Stock Picks for the week by First Metro Securities

Check out the Stock Picks for the week by First Metro Securities in this special report which you can find only here in PinoyInvestor. (Needs premium access.)

READ REPORT

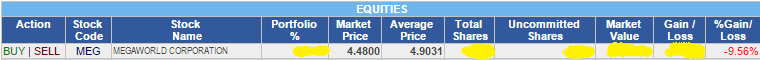

How To Calculate The Average Price In A Stock Portfolio

One way to reduce your paper losses in the stock market is to lower your average price per share or simply to do cost averaging down. Here’s a simple illustration on how I reduced my losses by averaging down my average price per share. See the screenshots below; Fig. 1 Portfolio screenshot before This is my […]

Read more...How To Value A Stock Using EPS, P/E Ratio And EBITDA

If you want to value a stock’s price, there’s an easy way to do that without having to find a lot of data in the Internet. This time, all the data that we’ll need can be found at COL Financial’s database. The data that we will be needing is the current share price, EPS (earnings per […]

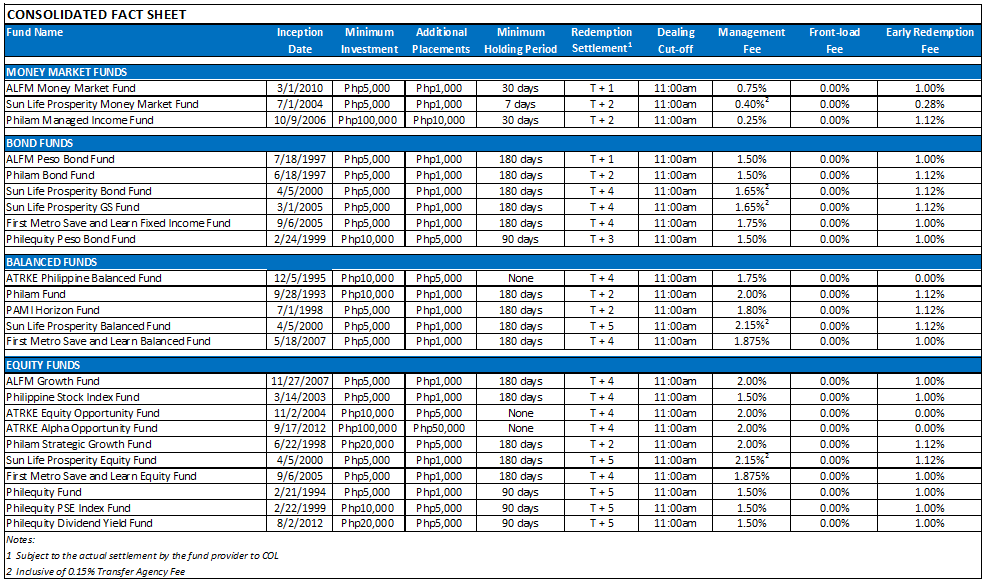

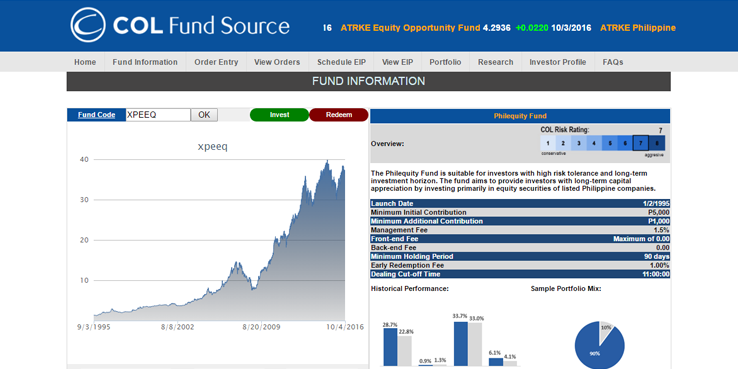

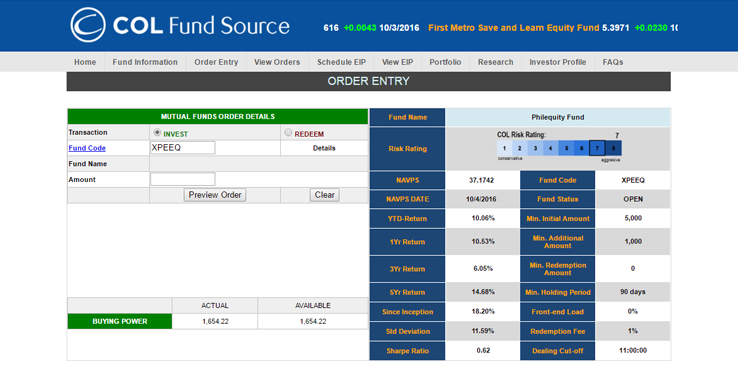

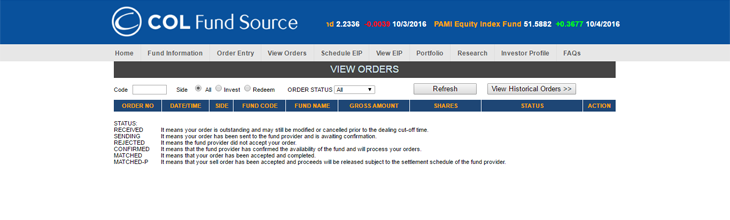

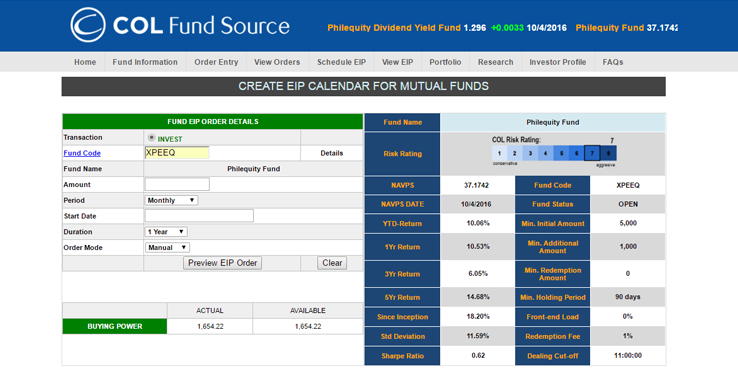

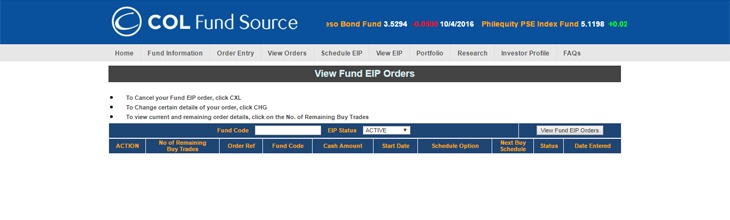

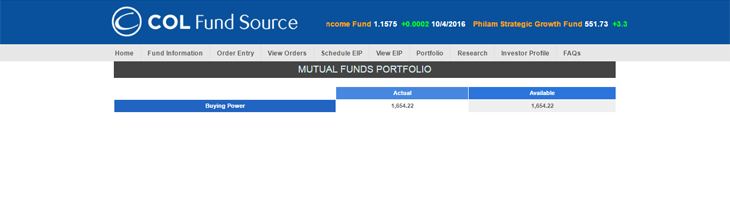

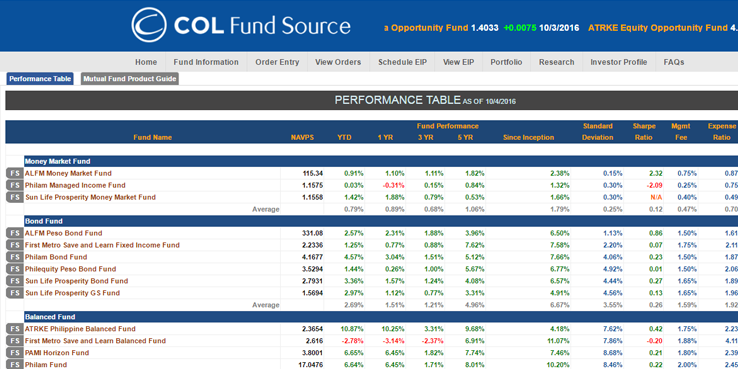

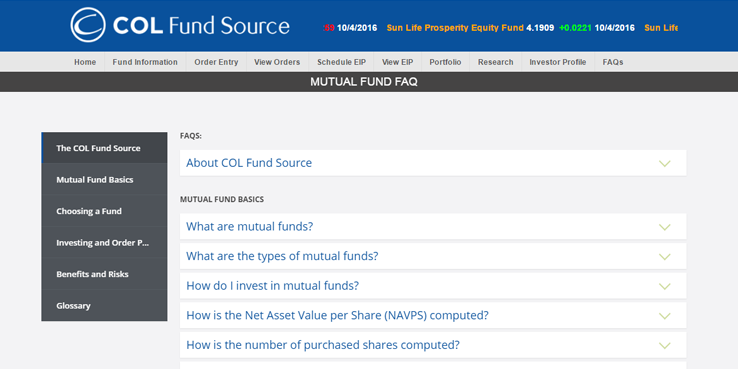

Read more...How To Invest In Mutual Funds Using COL Fund Source

For most people, investing in mutual funds is a better choice because these people don’t want the hassle of monitoring and making active decisions on their investments. Instead, they trust a fund manager to do all of this stuff. While it gives us the freedom to do other things that matter most, investing directly on individual […]

Read more...How To Value A Stock Using The Sustainable Earnings Growth Model

There are many valuation models out there on how to predict a stock price in the future. One model I always use is the Equity Bond Theory. The other is the Historical Earnings Growth Model. Today, I’ll share another valuation tool that you can use in order to foresee a stock’s future growth earnings potential.Sustainable Earnings […]

Read more...How To Value A Stock Using The Historical Earnings Growth Model

From my past posts, we learned how to value a company by reading financial statements and using Warren Buffet’s Equity Bond Theory model. If you are just new to this blog and are not familiar with the model or how to read financial statements, you may read it through here. Now, there are also easy ways how […]

Read more...How To Determine Financial Health

Have you ever thought what will happen to the Philippine economy if the euro debt crisis of Greece isn’t resolved? What if Greece defaulted? What would be the possible effect on our economy? What about the stock market bubble at China? Will it directly affect us? What if a great depression like what happened in […]

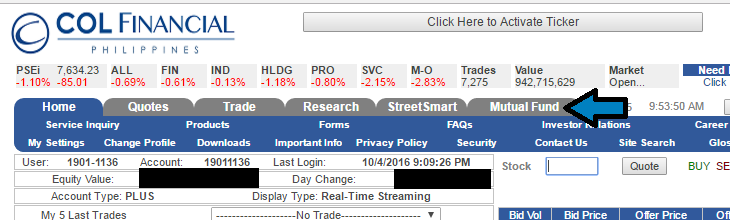

Read more...How To Buy And Sell Stocks Online Using COL Financial

I’ve just activated my account at COL Financial today. I received my login details and now I’m ready to buy my first company. Unfortunately, I’m still not decided on which company would I buy first. I’ve been busy on work last week and I haven’t had the chance to review the financial statements of the […]

Read more...Durable Competitive Advantage: Buffett’s Checklist To Pick Quality Stocks

I’ve been studying a dozen financial statements of different companies these past few days to find out how successful value & growth investors like Warren Buffett choose winning stocks by themselves. Warren Buffett’s investing style is based on finding companies with durable competitive advantage. His investing principles are written in these two books; Buffettology and […]

Read more...How To Determine A Stock’s Initial Rate Of Return?

To answer this question, you now enter the mind of the most successful investor in the world, Warren Buffett. These past few days, I see a lot of first-time investors like me asking these type of questions on Facebook forums that somewhat goes like this; In my opinion, as first-time investors, we should learn to […]

Read more...[WATCH] COL EIP: Investing In The Stock Market Using Peso Cost Averaging Method

![[WATCH] COL EIP: Investing In The Stock Market Using Peso Cost Averaging Method col financial](https://investingengineer.com/wp-content/uploads/2015/08/FEATURED-COL.png)

Three years ago, I bought a motorcycle amounting to Php 160,000.00. I had it financed for 36 months with a monthly amortization of Php 6,675.00. It was the happiest day of my life knowing that I now own a brand new Honda CBR150R Sportbike. Back then I didn’t know about stock market investing until recently. I thought to […]

Read more...