MRSGI Stock Analysis: Why I Think MRSGI Is Still A Good Buy Despite The Stock’s Decline

Just to give you an update, the MRSGI’s (Metro Retail Stores Group, Inc.) 3Q2016 report has just been released. According to the report, Net Income was down at 20.2% YoY – from Php 344.30 Million down to Php 274.65 Million.

At the same time, the stock had declined from last September’s median price of Php 5.58 down to today’s closing price of Php 3.61; lower than the stock’s IPO offer.

This left investors wondering what the hell has just happened?

In today’s stock analysis, we’ll try to analyze MRSGI’s (Metro Retail Stores Group, Inc.) the quality of its earnings to see whether the company is really worth investing in.

Whether you’re an MRSGI investor for quite some time or just planning to invest in this stock, this post might give you an insight to better decide if you’re planning to buy, hold or sell this stock.

So let’s get right on into this.

Profitability

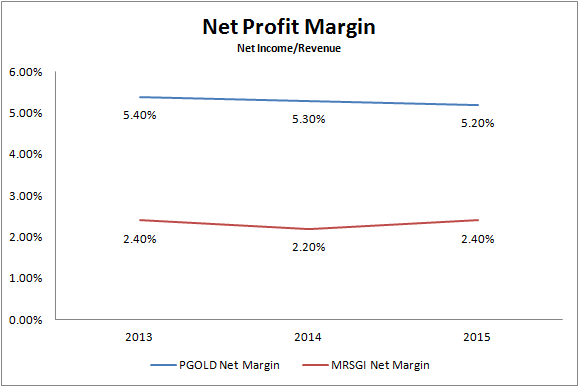

We look at the Net Profit Margin for the past 3 years and we can see that it averaged at 2.33%.

Now let’s get a better perspective. If we compare it to one of its competitors – Puregold (PGOLD), we can say that MRSGI, regardless of company size, is not as profitable as compared to PGOLD.

Fig. 1 Net Profit Margin of PGOLD and MRSGI

Nonetheless, we calculate the 3-yr. CAGR for the Revenue and Net Income at 12.8% and 11.2% respectively which I find reasonable enough.

However, the 9M2016 income report shows a Net Income decline of 20.2% YoY. One of the reasons is the acquisition of two Wellworth department stores that caused a Php 70 Million operating loss.

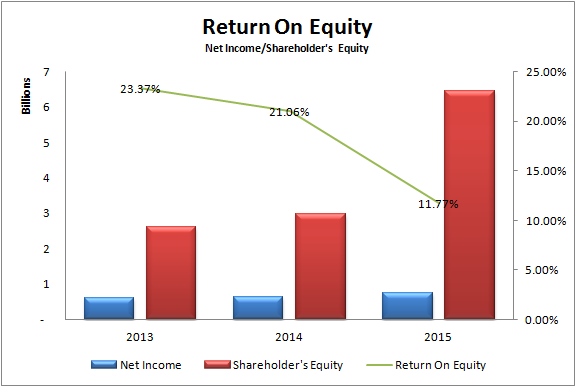

Return On Equity also shows a huge decline from 23.37% in 2013 down to 11.77% in 2015.

Fig. 2 Return On Equity

But analyzing it further using 3-point DuPont Analysis, you’ll find out that the main reason why it suffered a huge decline is the increase in Shareholder’s Equity. The IPO proceeds increased the Assets and thus increased Shareholder’s Equity.

What the company needs to do is to put those assets to work so that it can generate additional earnings that will in turn increase the Return On Equity.

I think that they are now starting to do that when they acquired the Wellworth department stores from the Ayala and Tantoco group valued at Php 499 Million. They have already paid 25% of that acquisition last March 2016 using the IPO proceeds. As of the 9M2016 report, they have already paid an approximate total of Php 179.6 Million.

Now, I don’t think that the earnings decline will be a cause of worry for long-term investors. Remember that business acquisitions can boost a company’s earnings in the future assuming that the business they acquire is proven to be also profitable.

If the company plans to pay off the acquisition using income from operations, then we would expect low earnings until January 2017.

I believe that this will just be a temporary decline and not something that will really affect the company’s profitability in the long-term.

Liquidity, Solvency And Efficiency

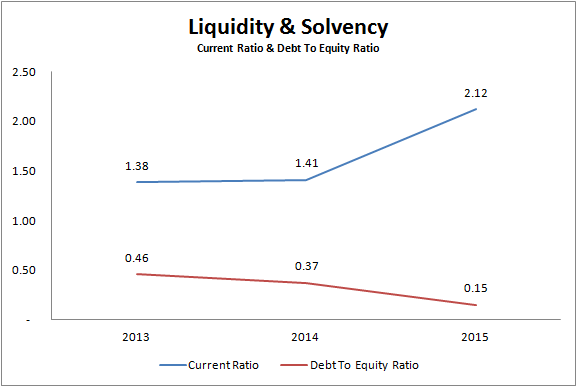

Fig. 3 Current Ratio & Debt To Equity Ratio

The good thing about MRSGI is it shows healthy financial ratios. Current Ratio and Debt To Equity Ratio for the last 3 years averaged at 1.64 and 0.32. This shows that it can easily support its current debts. It also shows that majority of its operations are funded by equity rather than debt.

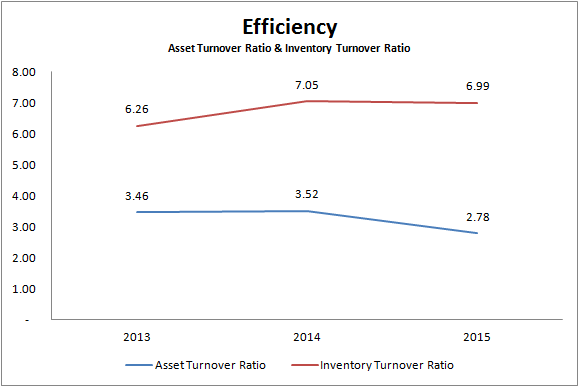

Fig. 4 Asset Turnover Ratio & Inventory Turnover Ratio

The Asset Turnover Ratio averages at 3.26 which I find efficient. It generates Php 3.26 for every Php 1.00 of assets. The company sure knows how to extract income using every available asset it owns.

Inventory Turnover Ratio averages at 6.77. This means that they re-stock their stores roughly 6 times a year or twice a month.

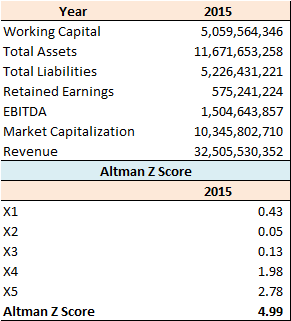

Now to further see how healthy the company is, the Altman-Z score showed a very high 4.99 score.

Fig. 5 Altman-Z Score

A score of 3.00 and above is considered healthy and is safe from bankruptcy.

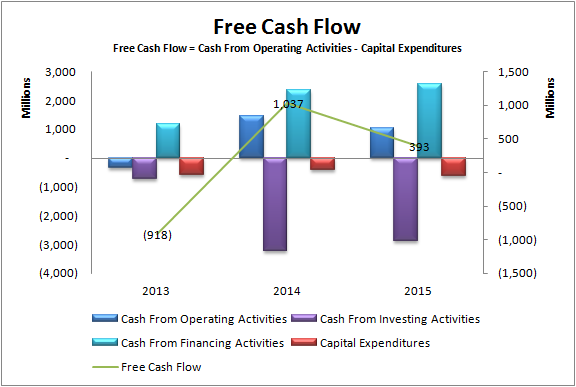

Free Cash Flow

Fig. 6 Free Cash Flow

According to their IPO prospectus, MRSGI is planning to approximately use 71% or Php 2,397.5 Million of the IPO proceeds to expand their store network by opening new stores and acquiring existing retail chains.

With that, I believe that Capital Expenditures and Cash Flows Used In Investing Activities will increase as they enter this expansion period until 2017.

I’m expecting a negative FCF this 2016. As of now, 9M2016’s FCF is already at negative Php 484 Million. Capex has already increased by 29% compared to 9M2015 figures YoY.

Valuations

Net Income in 2015 was recorded at Php 758.6 Million while Market Capitalization as of today is at Php 12,380.04 Million. Dividing Net Income with Market Cap, we get an initial return rate of 6.13%. This is better compared to a risk-free LCY 5-yr. Gov’t bond rate of 4.696%.

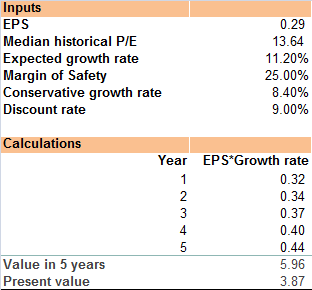

By using a growth rate of 11.2% similar to the 3-yr. Net Income CAGR, 25% Margin Of Safety and a Discount Rate of 9% in the P/E valuation model, we can arrive at a Net Present Value of Php 3.87/share.

Fig. 7 P/E Valuation

At Php 3.61/share, we can say based on the data that the stock is currently undervalued.

Final Thoughts

Although MRSGI’s 9M2016 earnings have declined, I believe that long-term investors shouldn’t worry too much about this. As I explained above, the quality of earnings and the financial health of MRSGI is good. I believe that the current price today is already attractive relative to the calculated net present value of Php 3.87/share.

This concludes my MRSGI stock analysis. Do you think that MRSGI is a good buy? Or should you stay away from it for a while?

I want to know your thoughts. Share your insights below by kindly leaving your comments below.

Happy investing!

FURTHER READING:

- Stock in Focus: MRSGI (29 Aug 2016) by Regina Capital Development Corp.

- Stock in Focus: MRSGI (17 Aug 2016) by Unicapital Securities

- Stock in Focus: MRSGI (27 May 2016) by AB Capital Securities

- Stock in Focus: MRSGI (19 Feb 2016) by Unicapital Securities

- Stock in Focus: MRSGI (21 Dec 2015) by AB Capital Securities

Full year 2016 financial report is already available but it did not push the falling price. Low volume from the past months worries me. Reading your report makes me think twice to hold for long term since my average price is 3.73. Thanks forthe review.

Thanks for your feedback Nigo. It will take time for the market to realize value. I haven’t seen the FY2016 report yet but as long as the company earns consistently high and able to generate high returns on invested capital, the price will appreciate itself give or take 3 to 5 years at least. If not, then ypu should take a second look.

If you have a conviction that P3.73/share is a low price to pay, then averaging down should further lower your risk. Good luck in your investments.