5 Best Sites I Use To Get Accurate Financial Data For Free

If you’re struggling to find financial data to use in your stock valuations, then this list might be of help from you.

I have been asked numerous times where I get the financial data that I use in my stock valuations. I always say that I get them from the actual reports that the companies provide.

The problem with reading financial statements is that it’s time-consuming. When I’m valuing a handful of stocks, checking their financial reports for the last five years will take me at least one whole day.

To solve this problem, I went on to find the best financial websites that can provide me at least five years of financial data so that I would not consume a lot of time.

I’ve listed below five of the best financial websites I use to easily get all the figures and ratios I need. Three of them I still use up to this day.

These sites made my stock valuation activities faster and easier. I also became more productive because of the time I had saved.

If you want to value stocks faster and be more productive just like me, then try the sites I recommend below.

#1 Morningstar

I consider Morningstar as the best when it comes to gathering financial data. It’s by far the most comprehensive resource to get all the financial data you need.

To get the data you need, click the FINANCIALS tab and from there, you can choose whether to display the Income Statement, Balance Sheet or Cash Flow Statement.

To demonstrate, here are the financial statement links of stock Unionbank (UBP).

There’s also a tab where you can find useful financial ratios pertaining to profitability, growth, cash flow, financial health and efficiency.

Here’s an example from UBP.

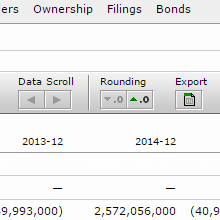

Fig. 1 EXPORT button

The fun thing about this is that you can export all of these data into a spreadsheet file which will make it easier for you to calculate other financial ratios.

You can also use the data in the spreadsheet for your customized screening tool.

You can find the EXPORT button on the right side of the screen (Fig. 1).

Morningstar is one of the best websites I use to get all of these data to use in my personal stock screener spreadsheet. I export the data I want and copy paste it in my screener.

What I don’t like is that some stocks have incomplete data. If I encounter such, I have no choice but to recheck it in the actual financial statements.

But nevertheless, this website is a very good resource for getting the data you want.

#2 Wall Street Journal

I like this site because it also provides very detailed financial data just like Morningstar.

Here’s what you’ll find if you search for UBP.

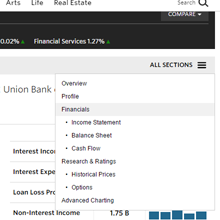

Fig. 2 WSJ menu

To access these data, just go to the drop down menu on the right part of the screen and click on the desired data you want (Fig. 2).

What I like in particular in this site is that they can display historical prices and you can download it in a spreadsheet format just like in Morningstar. See the example below.

Although I don’t use charts in my valuations, I like the charting service they provide because you can compare the price movements of different stocks.

To do that, just click COMPARE and enter the stock you want to compare with.

You can also do ADVANCED CHARTING if you use a lot of technical indicators.

What I don’t like is that unlike Morningstar, you can’t download the financial data.

And because of that limitation, I only use WSJ if I want to get a stock’s historical prices.

#3 Financial Times

When I first started, this is the website I first used to get all the data I need. To give you a glimpse of their platform, here’s an example.

Just like WSJ, they also have data on historical prices.

Take note that you need to sign-up in order for you to access five years worth of data.

I like their service because during the times when I was starting out, I really have no idea where to find the data I need.

I stumbled upon this website on Google Search and have used it since then.

But when I found out about Morningstar, I stopped using FT because Morningstar is much more easier to use especially that you can download the data whereas in FT, you can’t.

However, FT is still one of the best sites out there and you should consider looking at this too.

#4 Microsoft Money

Just like the three sites I mentioned above, it’s also worth noting that MSN Money is one of the best out there before I migrated to Morningstar.

Here’s a sample of the financial data that you can get from the site.

I also like the stock screener that they provide and the mobile app in the Google Play Store.

Back then, I used the mobile app to monitor my watchlist and my stock investments. I just stopped using it and moved on to other mobile apps because I found better ones.

Nowadays, I no longer use the site and app for the same reasons I mentioned in FT. I now use COL Financial’s app instead.

Nonetheless, MSN Money is still one of the best sites to get financial data out there.

#5 PSE Edge

This is the most important site that every Filipino investor should know. PSE Edge provides all the information you need like financial statements, public ownership reports, quarterly reports and all sorts of disclosures ready for download.

It also has a mobile app so you can bring it anywhere you go and download any report you want.

The only thing I don’t like about it is that they only provide two years of financial data. Even the downloadable items are limited to two years of data.

I just wish that the site can offer at least five years of data.

But nonetheless, it’s the best go-to place to find and download all kinds of financial data and disclosures you need.

Final Thoughts

The financial data websites I mentioned above will provide you all of the information you need to value stocks. If you have your personal stock screening spreadsheet tool, you can use these websites to get the data you need for your screeners to work.

If you want to be a better value investor, I still recommend that you learn how to get your data directly from the financial statements. I find that from experience, the financial ratios are better understood if you understand the figures behind it which is explained when you read them directly.

It’s more rewarding even though it consumes more time.

Happy investing!

I do often wonder which website/s you go to for data gathering.

I use WSJ & FT myself, and I also gather data from COL. I know I should go to PSE Edge more, but you’re right – 2 yrs worth of data is no good if you need figures for the last 5 yrs.

I do notice though that sometimes, the figures from WSJ/FT differ from COL’s. I understand that the WSJ/FT figures are stated in millions, but the difference with COL’s figures are significant (although not too big) that I can’t attribute the discrepancy to the rounding up process.

Can I assume that the COL figures are more accurate/reliable since it’s a local site?

Keep up the good work!

Hi JRP,

I noticed that too. I think that analysts have different ways, methods or whatever when they gather data. I agree that COL’s figures are accurate.

It’s really preference based. I still prefer to get my data on the actual financial reports.

DO YOU PREFER MORNINGSTAR OVER PSE EDGE? BECAUSE I NOTICED THAT SOME DATA ARE DIFFERENT,,,LIKE DEBT T0 EQUITY RATIO.(EX. JFC).

If in doubt, check the actual financial statements and calculate it manually.