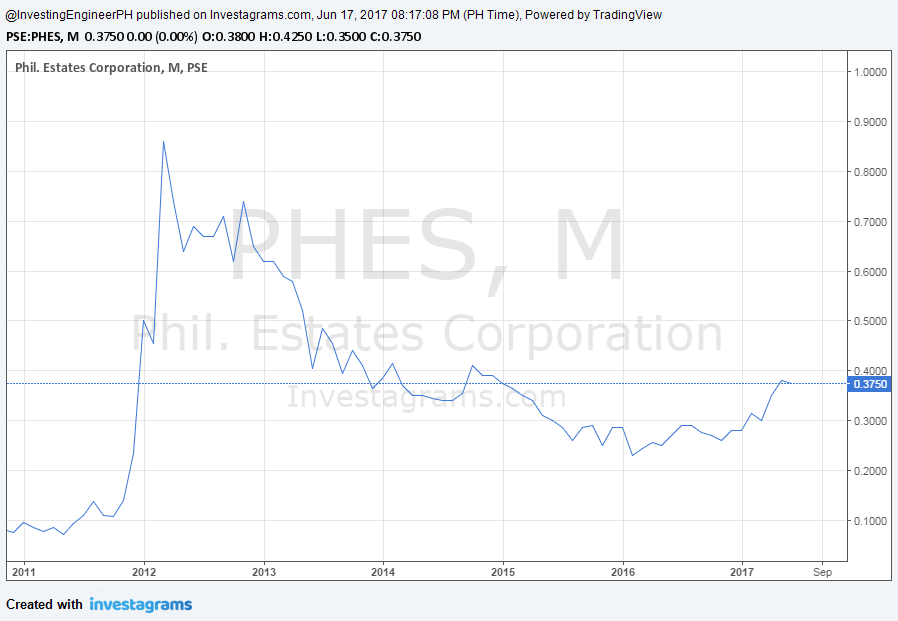

Finding Value In PHES (Philippine Estates Corporation)

In today's post, my hunt for bargains has led me to analyze PHES (Philippine Estates Corporation).

PHES, which is majority controlled by The Wellex Group, Inc., is engaged in the business of holding and developing real estate with projects located in several developed areas all over the country.

This post summarizes the valuations based on net current asset value, net-net working capital and owner earnings analysis which supports my conclusion of the stock being an undervalued security.

If you are looking forward to invest in PHES, and want to know the range of prices to buy and sell the stock based on value, then this post is right for you.

Which stocks to BUY or SELL? Find out on PinoyInvestor.com!

Switch from FREE Version to PREMIUM ACCESS now! Subscription starts at P399 per month. Click here and try it today!

ADVERTISEMENT

Net Current Asset Value

The latest quarterly financials (1Q17) recorded the following items in the balance sheet. Excluding all other non-current assets, total net assets equates to P952 million. Subtracting total liabilities, we get an estimated net current asset value of P549 million.

Items | 1Q17 Book Value (in Mil of PHP except per share values) |

|---|---|

Cash and cash equivalents | 12.268 |

Trade and other receivables | 180.260 |

Real estate inventory | 689.469 |

Prepayments and other current assets | 26.778 |

Fixed assets | 43.324 |

Total net assets | 952.099 |

Total liabilities | 402.787 |

Shares outstanding | 1,445.549 |

Net current asset value | 549.312 |

Net current asset value per share | 0.3800 |

This value if divided by the outstanding shares, we get a NCAV per share value of P0.3800. At the time of this writing, PHES price closed at P0.3750. Clearly, PHES trades at a slight discount to its NCAV value.

Net-net Working Capital

Getting the net-net working capital equates to a value around P229 million or a per share value of P0.1589. I consider a price like this a safe buy and if the market offered an opportunity, I would not hesitate to grab a lot of shares

Items | % of BV | 1Q17 Liquidating Value (in Mil of PHP except per share values) |

|---|---|---|

Cash and cash equivalents | 100% | 12.268 |

Trade and other receivables | 80% | 144.208 |

Real estate inventory | 67% | 461.944 |

Prepayments and other current assets | 20% | 5.356 |

Fixed assets | 20% | 8.665 |

Total net assets | 632.441 | |

Total liabilities | 402.787 | |

Shares outstanding | 1,445.549 | |

Net-net working capital value | 229.654 | |

NNWC value per share | 0.1589 |

Discounted Owner Earnings Analysis Adding Equity

Owner earnings analysis reveal that the company burned cash at a rate of P5.2 million a year since 2014. At 0% growth (which I consider a conservative assumption), the value of the future cash projected at 20 years at a discount rate of 12%, discounted to present equates to negative P39 million.

Book value recorded for the first quarter of 2017 equates to P1,054 million. Less the future cash, the value of the company at present equates to P1,015 million or a per share value of P0.7023. At a 50% margin of safety, an estimated buy price of P0.3511 per share is calculated.

Items | in Mil of PHP except per share values |

|---|---|

Total cash discounted to present | (39.294) |

Equity (1Q17) | 1,054.467 |

Shares outstanding | 1,445.549 |

Intrinsic value | 1,015.173 |

Intrinsic value per share | 0.7023 |

Intrinsic value @ 25% MOS | 0.5267 |

Intrinsic value @ 50% MOS | 0.3511 |

Intrinsic value @ 75% MOS | 0.1756 |

Discounted Owner Earnings Adding NCAV

An interesting idea came up to me. Instead of considering the book value, I used the net current asset value instead and added the discounted future cash. Intrinsic value calculated turned out to be P510 million or a per share value of P0.3528. At 33% margin of safety, buy price calculated was P0.2364 per share.

Items | in Mil of PHP except per share values |

|---|---|

Total cash discounted to present | (39.294) |

NCAV (1Q17) | 1,054.467 |

Shares outstanding | 1,445.549 |

Intrinsic value | 510.018 |

Intrinsic value per share | 0.3528 |

Intrinsic value @ 33% MOS | 0.2364 |

Discounted Owner Earnings Adding NNWCV

Using net-net working capital, we should expect a much lower value. At this rate, value calculated was estimated at P190 million or P0.1317 per share. This is a very conservative value especially if a 33% margin of safety will be applied.

But in this scenario, I don't think a safety margin should be applied at this point. NNWC per share is already a safe buy price in my opinion.

Items | in Mil of PHP except per share values |

|---|---|

Total cash discounted to present | (39.294) |

Net-net working capital (1Q17) | 229.654 |

Shares outstanding | 1,445.549 |

Intrinsic value | 190.360 |

Intrinsic value per share | 0.1317 |

Intrinsic value @ 33% MOS | 0.0882 |

Interpretation Of Calculated Intrinsic Values

You can see that a price anywhere below P0.3500 per share pose an opportunity to buy and a target of at least P0.5000 based on owner earnings analysis backed by NCAV and NNWC calculations.

We can also see that the stock traded at prices we expect them to reach in the past. It may be possible for the stock to rally if good news presents itself and investors respond positively.

What I don't like about the stock is that PHES is a thinly traded security. You can make a lot of money if a good price presents itself or if it goes south, you'll be left with an illiquid stock and would have to wait for an indefinite amount of time for the market to effectively price the business. I would buy this stock if it meets at least a 50% margin of safety - the more the better.

If the stock and price meets value at P0.7000, it's definitely a no-brainer sell.

Final Thoughts

I would love to buy this stock regardless of its historical bad earnings because of the market's inefficient pricing. What I learned from the greatest value investors in our time is that we wait for the best offer. If the market presents that offer especially at net-net working capital values, it's a no-brainer.

This concludes my PHES stock review. I would love to hear your thoughts so make sure you leave them in the comments section below.

Happy investing!

Know The Numbers And Trade Smart Using Quantitative Data Solutions!

Applicable in PSE, Forex and Commodities. Click here and start trading intelligently!

ADVERTISEMENT

Do You Want to Gain Financial Wealth and Spiritual Abundance at the Same Time?

If you want Bro. Bo to be your personal financial coach and know more about the Truly Rich Club, then click this link here.

ADVERTISEMENT

Hello , good day, can you share, how to compute the Net Current Asset Value per Share? Can you guide as how to compute by our own with formula? Thank you very much sir.

Hi Nico, the process is described in detail by Ben Graham in his book Security Analysis ch. 43. The simplest way to do it is to get the current assets and subtract the total liabilities and divide by the outstanding shares.

Thank you very much Sir!

Hi. Would appreciate if your posts contain specific dates after the title or somewhere for bibliography purposes, additional credibility, etc.

The blog theme posts dates at relative time. I will try to change that. Thanks for your feedback. 🙂

Hello Engr, Marc tnx sa info mo about PHES,Ask kolang sana kung me info ka sa Chelsie Logistics coming siya itong July IPO.Masyado kasi siyang malaki to handle FA.tnx

Hi Ernie,

Let’s see kapag makuha ko yung prospectus. I’ll make a quick valuation.

Salamat Sir Marc, yung CLI salamat pala ulit sa info mo napagbigyan ako ng col, long term ko na rin ito.wag ka sana mag sawa tumulong.GOD BLESS Marc

No problem Sir Ernie. 🙂

Greetings Mark! Great review and analysis once again. I was wondering if you can take a look at COSCO and share your thoughts. Thanks in advance and more power!

Ok Ms. Alex I’ll try and give some time to it. 🙂

hi Mark!

I find your posts valuable, hope next time you can also post analysis for GERI. More power! ?

Thanks,

Divine

Hi Divine,

I’ll try my best to grant your request. Thanks for the lovely feedback. 🙂

hi Sir Mark,

How did you get Total Cash Discounted to Present (39.294)

Thanks,

Nino

Hi Nino,

I used a DCF model I created to calculate the figure.

thanks sir, God Bless