Manila Mining Corporation Stock Analysis And Opinion

Mr. Anonymous here is asking the main reason why Manila Mining Corporation's (MA) stock price dropped. He doesn't know why.

In this post, I'll share my fundamental and technical view on this, and my opinion of owning its shares.

Hello Sir Mark, please keep my identity anonymous. I follow your blog both online and via the social media. I am totally new when it comes to analyzing companies and valuation. I currently have shares of stock with Manila Mining Corporation A. For the past couple of weeks now, the company stock value has dwindled rather drastically faster than ever before.

I tried to research on what would be the main reason for this but I guess I am not looking at the right place. I as well cannot understand because this is not the case for Manila Mining Corporation B. I am not sure if this was because of the tight mining policy of the government because the mining index has been booming for a while now. My questions are, will it still further go down? Any projected number on where the price will stop to?

Do you think it is my best chance to sell my current position to minimize my losses then buy back at a lower price sometime in the future?

Thank you so much for any feedback. More power to you and Investing Engineer.

Warm regards,

Hi Mr. Anonymous,

Let's try to analyze Manila Mining Corporation and see if there's a promise of compounded returns in the future.

Here's my fundamental and technical view of it.

My Technical View of MA

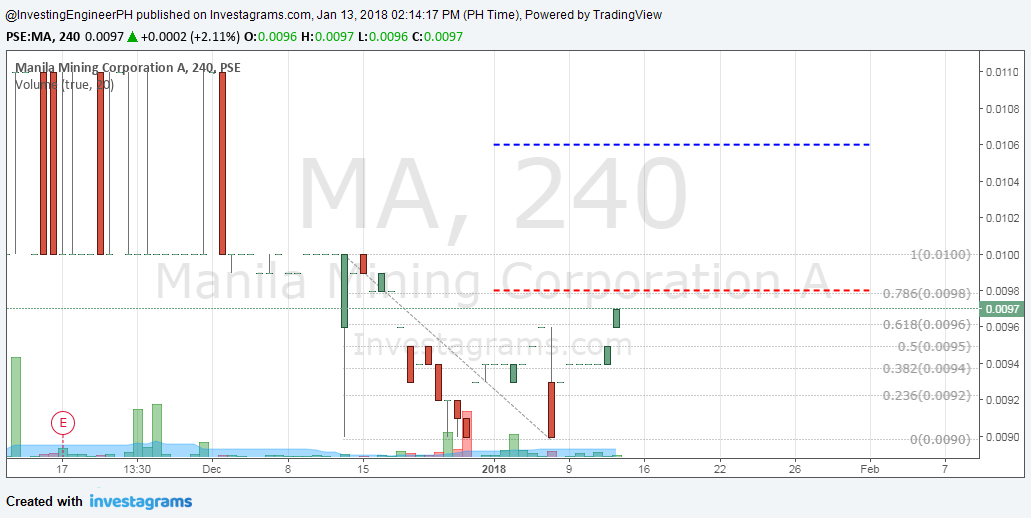

MA chart 1-13-2018

After ranging for almost 4 months, the repeated movement translated into a lower move. It now sits on the 0.009 - 0.01 range. It retraced back from the downward move last December and is now sitting between the 78.6 and 61.8 Fibonacci levels. Immediate resistance is at the monthly pivot point of 0.0098. This suggests a mild bearish tone for me.

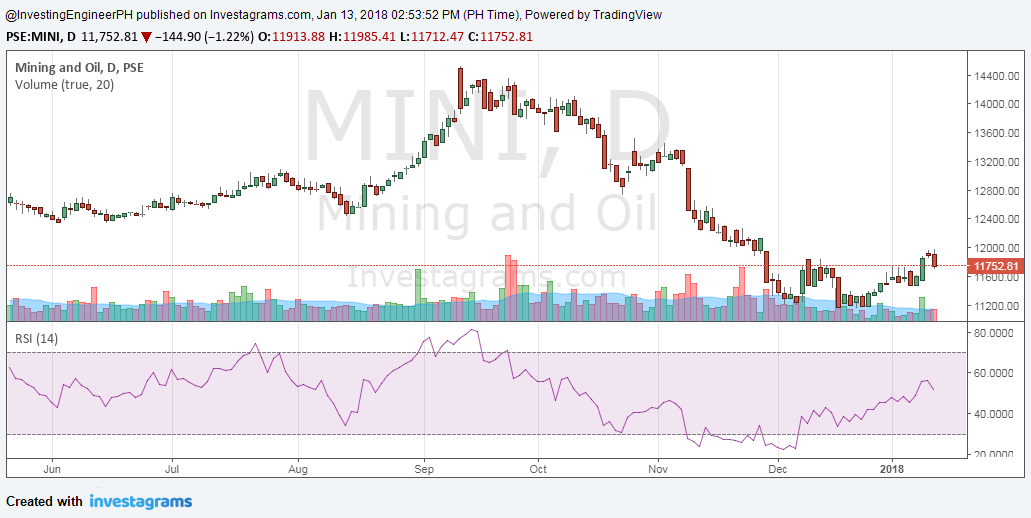

If you look at the Mining and Oil Index, the weakening started last September 2017 during the news about the banning on open-pit mining and continued to December that reached as low as 11181.86 which also I think is the reason of MA's sell-off during the same period.

The recent rally you see might be just a retracement and may continue downward unless a major mining news brings out positive sentiment.

My Fundamental View of MA

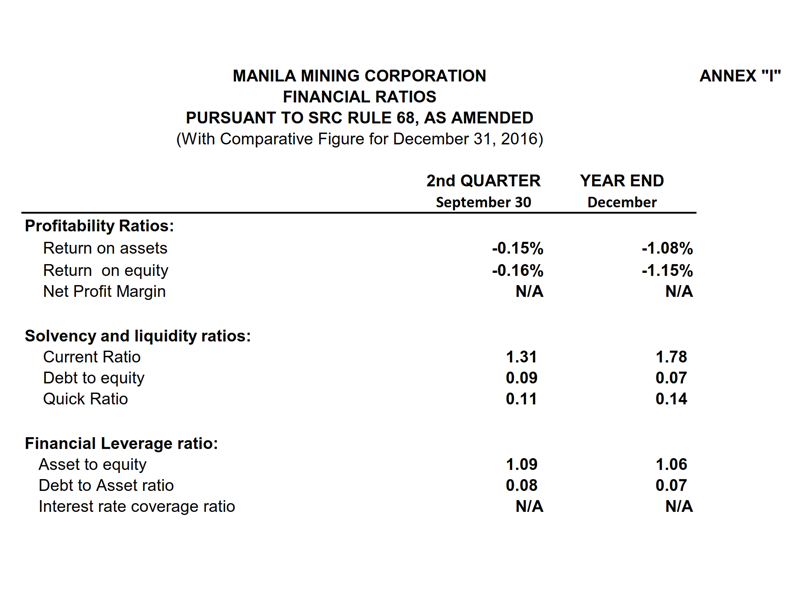

Financial ratios: Source - PSE Edge

I would stay away from companies with negative return on assets and return on equity. Although their liquidity ratios are good, it doesn't mean anything if a company doesn't book profits.

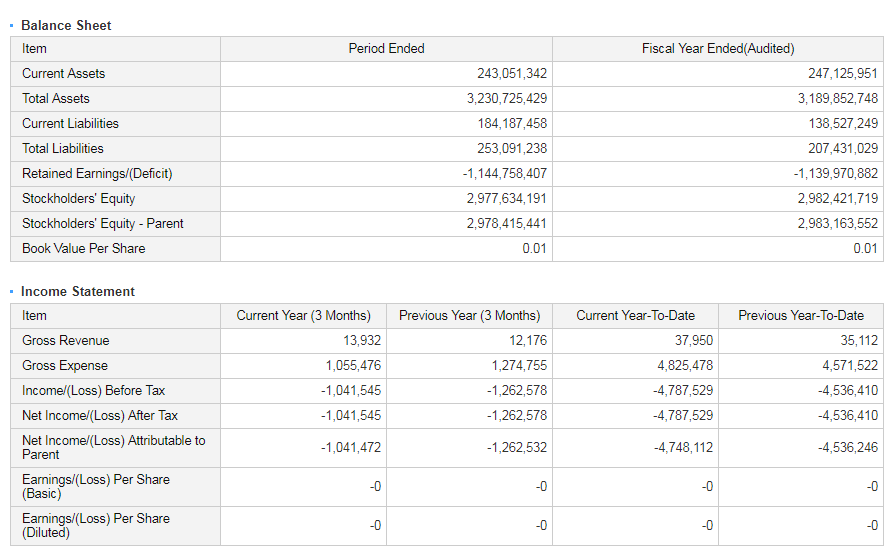

Summary of financial statements: Source - PSE Edge

If you're looking to invest based on Graham's Net Asset Value, then the stock might be a good candidate. Current price is almost equal to its book value. But buying this alone is not a good idea. It should be bought and mixed on a portfolio with at least 30 stocks of the same characteristics (i.e. stocks that pass the NAV approach) so that there's a chance to make money on a portfolio level.

In My Opinion...

I wouldn't buy this stock. I just don't see any reason why. It's speculative and it doesn't give me any confidence that my money will grow from them. They don't have any earnings which also means that there will be no dividends in the future. They also have a retained deficit so I really don't see any reason why you should accumulate and buy.

If you like mining stocks, then consider looking at the strongest in the sector like NIKL and SCC.

So that's it! If you have any questions and would like to share some of your opinions, you may do so by posting your comments below.

Happy investing!