearly 20%.

The net income to total assets percentage is quite low too. The total receivables to gross profit is just right the expected percentage but it would be better if it is much lower.

In general, we can conclude that JFC is in a fiercely competitive industry based on the company's balance sheets.

The net income to capital expenditures from 2010 to 2014 was computed at 74%. JFC spent a lot of capital for expansion. And they also bought back their stocks which is a very good indicator of a company's growth.

What about its financial health? Not to worry. JFC's did a lot of saving for the rainy day. Their 5-yr cash and retained earnings are superb and their debts are low.

Initial Rate Of Return

Now let's find out if the stock is undervalued or not;

Pre-tax EPS = Net Income before taxes (in millions) / Outstanding shares (in millions)

Pre-tax EPS = 6609 / 1069 = 6.18JFC's closing price as of August 11, 2015 is 191.20 Php. The rate of return is;

%RoR = (Pre-tax EPS / Stock price) x 100

%RoR = (6.18/191.20) x 100 = 3.23%The 5-yr Gov't bond yield today is 3.852%. So in comparison, JFC's predicted yield is almost the same as a gov't bond yield. In theory, this is quite low and we may safely say that JFC is overvalued in terms of its rate of return.

Final Thoughts

This is the reason why I think purchasing shares of JFC is not a good idea as of now. If I have the money to spend now, I'll find other companies that have better valuations. JFC's stock is experiencing a market correction right now so maybe we can still wait a little bit longer to make the price more attractive.

Happy investing!

hi.

i would like to buy a share in jollibee. is my php300,000 able to buy a share? if so, how?

thanks.

Hi Reynaldo,

Yes you can buy JFC shares. With that capital, you can buy 1,457 shares at yesterday’s price of Php 205.80/sh.

To do that, you have to open a stockbroker account and from there, you can start to buy. I recommend COL Financial for that.

Good day sir.. i just want to ask if how much is the starting amount that can invest in stock market of jfc?. Thank you

Thanks for the analysis. Just as I thought. JFC is currently overvalued. With current PEG ratio of around 2.8++. Not worth buying as of now for value investors.

Hi good day.. may ask if how much is the starting amount can i invest in jfc? Thank you.

Hi Erwin,

JFC is currently trading at P200/share. You can buy a minimum of 10 shares. That would be P2,000 all in all.

good day.. can you help me with how to invest in JFC?

Hi Edd, you can buy JFC shares if you have a stockbroker account. You can open one at COL Financial. Instructions on how to open can be found here: https://www.colfinancial.com/ape/Final2/home/open_an_account.asp

After that, get back at me so that I can guide you how to buy JFC shares.

Best of luck!

hi there.i just wanna ask,if i’m going to buy 10 shares for JFC where will i’m going to send the money?and is it a one time payment only for the ten shares or i have to give 2000 every month?i was just confused,i hope you can help me understand with this buying a stock..thank you so much?

hi there.i just wanna ask,if i’m going to buy 10 shares for JFC where will i’m going to send the money?and is it a one time payment only for the ten shares or i have to give 2000 every month?i was just confused,i hope you can help me understand with this buying a stock..thank you so much!

Hi Bella,

Open a stockbrocker account and from there, you can execute the buying and selling of shares from weekdays 9:30am to 3:30pm. I recommend COL Financial for that.

Food industry is really competitive. Good evaluation of JFC.

Thanks for the feedback. 🙂

Saan po pinakamaganda mag invest? 🙂 Any recommendation? 🙂

Hi Lex, hanap ka ng stocks na undervalued. I’m not in the business of stock recommendations. There are services like Pinoyinvestor where you can get fundamental and technical analysis… baka makatulong yan sa’yo.

However, you can browse my posts baka meron ka makita. Just do your own due diligence na lang.

Happy investing Lex!

How to open account to buy stocks in JFC?

Hi Emilee,

You need a broker account to buy stocks of JFC or any other stocks. Please Visit colfinancial.com for more information on how to open one.

When should I start buying JFC stocks again?

I also want to know some tips about trading. I am beginner and I don’t know anything about it.

Hi Ramesh, you could start reading basic books about it. But first, decide on your goals so that you can effectively choose on what type of investor you’ll become.

hello po sir, I plan buying shares to JFC, my question po ay my bayad po bah every month yung stockbroker?

Hi Grace,

Wala pong bayad ang broker. Ang broker eh parang tindahan lang. Sila ang ‘middleman’ between the company and you para makabili ka ng shares. May broker account ka na ba or mag-oopen ka pa lang?

Hi i want to invest jfc but how please teach me

You first need to open a broker account. I recommend COL Financial: https://www.colfinancial.com/ape/Final2/home/open_an_account.asp

After you do this, get back at me so that I can teach you how to buy and sell stocks on that platform.

Good luck Joan!

good day! if you have a 400 shares from 1997 up to present how much it will cost?

Good day po,

Wanna invest in JFC, how much is the starting and what shall I do?

Open a broker account and start buying JFC shares.

Hi po gusto.ko lang po malaman kung ok po.b mag invest s jfc? Paano po ba beginner lng po ako kase di ko alam paano mgstart aattend pb ng seminar?

You first need to open a broker account. I recommend COL Financial: https://www.colfinancial.com/ape/Final2/home/open_an_account.asp

After you do this, get back at me so that I can teach you how to buy JFC stocks on that platform.

I already have my Col account. Please teach me ways on how to gain buying/selling JFC stocks.

Regards,

What happen if I buy all available stocks of jollibee?? will it be mine?

Even if you wanted to, will the majority shareholders sell their stocks to you?

Hi good day, may ask if how much is the starting amount and pwede ko inest sa JFC ngayong 2020? anong price start? Thank you.

I just want to know…. How much starting amount?

Hi good morning what company can you recommend to invest stocks right now that you see it will do well in the future…

Technology companies that uses the blockchain technology, or those that makes life easier during these times. I doubt you’ll find good companies in PSE alone.

Good day sir/ madam, How much minimum initial capital to buy share / stock to JFC ? What are step by step to do it this kind of business? JFC can gove ROI or devidends to all share holders or stockholders? Thank you .

Good day sir/ madam, How much minimum initial capital to buy share / stock to JFC ? What are step by step to do it this kind of business? JFC can gove ROI or devidends to all share holders or stockholders? What Thank you .