Stock Analysis: Holcim Or Cemex? Which Is Better?

COL Financial announced in their report that Holcim (HLCM) 1H16 earnings are up by 21.1% y/y above consensus estimates. At the same time, Truly Rich Club added Cemex (CHP) to their recommended SAM stocks and explained that CHP will benefit with the current administration’s focus on infrastructure spending.

So does that mean that Holcim will benefit it too?

HLCM’s market capitalization is at P106.2 Billion. This gave me an estimated 7.6% return based on last year’s P8.1 Billion net earnings.

On the other hand, CHP is at around P61.8 Billion. Based on a P2.1 Billion net earnings, I arrived at a 3.5% return.

Just based on this quick valuation, we can say that HLCM is a much better investment. But let’s not be quick to judge. Let’s find out which company is more profitable between the two. I did a valuation of Cemex based on its IPO prospectus a couple of weeks ago. You may want to read it here just for a heads up.

So let’s dive in.

Valuations

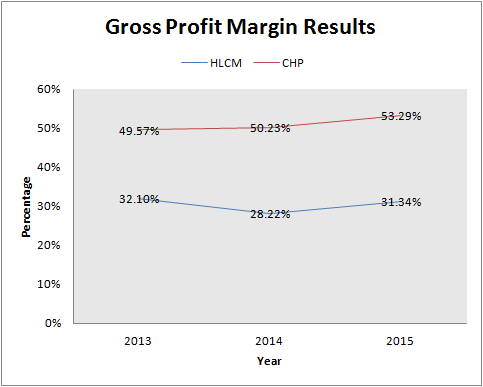

In this chart, CHP shows a higher Gross Profit Margin than HLCM. In 2015, CHP made 53 cents Gross Profit for every 1 Peso of Revenue compared to HLCM which only made 31 cents.

The previous years are also in favor of CHP which makes it look a better company.

Fig. 1 Gross Profit Margin

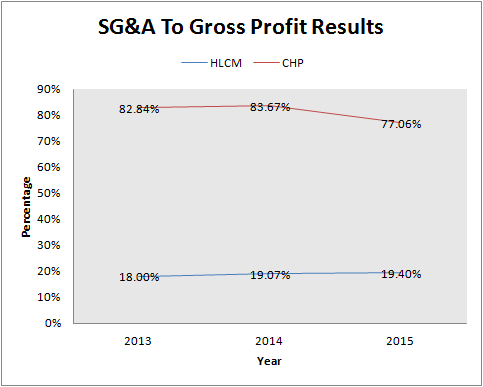

But if you look at its Selling, General & Admin Expenses, turns out they spend a big amount compared to HLCM.

Fig. 2 SG&A To Gross Profit

CHP spent 83% of their Gross Profit to SG&A costs last 2014. That’s 83 cents for every 1 peso of Gross Profits. Compared to HLCM which just spends around 19 cents, HLCM definitely wins this area.

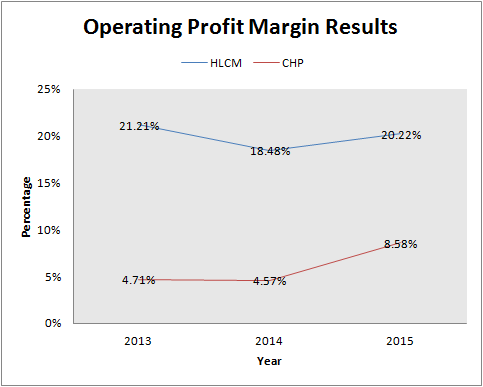

We can definitely see that HLCM is more profitable than CHP based on their Operating Profit Margin.

Fig. 3 Operating Profit Margin

At this point, you now have an idea how much money these two companies make on cement industry. This does not include the finance income and expenses, taxes and other gains/losses in the sales of assets which can make the bottom line higher or lower.

You can see that last year, HLCM made 20 cents for every 1 peso of revenue compared to CHP which only made 8 cents.

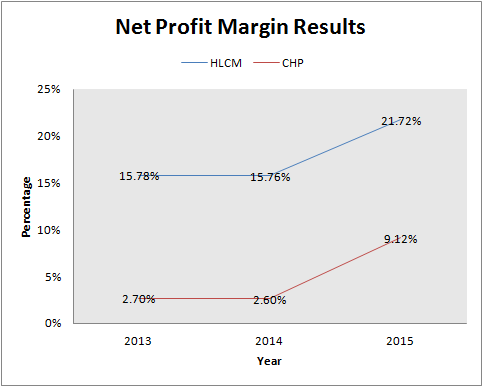

And when we factor in the other income and expenses, the Net Profit Margin shows 21 cents compared to 9 cents.

Fig. 4 Net Profit Margin

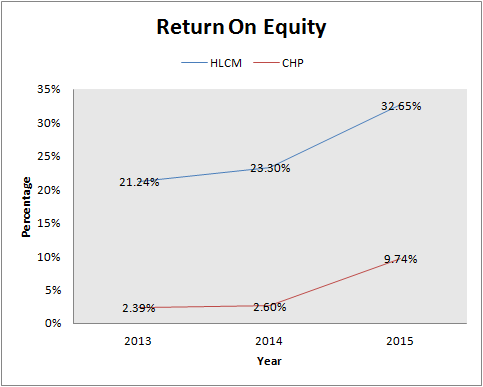

Even the Return On Equity shows that HLCM is much more profitable than CHP.

Fig. 5 Return On Equity

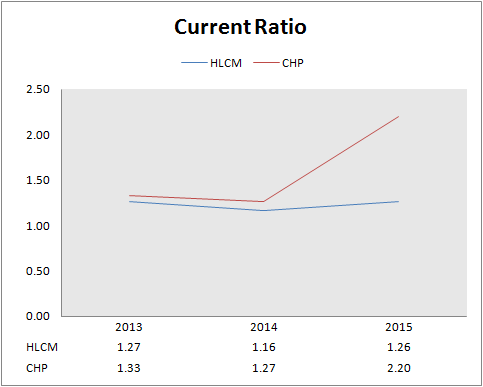

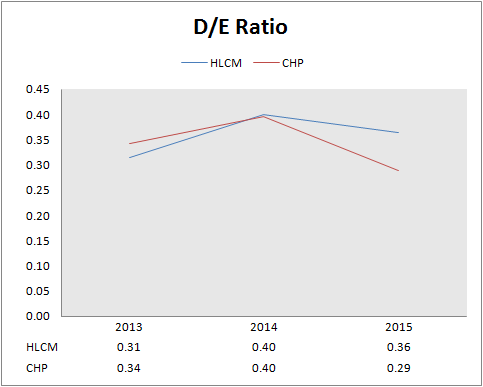

If you look at the Balance Sheet, you’ll find that the Current Ratio and D/E Ratio of these two are almost in the same ranges.

Fig. 6 Current Ratio

Fig. 7 Debt To Equity Ratio

The ratios are healthy and I can only assume that both are fairly liquid and solvent companies.

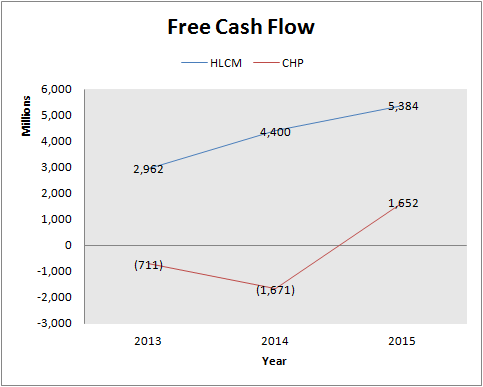

The Cash Flow Statement shows that HLCM had positive Free Cash Flow and it has grown for the last 3 years. Unlike CHP which in 2013 and 2014 are both negative. I like how HLCM has maintained its positive FCF and I can only assume that the management is doing a good job at handling their operating cash flow.

Fig. 8 Free Cash Flow

Final Thoughts

I believe that both of these companies will benefit from the government’s plan on infrastructure spending. If betting into the cement industry is one way to capitalize this segment, then we should know which among the cement companies are worthy of investing.

It is evident in this valuation that Holcim is a much more attractive investment than Cemex. But always keep in mind that one should still study the future prospects of each company and how the management is doing to achieve those goals.

I want to hear your thoughts about this. Do you think Holcim is a better investment than Cemex? Or is it the other way around? Share your thoughts below.

Happy investing!

Sir….what can you say about Liberty Telco owned by PLDT and Globe???

Hi Lyster,

I have no idea since I haven’t read anything about Liberty Telco. I’ll look into it during my spare time.

hi

do you know where we can get information as to who are the top players in cement market in phil?