Intrinsic Value Calculation: JGS, AEV, MBT for FY2017

Howdy Value Investing Fans!

As of this writing, the PSEI is hovering in the 7,500 area, just below the June Monthly Pivot Point of 7,620. I see no signs of reversal yet so it might still go down at 7,333 which is the Pivot S1. But as we all know, the more the market goes down, the more opportunities emerge to buy great companies at wonderful prices.

In this post, let's see if we can spot an opportunity by looking at JGS, AEV and MBT.

Let's begin.

JGS (JG Summit Holdings, Inc.)

June 2018 Pivot Points: PP 58.75, S1 53.55, S2 50.00, S3 44.80, R1 62.30, R2 67.50, R3 71.05.

JGS has a nice historical performance with Revenues growing at a 10.8% compounded annual rate and Net Income at 13.5% for the past 10 years. In 2017, it booked at total of ₱262 billion compared to ₱230 billion in 2016; a 13.8% growth. Its Book Value is also steadily growing at a rate of 13.8% compounded annually. 2017's Book Value increased by 9.35% compared to the previous year.

JGS has an average Gross Profit Margin of 33.7% for the past 10 years. Operating Profit Margin is at 14.7% and Net Margin at 9.4% during the same period.

JGS was able to maintain a healthy Operating and Free Cash Flow. In 2017, it booked a total of ₱38 billion of Operating Cash and ₱10 billion of FCF.

JGS is a steady dividend payer but the low dividend yield (0.10%) makes it unattractive to dividend investors.

The average RoE and RoA equates to 9.48% and 3.53% respectively while the Current Ratio and D/E Ratio for 2017 equates to 1.14 and 0.67. Both return measures and liquidity ratios indicates a healthy company.

At ₱57.25/share, JGS is trading at 1.53x Book Value. My fair value multiple of 1.56 puts it at a price of ₱58.33 which somehow gives a small upside of 1.9%.

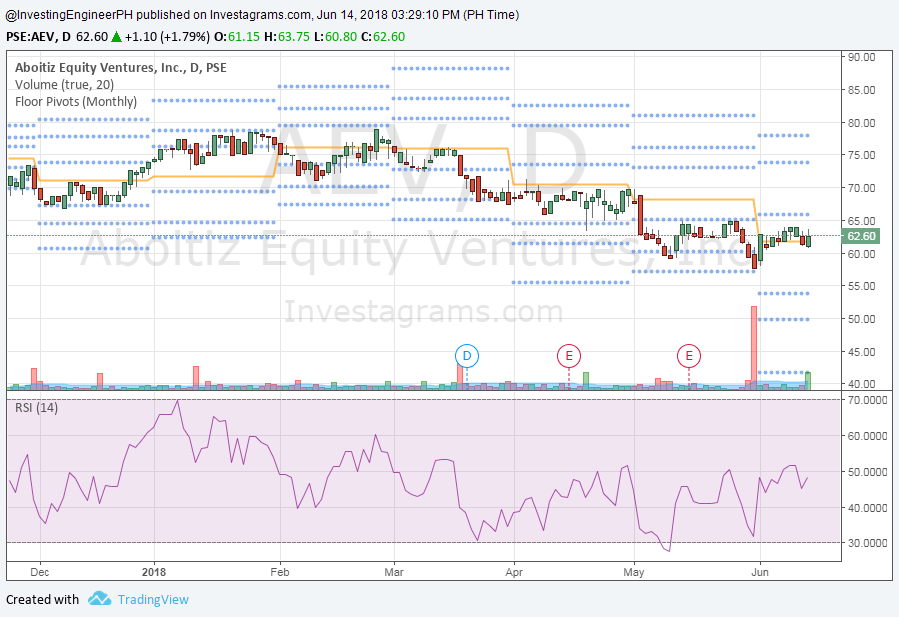

AEV (Aboitiz Equity Ventures, Inc.)

June 2018 Pivot Points: PP 61.82, S1 53.78, S2 49.77, S3 41.73, R1 65.83, R2 73.87, R3 77.83

AEV grew its Revenues at at 16.2% compounded annually for the past 10 years. It booked a total of ₱114 billion; an increase of 4.1% compared to the previous year. Net Income grew higher at 20% during the same period and it booked a total of ₱22.4 billion; an increase of 27.1% compared to last year. Book Value grew at 16.7% and recorded a 24.91/share; an increase of 23% compared to last year.

AEV is also a consistent dividend payer with historical yields going as high as 3%.

AEV is also a cash machine with consistent positive Operating Cash Flow. Free Cash Flow for the past 7 years is also consistently positive. AEV recorded ₱32 billion in Operating Cash and ₱504 million in Free Cash Flow.

The Current Ratio in 2016 performed well at 2.51 with 60% of its Current Assets tied to cash. D/E Ratio on the other hand, is at 1.69 with ₱15.9 billion tied on Short-Term Debts and ₱187.5 billion on Long-Term Debts.

Average profit margins for the past 10 years is as follows: Gross Profit Margin at 42.7%, Operating Profit Margin at 21.5% and Net Margin at 21.3%.

A drop in RoE and RoA can be seen historically, with RoA and RoE recorded as high as 13.7% and 40.1% respectively in 2010. In 2016, RoE equates to 17.4% while RoA at 5.6%.

At ₱62.10/share, AEV is trading at 2.30x Book Value. My fair value multiple of 2.63 puts it at a value of ₱71.06 which gives an acceptable upside of 14.4%.

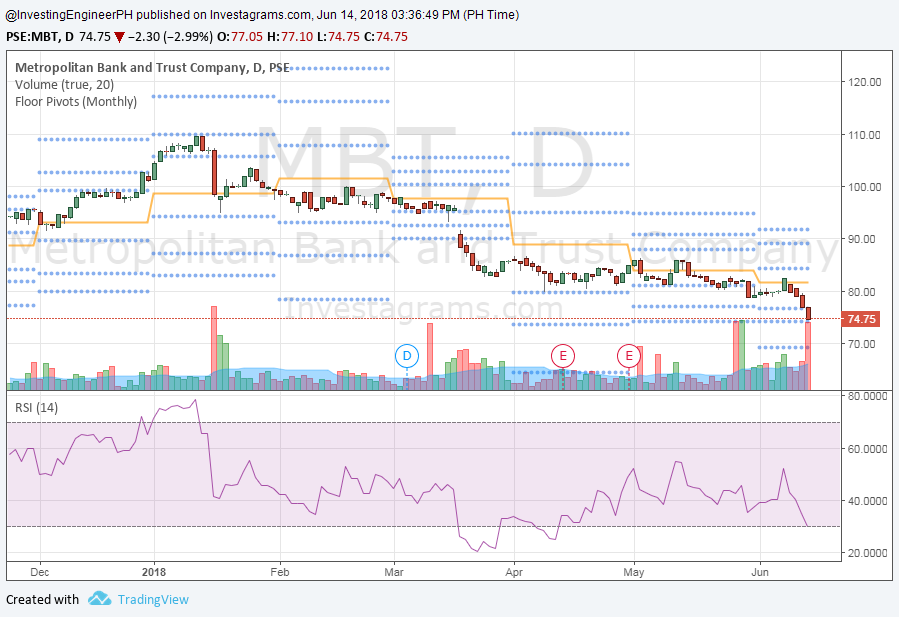

MBT (Metrpolitan Bank & Trust Company)

June 2018 Pivot Points: PP 81.63, S1 76.77, S2 74.13, S3 69.27, R1 84.27, R2 89.13, R3 91.77

MBT grew Revenues at an annual compounded rate of 8% for the past 10 years, making ₱83.5 billion in 2017. That's a 6.3% growth compared to the previous year. Net Income grew at 13.3% in the same period profiting ₱18.2 billion in 2017, an increase of 0.76% compared to the previous year. Book Value grew at 6.7% during the same 10-year period. In 2017, Book value was recorded at ₱63.26/share, an increase of 4.3% compared to the previous year.

The company is also a consistent dividend payer with yields reaching as high as 1.8%.

MBT has a history of diluting its shareholders. Shares Outstanding has increased by about 3% yearly, with 2.6 billion shares in 2008 to 3.3 billion in 2017.

The bank has maintained a healthy financial leverage of of 10.69 and averaged at 10.08 for the past 10 years.

Asset returns has performed poorly. From an outstanding 1.82% in 2013, it has dropped to a poor 0.92% in 2017. On a 10-year average, MBT performed at 1.09% which is still good.

At ₱75.80/share, it's trading at 1.19x Book Value. My fair value multiple of 1.36x puts it at ₱86.37 which gives an upside of 13.9%

Final Thoughts

All of the stocks mentioned today is trading at a discount being AEV and MBT as one of my bets if you're building a portfolio of index stocks. But between the two, I prefer MBT as it is already trading near its S2 pivot point and at a P/B of 1.19, it surely is a bargain.

AEV is also good at 14.4% upside to my intrinsic value estimate.

JGS need to drop down more because a 1.9% is not good at all.

I hope this post provided you insights to invest with a systematic approach.

If you have any thoughts you would like to share, I would love to hear it! Please leave them in the comments section below.

Happy investing!

Disclosure: I don't own any shares of JGS, AEV and MBT and do not intend to buy for the next 48 hours.

Hi Mark, how did you compute for your fair value multiple? Thanks ?

I base it on historical price data. Start by analyzing the price where they traded with respect to book in the past 10 years. From that data, determine at what P/B valuation it is trading below intrinsic value.

Hi Mark, thank you for this post. Is it oky to ask how you compute for your fair value multiple? Thanks!