Intrinsic Value Calculation: BDO, AC, BPI for FY2017

Hey investizen!

This post will discuss two banks; BDO and BPI, and the conglomerate AC.

BDO (BDO Unibank, Inc.)

BDO Monthly Pivot Chart as of May 20, 2018.

I like BDO's statistics because it shows hints of profitability. From 2012 to 2017, it has posted asset returns of above 1%. In 2017, it resulted to a 1.11% return. The average of this on a 10-year basis equates to 1.05% which is still above 1%. The average equity returns from the same period equates to 11.07% which is good.

I also like its growth for the past 10 years. From 2008 to 2017, earnings per share grew at an annual rate of 12.96%. The bank also maintained a healthy dividend yield.

Just something to take a look at is the dilution of shareholder value year-on-year. From 2.7 billion shares in 2008, BDO currently has 4.3 billion shares outstanding.

BDO is currently priced at ₱132.30 per share and is trading at 1.98x book. This is a little bit expensive in my opinion. I would say that a price anything below 1.85x book is worth considering.

On the technical side of things, the monthly pivot point rests at ₱133.70. Support levels to watch are ₱126.10, ₱120.50 and ₱112.90. Resistance levels to watch are ₱139.30, ₱146.90 and ₱152.50 (see chart).

Check out these reports as well;

BPI (Bank Of The Philippine Islands)

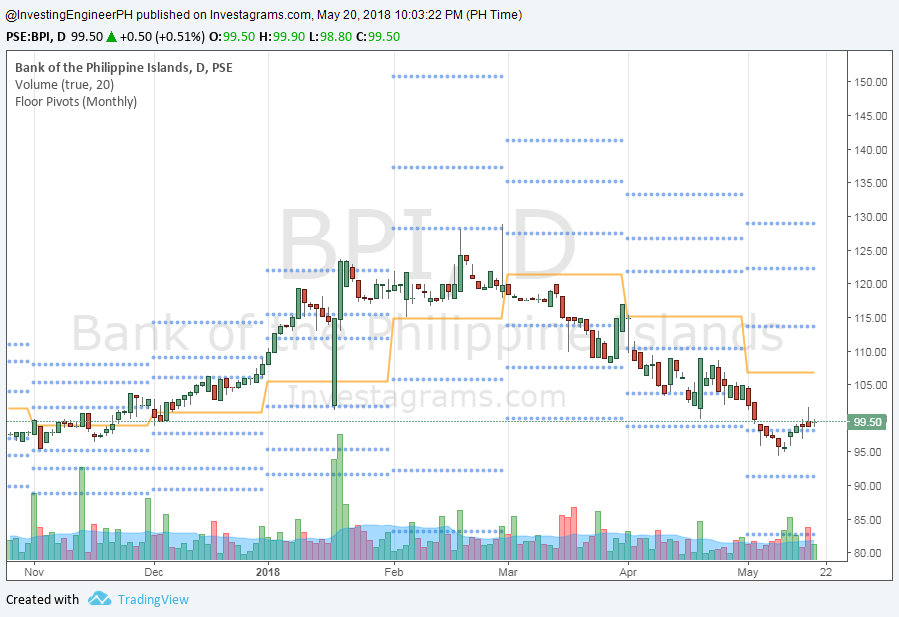

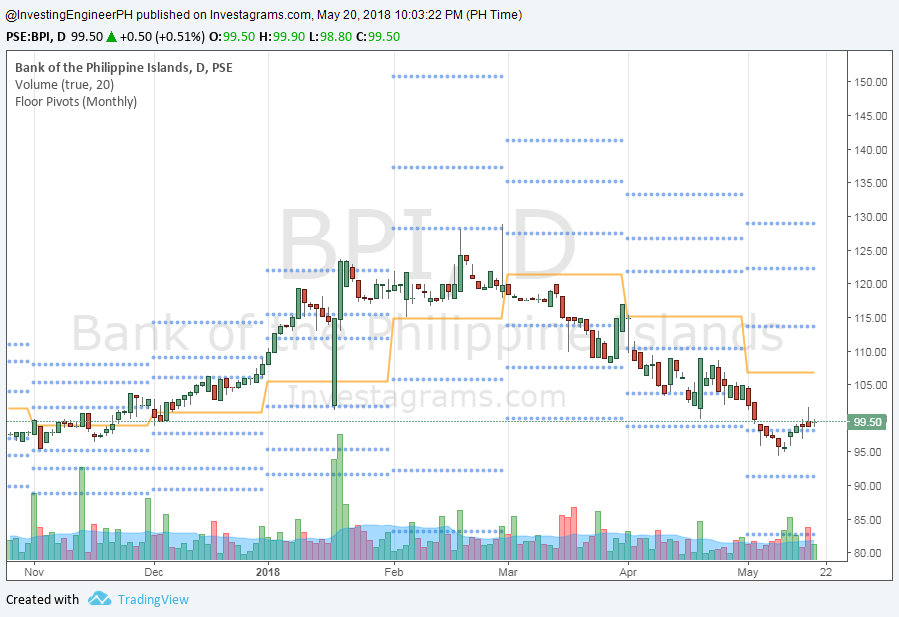

BPI Monthly Pivot Chart as of May 20, 2018.

BPI's statistics is quite a bit more attractive than BDO. Average asset returns from 2008 to 2017 shows 1.37% while equity returns during the same period shows 14.14%. Earnings per share grew at an annual rate of 9.20% and it also pays dividends regularly with better yield than BDO.

Same with BDO, I don't like the shareholder dilution. But while BDO increased shares at a rate of 4.92% yearly, BPI meanwhile only managed to increase by 1.96%.

BPI is trading at ₱99.50 per share with a P/B valuation of 2.17 which I believe is cheap. A soft target based on a fair value multiple of 2.54x may be considered.

The technicals indicate a monthly pivot point at ₱106.80. Support levels to watch are ₱98.20, ₱91.40 and ₱82.80. Resistance levels to watch are ₱113.60, ₱122.20 and ₱129.00 (see chart).

Check out these reports as well;

AC (Ayala Corporation)

AC Monthly Pivot Chart as of May 20, 2018.

Just like SM, AC is a company you also should own. It's a quantitatively healthy company. Just last year, AC booked ₱260.2 billion of revenues and made ₱30.2 billion in income. From 2008 to 2017, earnings per share grew at an annual rate of 21.06% while book value grew at 9.09%. The company also regularly pays dividends.

Operating cash flow in 2017 was booked at ₱25.5 billion. Free Cash Flow meanwhile was at negative ₱207 million due to a huge capital spending that summed up at ₱25.7 billion.

The current ratio for FY2017 is good at 1.31 but you should take a deeper look at its D/E ratio of 1.29.

AC currently trades at 2.48x book which is ₱929 per share. It's a bit expensive for now in my opinion. I'm better off to buy it below 2.23x book.

The pivot levels to watch are as follows; PP ₱947.83, S1 ₱914.17, S2 ₱862.33, S3 ₱828.67, R1 ₱999.67, R2 ₱1,033.33 and R3 ₱1,085.17 (see chart).

Check out these reports as well;

Final Thoughts

In these three stocks, we can see that only BPI is trading below intrinsic value. Buying it at ₱99.50 gives you an upside of 17.1%.

As for BDO and AC, waiting may prove to be wiser at this moment.

I hope this post provided value to you. If it does, please share it to others as well.

If you have any questions, let's discuss it in the comments section below.

Happy investing!

Disclosure: I don't own any stocks mentioned in this post. I also don't plan to initiate a buy within the next 48 hours.