Read This Infographic About Facts On Filipino Money Habits

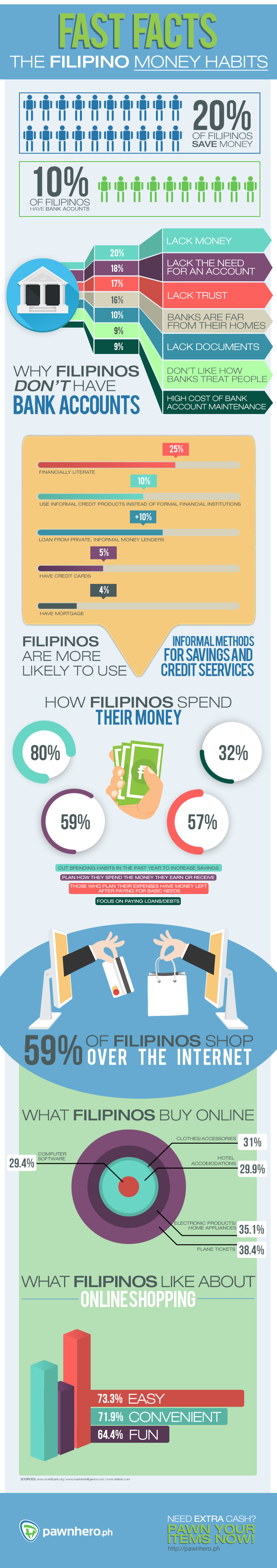

An interesting infographic by PawnHero shows interesting facts about Filipino money habits on spending and saving money.

I once belonged to the 80% of the Filipinos who doesn’t practice the habit of saving. I know a lot of people, most of them are like me too before I learned to be financially literate. Too bad that those same people haven’t realized the importance of saving yet.

I really didn’t give much thought about it until I learned the importance of investing and saving for retirement. It’s one of the reasons why I opened one barely 2 years ago and have started putting in small amounts every month.

Opening a bank account has made me realize how important it is to constantly be on the lookout for new ways to save money on your bills too.

Saving also taught me to prioritize. I have paid all my debts more than a year ago and been living debt-free since then.

Apart from these reasons, having a bank account will enable you to do cashless transactions especially in the Internet. I find it convenient when paying for online subscriptions, bills and online shopping in Lazada and other platforms using debit cards.

The infographic shown below will tell you more about the good and bad Filipino money habits. The figures will make you realize where you belong and with that, you can adjust your spending and saving to get in line with your financial goals.

Final Thoughts

Filipinos have different money habits. Some spend more and save less while others do the opposite. The important thing that we must learn from this infographic to have the proper balance of spending and saving. Breaking your bad money habits and learning the good ones will enable you to effectively plan for your financial future.

Got any thoughts in this infographic? Share them in the comments section below.

Happy saving!