Why Do Retail Traders Lose Money In The Philippine Stock Market

In order for us to understand why the vast majority of retail traders lose money in the stock market, we have to first understand the volatility levels of the asset we are trying to trade on.

The reason being is that if there's no volatility, then there's no opportunity to make money.

Having a deeper understanding of volatility gives us a rough statistic of how much money we can make consistently if we decide to trade a specific asset at a specified amount of time.

In this post, we'll talk about the Philippine Stock Exchange Index's volatility levels on a daily, weekly and monthly time frames. We'll use this information to our advantage in our trading decisions so that we can make money on a consistent basis.

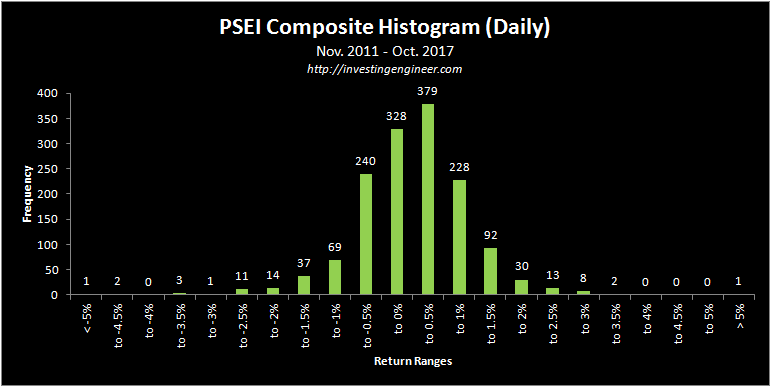

PSEI Composite Histogram (Daily)

The chart above shows the daily returns of the opening and closing price of the PSEI from Nov. 2011 to Oct. 2017 and the frequency or the number of occurrences within the data set. In this time period, we have a total of 1,459 days.

The idea behind this analysis is to determine our odds of making money if we buy the PSEI at the opening and sell at the close everyday for the past 1,459 days.

In our data set for example, if we bought at the opening and sold at the close, there's a 25.97% chance of gaining anywhere between 0% and 0.5% (379 out of 1,459). There's also a 16.45% chance of losing anywhere between 0% and -0.5% (240 out of 1,459).

Here's some statistics that every retail trader should know based on this analysis.

The numbers don't lie. This shows that the odds of making 1% by day trading is very low. If you make 1% and factor in taxes and commissions in the equation, you're basically left with almost nothing.

The odds is further supported by the PSEI's Daily Rolling Average True Range as shown below.

Desc. | 1 Week | 1 Month | 3 Months | 1 Year | 2 Years |

|---|---|---|---|---|---|

Daily ATR | 6 Days | 24 Days | 72 Days | 288 Days | 576 Days |

1.046% | 1.004% | 0.879% | 1.002% | 1.064% |

As you can see, opportunities both on the short-term and the long-term are typically worse.

This is the reason why I don't believe in day trading. To make money consistently as a day trader, you have to capture only the positive trades. To do that, you have to possess the ability to see the future. We all know that such ability doesn't exist in the real world.

What about trading on a weekly basis? Let's see the statistics.

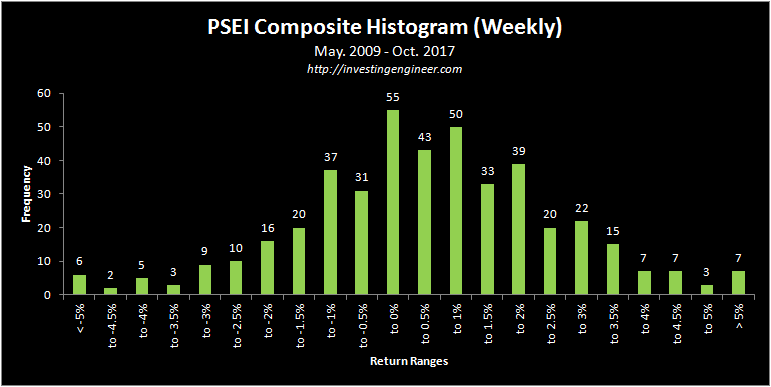

PSEI Composite Histogram (Weekly)

The chart above shows the weekly returns of the opening and closing price of the PSEI from May. 2009 to Oct. 2017. In this time period, we have a total of 440 weeks.

Here's a quick summary:

How about the weekly ATR?

Desc. | 3 Months | 6 Months | 1 Year | 2 Years | 3 Years |

|---|---|---|---|---|---|

Weekly ATR | 12 Weeks | 26 Weeks | 52 Weeks | 104 Weeks | 156 Weeks |

1.983% | 2.024% | 2.543% | 2.854% | 2.767% |

Did you notice how the odds of making money trading on a weekly basis is better compared to day trading? There's obviously an increase in volatility levels on a higher time frame.

But did you also notice that the volatility levels are getting lower as we move to a lower time frame? What this means for retail traders is that the opportunities available to make money in the market is getting lower and lower every time you move on a lower time frame.

The odds of making money on a monthly basis is much better. Let me show you.

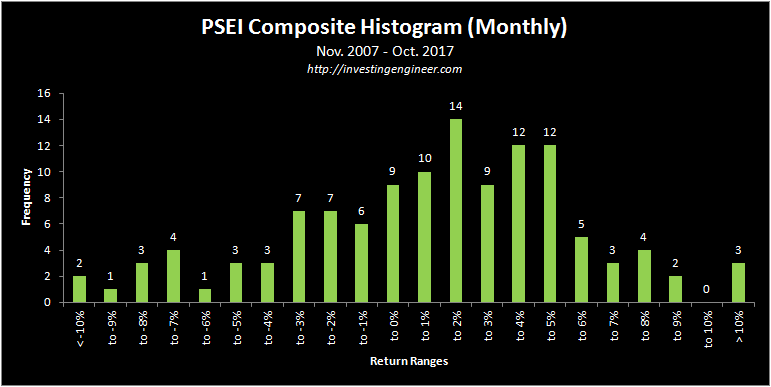

PSEI Composite Histogram (Monthly)

The chart above shows the monthly returns of the opening and closing price of the PSEI from Nov. 2007 to Oct. 2017. In this time period, we have a total of 120 months.

Here's a quick summary:

Monthly ATR:

Desc. | 6 Months | 1 Year | 2 Years | 3 Years | 5 Years |

|---|---|---|---|---|---|

Monthly ATR | 6 Months | 12 Months | 24 Months | 36 Months | 60 Months |

4.189% | 5.255% | 6.093% | 6.127% | 6.686% |

Even though the volatility levels are getting lower as we move to a lower time frame, the odds of making money on a monthly basis is higher compared to the daily and weekly histogram.

What can we prove of this? This just proves Warren Buffett's view on long-term investing. On higher time frames (e.g. quarterly or yearly), volatility is higher and thus the opportunity to make money exists.

What Can We Learn From This

Retail traders lose money in the stock market because they think they are smarter than Mr. Market. They don't understand the opportunities being presented to them by Mr. Market. They trade non-stop even if there are no short-term opportunities available. They also neglect to calculate their odds of making money because they don't know how to assess market volatility.

In other words...

They do the complete opposite of what professionals really do.

The data I presented above shows that 75% of the time, retail traders should be portfolio managers instead. They should be spending most of their time managing a portfolio of well diversified group of stocks; re-balancing or selling on gains every 1 to 3 months instead of day trading.

The ONLY time that you would think of day trading is when an opportunity occurs. 25% of the time, short-term opportunities appear. When it happens, then this is the only time that we should switch from portfolio managers into day traders.

This is also the reason why I believe that there's no such thing as trading for income.

Imagine this; You put Php 200,000 in a brokerage account and decide to become a day trader. On the first month, you get lucky and make Php 20,000. You take out Php 20,000 and spend it on food, bills and vacation. The next month, you lose Php 20,000. You also take out another Php 20,000 for your living expenses. You're now down to Php 160,000.

On the third month, you realize that you need to make Php 60,000 in order for your account to return to its original value while still paying your bills. Since you're so desperate, you enter every trading opportunity you see. You make profitable trades and you also make losing ones. At the end of the month, you're breakeven but you need to withdraw another Php 20,000 to pay for living expenses. You're account is now down to Php 140,000.

Repeat this process and within a year, you'll definitely blow your account. Without money to make a living, you now look for a new job AGAIN. You work hard AGAIN and after a year, save enough AGAIN. You resign from your work AGAIN and guess what?.. You start trading AGAIN. You then repeat the whole process until you're broke AGAIN.

Sounds funny but this is the reality that most aspiring traders don't know about.

If you'll take out Php 20,000 every month on a Php 200,000 account, you'll never grow your portfolio no matter how hard you strive to achieve monthly positive returns. But if you'll reinvest your gains and grow your portfolio 12% every year, you'll double your initial investment after 6 years.

It doesn't matter even if you start with Php 500,000 or Php 1,000,000. The numbers always regress back to the mean. The point is, if you don't let your gains compound, you'll just always end up to where you started.

To avoid getting stuck, you're going to need a stable source of income. Having an income protects you from drawdowns. Every professional trader knows this. If a trader claims to make a living only by trading, then he or she is LYING. Why? Because the statistics I presented to you don't LIE.

Have you ever wondered why your favorite stock market guru sell books, training courses and stock subscription services?

Now you know.

The most profitable traders trade ONLY when an opportunity presents itself. I repeat... ONLY. This could be once a month, once every two weeks or even two to three months. If you're a retail trader, you have to think how professional money managers trade and this is how they determine their odds of making money. They analyze the stock's volatility and enter a trade with a systematic process (technicals/fundamentals) and risk management.

The ultimate goal of trading/investing is to build wealth overtime. If you want to make an income from your investments, then accumulate preferred stocks or high dividend yielding stocks. Hold them for twenty to thirty years. That's an income strategy. Otherwise, the goal is to just build and grow it overtime.

Happy investing!

This was very helpful. I enjoy reading and learning from your blogs.

I hope you keep sharing these information. Godspeed!

Thanks Alan. 🙂

Good Read Bro! Very informative.

Anytime. 🙂