Have You Bought Stocks At The Peak Of A Bull Market?

Have you bought stocks at the peak of a bull market? Well, I did.

Let me share you this story.

Just like every newbie, when I bought my first stock, MEG, last July 2015, I didn’t realize that I bought it during the peak of a bull market. As the months passed, I observed that the stock price continued to go down month after month as the markets continued to decline.

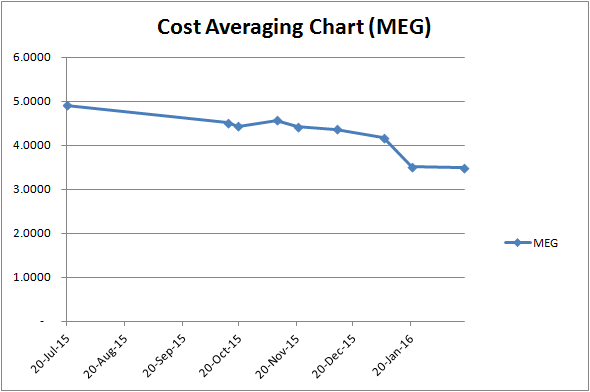

But still, I continued to buy the stock as shown in the cost averaging chart I made below based on my purchase for the last seven months.

7-mos. cost averaging period.

Why Did I Keep Buying Even Though The Stock Is Going Down?

To most people who don’t understand how stocks work, the question would be why should you buy something that is losing value over time? How could you profit from something if you can’t sell it for a higher price?

In the normal day-to-day world, logic would tell us that this isn’t the right way to make a living. Just like in a Buy & Sell business, we should buy low and sell high to make the business profitable.

But since we are talking about stocks, it is more advantageous to buy more when stocks are going down. In the case of MEG, there are four reasons why I did it;

- I believe in the company fundamentals. Megaworld is one of the leading companies in the property sector which also expands rapidly and has strong income statements and balance sheets.

- Cost averaging. Since I bought at the peak at an average price of Php 4.9031/share, I have reduced my average cost to around Php 4.2630/share within the 7-month period. If the stock rallies, I would profit faster since I’ve reduced my average cost. To put it in numbers, if the stock just went up for Php 4.31/share, my portfolio would now turn green.

- My priority is to buy more shares as much as possible. With lower stock prices, I was able to buy more with less capital.

- I’m not into trading stocks, I’m into “investing”. Because of my long-term perspective, I don’t have any plans on trading this stock for short-term gains that’s why I buy more shares even if the price is dropping.

Peak Of A Bull Market: Expert Recommendations

My broker recommends that if you are heavily invested, you should reduce your position by taking advantage of the rally that is happening.

Since I’m not yet in that part of my investing career, the market’s weakness became my motivation to stick to my plan to continue buying on a cost averaging basis since I know to myself that I invested in a fundamentally sound company.

This is something that I already set in my mindset because of my long-term investing perspective. Even though I have huge paper losses right now, it doesn’t deter me to sticking to my plan because I strongly believe that my profits will also be much larger when the market recovers over the long-term.

Recommended Strategy During This Year’s Bear Market

Here is a list of the strategies that my broker recommends during this year’s bear market;

- Invest only long-term money. You always hear from technical analysts that the “trend is your friend“. As a value investor, I believe that “time is your [best]friend“. Since we really can’t predict when bear markets would finish, it would be wise to only invest money which you wouldn’t be needing in a long-time for compounding to work. Apart from my bank savings and personal expenses, I save 20% to 30% of my salary which I consider is my long-term money that I use to invest in stocks. Even though I have extra funds in my savings account to add to my investment account, I don’t do it even if its tempting because the money in my bank account is not my long-term money. We don’t know when will the market hit the bottom so it’s safer if you have liquid funds in case of emergencies.

- Don’t use margin. Investing on margin amplifies your gains if the stock rises but during bear markets, it’s kinda risky because when the stock falls, you expose yourself to a margin call and when you sell, you lose money. Leverage is good if you know how to handle the risks associated with it.

- Spread out your buying. I’m consistently doing this now for seven months already, 20% to 30% of my salary is used to buy stocks monthly. Doing this improves my average cost thus risk is minimized.

- Set conservative buying prices. Since it’s a bear market, we should always take into consideration the safety of our capital invested.

- Be defensive. Being defensive means buying a basket of stocks with strong fundamentals. For newbies, Truly Rich Club recommends well diversified mutual funds in the SAM table as well as a few stock picks to choose from if you don’t want to trouble yourself in finding defensive and fundamentally sound companies.

- Be mentally prepared to see losses in the short-term. In paper, I have already lost 19.25% of my portfolio as of this writing. But still, I consider it a normal sight to see everyday. If you can’t handle the emotion of seeing huge paper losses in your portfolio in the short-term, then I suggest you learn how to overcome the fear of it. If not, then stock investing isn’t for you.

The Bottom Line

For those that are heavily invested already, you should take advantage of the rally by taking profits if you bought stocks on the peak of a bull market.

If you’re a newbie just like me who just started, consider this as a blessing because the weakness of today’s markets will be the strongest of our green portfolios tomorrow.

Happy investing!