How To Determine Financial Health

Have you ever thought what will happen to the Philippine economy if the euro debt crisis of Greece isn’t resolved? What if Greece defaulted? What would be the possible effect on our economy?

What about the stock market bubble at China? Will it directly affect us?

What if a great depression like what happened in the US way back in 1929 descended upon us today?

What if the Asian Financial Crisis of 1997 were to happen again?

What if the subprime mortgage crisis of 2008 were to happen again?

Now think, what will happen if we, as an investor were hit by such global economic crisis? What will happen to our stock investments?

The big question is, can the company we invested in survive such a global economic disaster?

Believe it or not, there are some indicators on a company’s balance sheet that can answer that question. It’s just a matter of simple math and analysis.

As long term investors, we should at least be familiar about the company’s financial health of the we invest in. After all, we are long term investors.

We can’t predict when the next stock market crash will occur but surely enough, if we have a complete knowledge of the company’s financials, we can reassure ourselves that the companies we buy can withstand the tests of a recession.

Determining A Company’s Financial Health

So how do we find it out?

First of all, find these figures on the financial statements;

- Notes Payable/Short Term Debt (NP/STD)

- Current Portion of Long Term Debt/Capital Leases (CPOLTD/CL)

- Cash & Short Term Investments (C&STI)

- Retained Earnings (RE)

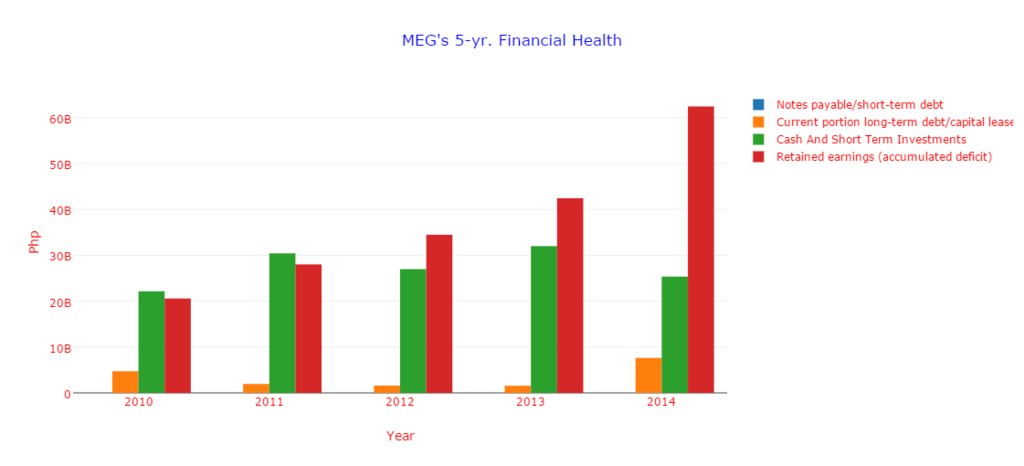

Let’s look at the data on my first investment, MEG;

Fig. 1 5-yr financial health

The idea behind this is that companies that can pay off all of their short-term debts and long-term debts due every year using their cash reserves has a very good financial health.

And what this means is that they have a high probability of surviving a recession.

What we now do is that we get the sum of NP/STD and CPOLTD/CL and compare it to the sum of C&STI and RE. What we need to find out is that C&STI and RE must be greater than NP/STD and CPOLTD/CL.

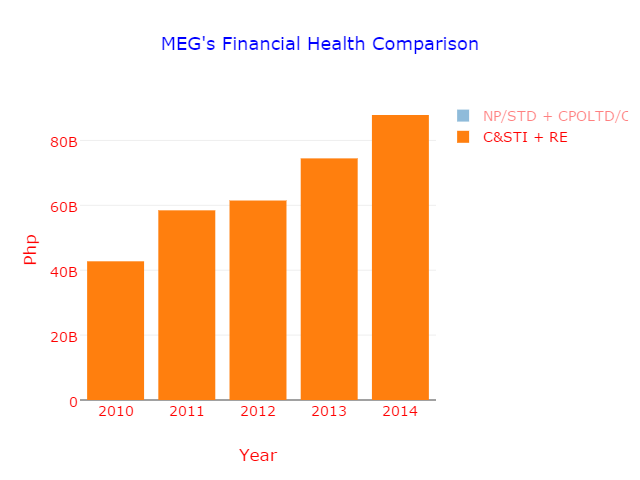

Let’s look at the data below;

Fig. 2 Financial health comparison

As you can see, the sum of C&STI and RE is always greater than NP/STD and CPOLTD/CL on a consistent basis. This mean that MEG has vast reserves of liquid money and investments to easily pay off her debts when Revenue declines due to a recession.

To conclude, MEG has a very good financial health.

Now we get the ratio of these data. We divide C&STI and RE to NP/STD and CPOLTD/CL. a good ratio is equal or greater than 5.

Here’s the results;

- 2010 – 9.04

- 2011 – 29.98

- 2012 – 38.72

- 2013 – 47.58

- 2014 – 11.52

As you can see, the company consistently beats the minimum ratio of 5. Now we can really say that MEG can withstand a recession.

If you’ll remember the Asian Financial Crisis of 1997, MEG’s stock dived down from 4.37 Php to 0.19 Php in just a year. And during the Sub Prime Mortgage Crisis of 2008, MEG’s stock dived down from 4.35 Php to 0.55 Php in just two years. But since the company has a good financial health, she recovered and survived.

Now, take a look on your stocks and see if they have strong financial health. Know the risks of investing so that it won’t bite you and bleed to death. If you would like some more help with finance then you can check out sites such as Rapid Ratings, where you can Manage third party risk and other financial tasks that need managing.

Happy investing!