Stock Picks for the week by First Metro Securities

Check out the Stock Picks for the week by First Metro Securities in this special report which you can find only here in PinoyInvestor. (Needs premium access.)

READ REPORT

PSE, SEC approve IPO of Solar Philippines Nueva Ecija Corporation

The Philippine Stock Exchange (PSE) and Securities and Exchange Commission (SEC) have approved the Initial Public Offering (IPO) of Solar Philippines Nueva Ecija Corporation (SPNEC), the developer of a 500 MW solar project that is planned to be the largest solar project in Southeast Asia. SPNEC could raise up to Php 2.7 billion, with the first […]

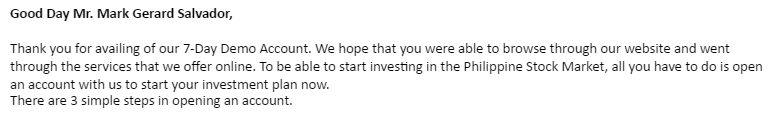

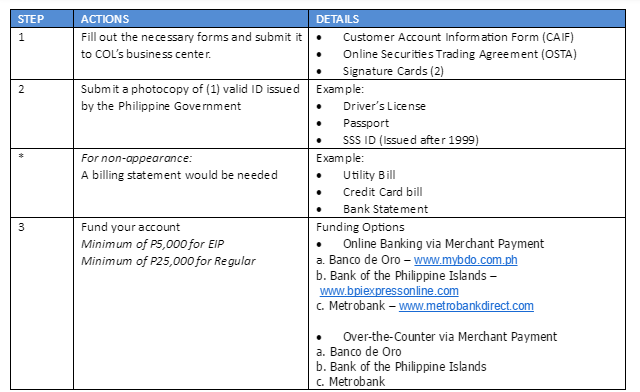

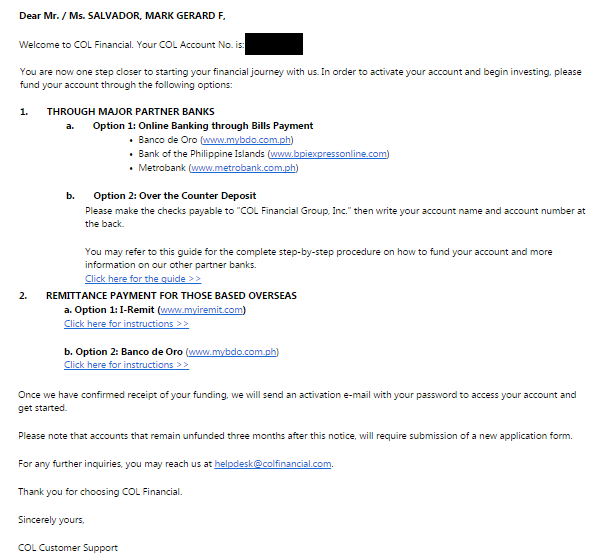

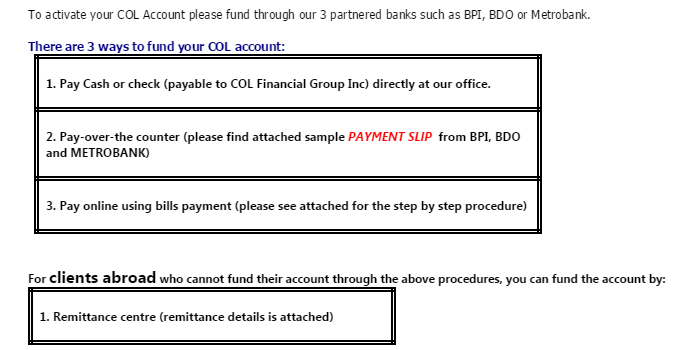

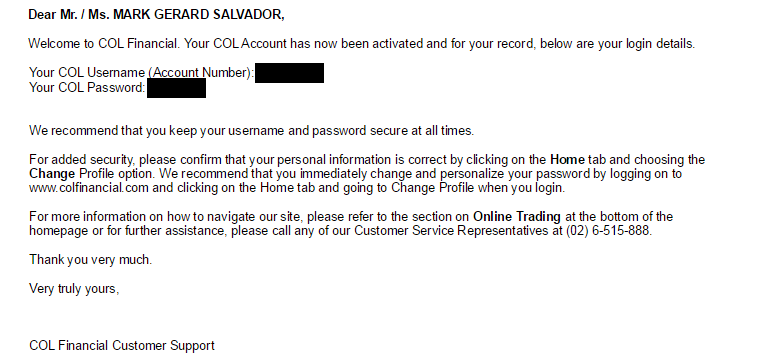

Read more...How To Open An Account In COL Financial

This post will guide you how to open your stock broker account at COL Financial. With so many similar inquires on my Facebook page asking about how to open an account in COL Financial, I decided to post my experience way back in 2015. If you made the decision to invest and you’re looking for a broker, […]

Read more...Intrinsic Value Of HVN (Golden Bria Holdings, Inc.)

In this post, I will discuss about Golden Bria Holdings, Inc. (HVN). A reader asked me about my take on HVN. Personally, I’ll avoid this stock for now. It’s hugely overvalued. I’ll explain why. Hi Mark, First of all, I want to thank you for creating a value investing blog here in the Philippines. Your analysis really […]

Read more...San Miguel Food And Beverage Inc. Analysis Of 1H18 Financials And What I Think About It

Finally! The 1H18 report is already out and I’m excited to share with you my analysis and opinion of FB now that the report contains the consolidated figures from the merging. This post will analyze the six-month ended June 30 financial figures so that we can come up with an idea of the growth and margins […]

Read more...Intrinsic Value Calculation: TEL, URC, JFC for FY2017

Hi Value Investing fans! This post will discuss about three PSE stocks; TEL, JFC and URC. For the previous posts, you can find them here;Let’s begin! Quick Navigation TEL (PLDT Inc.)URC (Universal Robina Corporation)JFC (Jollibee Foods Corporation)Final Thoughts TEL (PLDT Inc.)TEL’s Revenue has remain stagnant for the last 10 years. In 2009, it booked ₱162 billion of […]

Read more...Intrinsic Value Calculation: JGS, AEV, MBT for FY2017

Howdy Value Investing Fans! As of this writing, the PSEI is hovering in the 7,500 area, just below the June Monthly Pivot Point of 7,620. I see no signs of reversal yet so it might still go down at 7,333 which is the Pivot S1. But as we all know, the more the market goes down, […]

Read more...You Asked, I Replied: Which Is The Better Option, Peso Cost Averaging Or One-Time Investment Of A Large Amount?

Good evening Sir Mark. If you will allow me, I just want to ask your honest opinion. Which is the better option? Peso cost averaging or one-time investment of a large amount? Thanks and more power. Both options are good. But first things first, you should ask this question, “Does it make business sense to […]

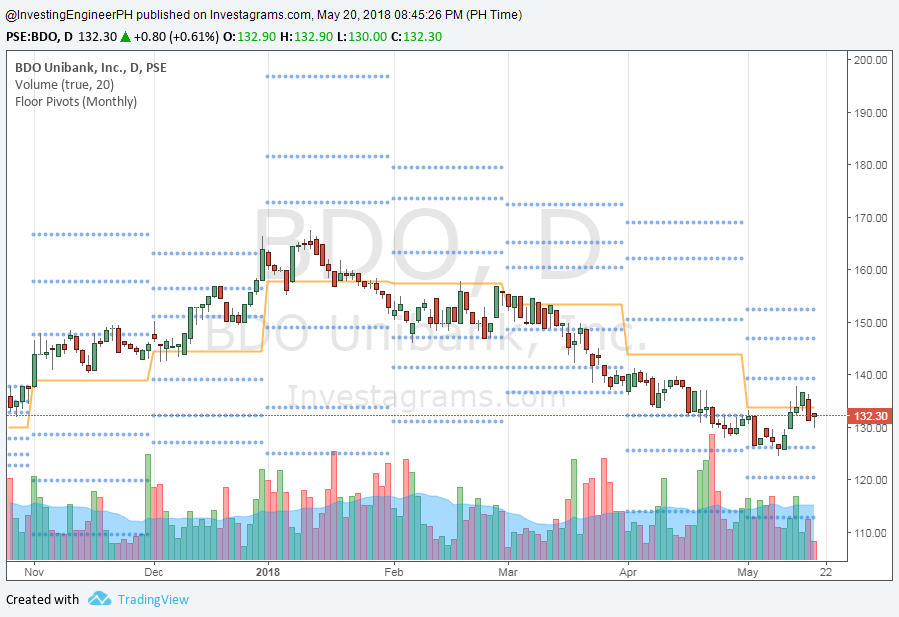

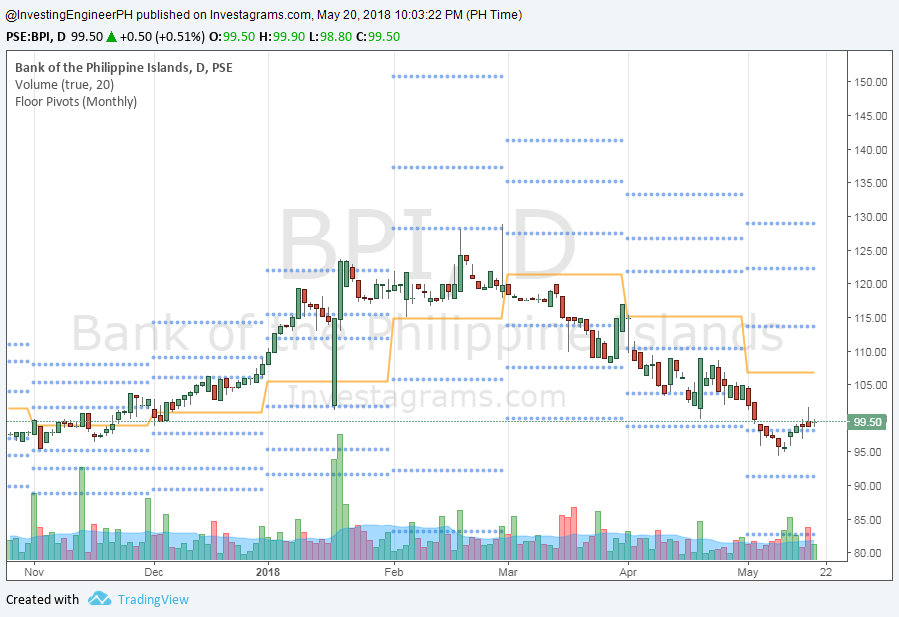

Read more...Intrinsic Value Calculation: BDO, AC, BPI for FY2017

Hey investizen! This post will discuss two banks; BDO and BPI, and the conglomerate AC. Quick Navigation BDO (BDO Unibank, Inc.)BPI (Bank Of The Philippine Islands)AC (Ayala Corporation)Final Thoughts BDO (BDO Unibank, Inc.)BDO Monthly Pivot Chart as of May 20, 2018.I like BDO’s statistics because it shows hints of profitability. From 2012 to 2017, it has […]

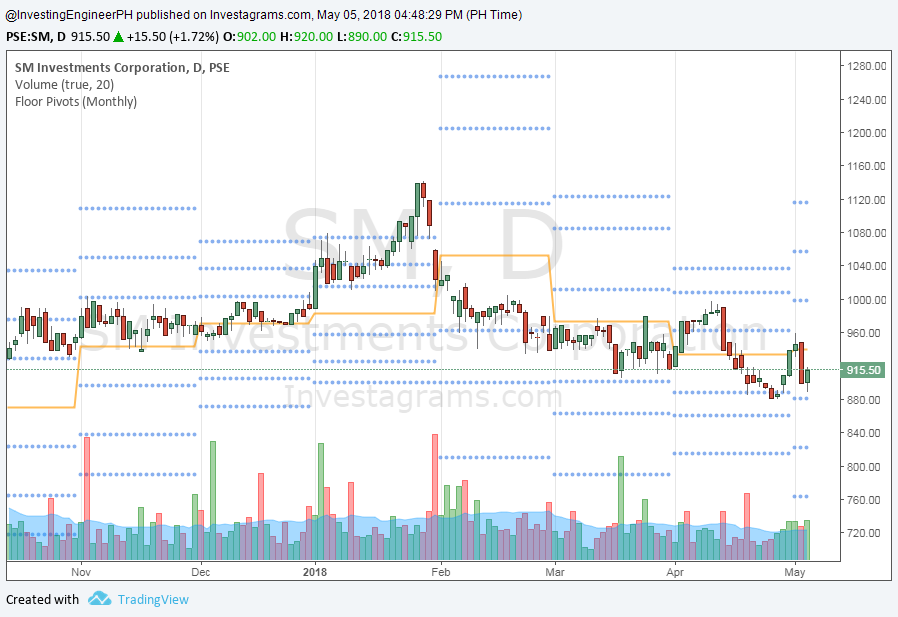

Read more...Intrinsic Value Calculation: SM, SMPH, ALI for FY2017

Hey investizen! This post will discuss SM, SMPH and ALI. You may check back at this post for the intrinsic value calculations I did based on the annual reports released and data from Morningstar. If you want to find professional recommendations, I encourage you to subscribe at PinoyInvestor. Quick Navigation SM Investments Corporation (SM)SM Prime Holdings Inc. (SMPH)Ayala […]

Read more...[WATCH] The Millionaire Maid Gina Macahilos – Here’s How She Did It!

![[WATCH] The Millionaire Maid Gina Macahilos – Here’s How She Did It! Bo Sanchez maid](https://investingengineer.com/wp-content/uploads/2016/04/gina-220x116.png)

Hi guys, here’s something for you to watch today from Bo’s Success Live series. Be inspired by the one and only Millionaire Maid Gina Macahilos. Oh by the way, have you grabbed a copy of Bro. Bo’s Millionaire Maid book? I recently got my copy (by the way, the book is FREE. Just pay for shipping cost. […]

Read more...