Volatility Analysis: MRC (Nov. 24, 2017)

Last week was a very volatile market for MRC. The 5-day rolling ATR spiked to 8.08% compared to it's 20-day rolling ATR of 5.29%. The 1,250-day rolling ATR is at 4.83% which is lower than the recent rolling ATRs. This suggest that opportunities to trade the asset on the short-term almost doubled.

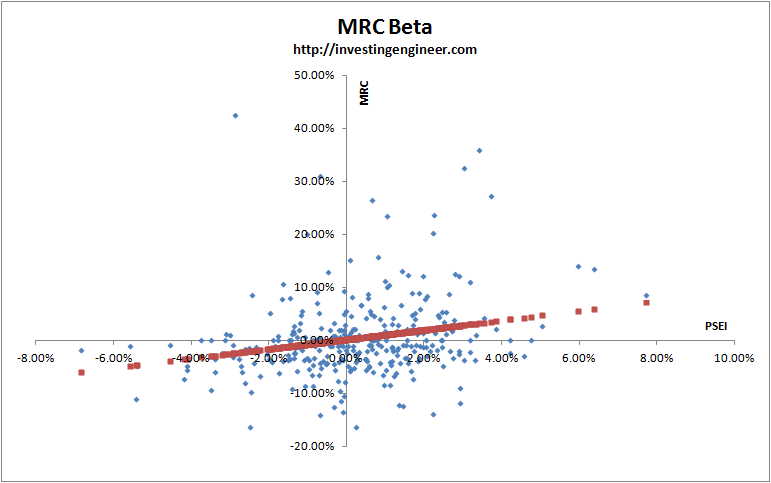

Although the recent ATR has improved, the 260-week beta analysis indicates that MRC's is still less volatile than the PSEI by 10%.

More volatility is expected on today as MRC announced in a disclosure that it has partnered with a Chinese firm to look into possible investments in the Philippine liquefied natural gas (LNG) industry.

Average True Range (Daily)

Average True Range | ||||||

|---|---|---|---|---|---|---|

Days | 5 | 20 | 60 | 250 | 750 | 1250 |

H-L | 8.08% | 5.29% | 5.33% | 5.93% | 5.40% | 4.83% |

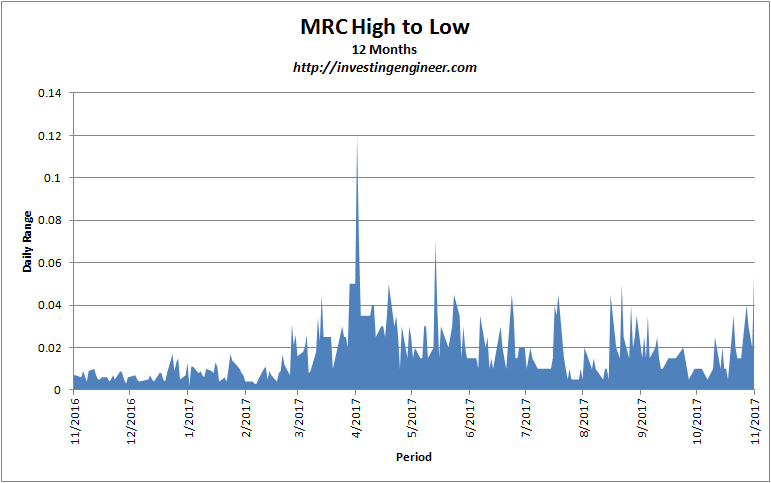

High To Low Range

Average Range (high to low) | ||||||

|---|---|---|---|---|---|---|

Days | 5 | 20 | 60 | 250 | 750 | 1250 |

H-L | 0.0340 | 0.0193 | 0.0088 | 0.0173 | 0.0099 | 0.0078 |

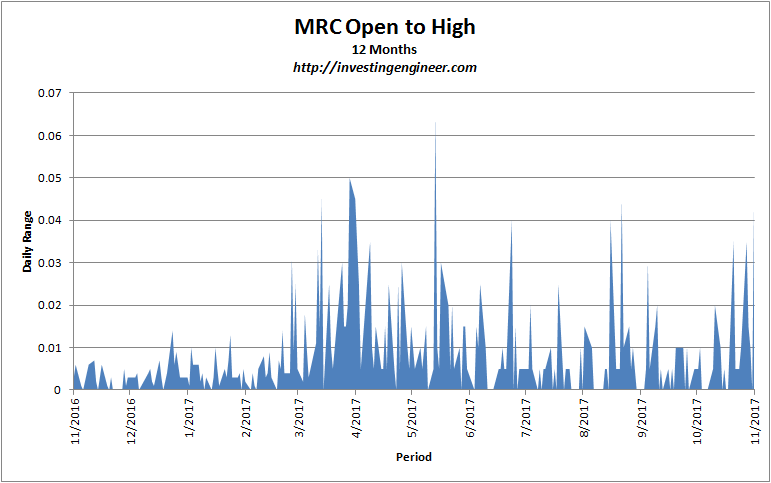

Open To High Range

Average Range (open to high) | ||||||

|---|---|---|---|---|---|---|

Days | 5 | 20 | 60 | 250 | 750 | 1250 |

O-H | 0.0210 | 0.0108 | 0.0088 | 0.0083 | 0.0049 | 0.0038 |

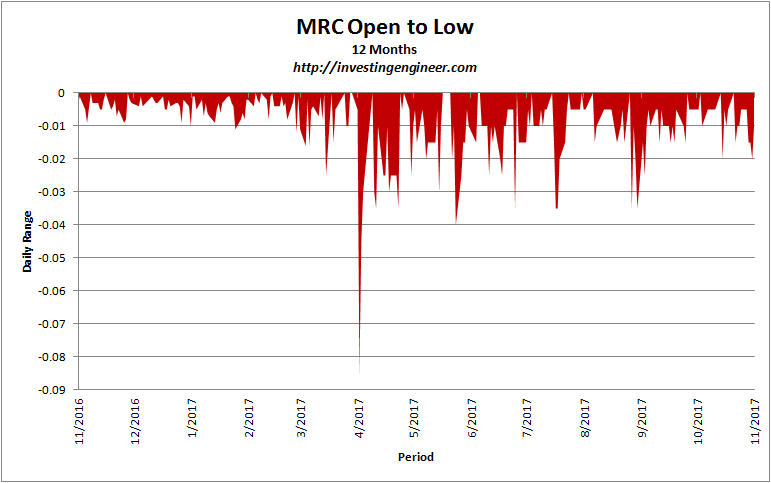

Open To Low Range

Average Range (open to low) | ||||||

|---|---|---|---|---|---|---|

Days | 5 | 20 | 60 | 250 | 750 | 1250 |

O-L | -0.0130 | -0.0085 | -0.0096 | -0.0090 | -0.0050 | -0.0039 |

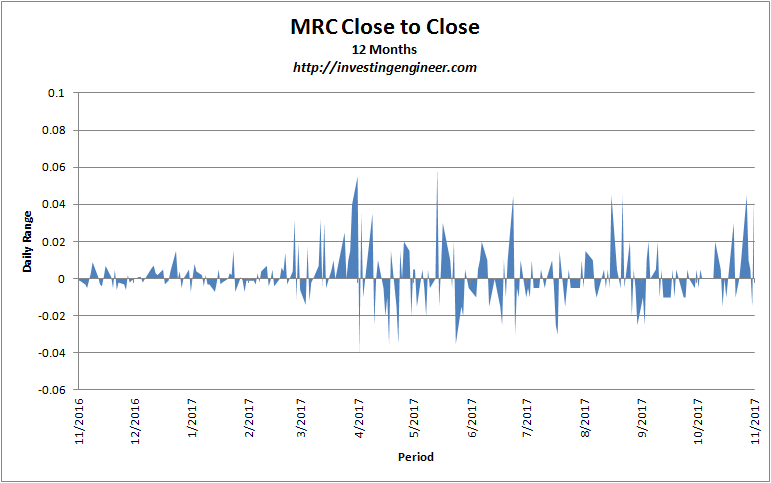

Close to Close Range

Average Range (close to close) | ||||||

|---|---|---|---|---|---|---|

Days | 5 | 20 | 60 | 250 | 750 | 1250 |

C-C | 0.0180 | 0.0060 | 0.0026 | 0.0011 | 0.0004 | 0.0002 |

Beta Value

Beta |

|---|

0.901636772959969 |

Technical Analysis

For entry and exit targets, here's a technical analysis report by Unicapital Securities to serve as your guide to trade.

Happy investing!

Disclaimer: I don't own shares of MRC as of this writing.