Introduction To Understanding Financial Statements

I was often asked by some of my readers where I get the figures I present in my stock valuations.

Some are confused because they couldn’t find the exact numbers that I present.

Some generally don’t understand how a financial statement is interpreted.

Others, just hate math in its entirety and asks for easy ways to get the data they want.

I see this as a major problem for most aspiring value investors. That’s why today, I have decided to do a series of blog posts that will tackle this important subject.

Consider this post as my first guide to understanding financial statements and how financial ratio analysis can help you pick better performing stocks for long-term investing.

Do We Need To Learn How To Analyze Financial Ratios?

As a value investor, a financial statement is like a tool that we use to help us find those hidden gems inside a company so that we can invest in it to become stock market winners in the future.

Without this tool, it’s like seeking a treasure chest in the Caribbean islands without a treasure map.

That is why we need to understand the basics of accounting to identify financially strong companies.

In these series of tutorials, I’ll show you some of the things I do on how I interpret these public documents by using financial ratios. I guarantee that once you have read these tutorials that I’m about to post these coming days, you’ll be surprised how easy it is to find those treasure chests filled with precious gems.

I’ll be sharing all of this valuable information for all those loyal The Investing Engineer PH readers like you.

With that said, let’s get started.

The Components Of A Financial Statement

A financial statement consists of four items; the Income Statement, Balance Sheet, Cash Flow Statement and Statement of Changes in Equity.

I’ve downloaded Puregold’s (PGOLD) financial statement to show as an example.

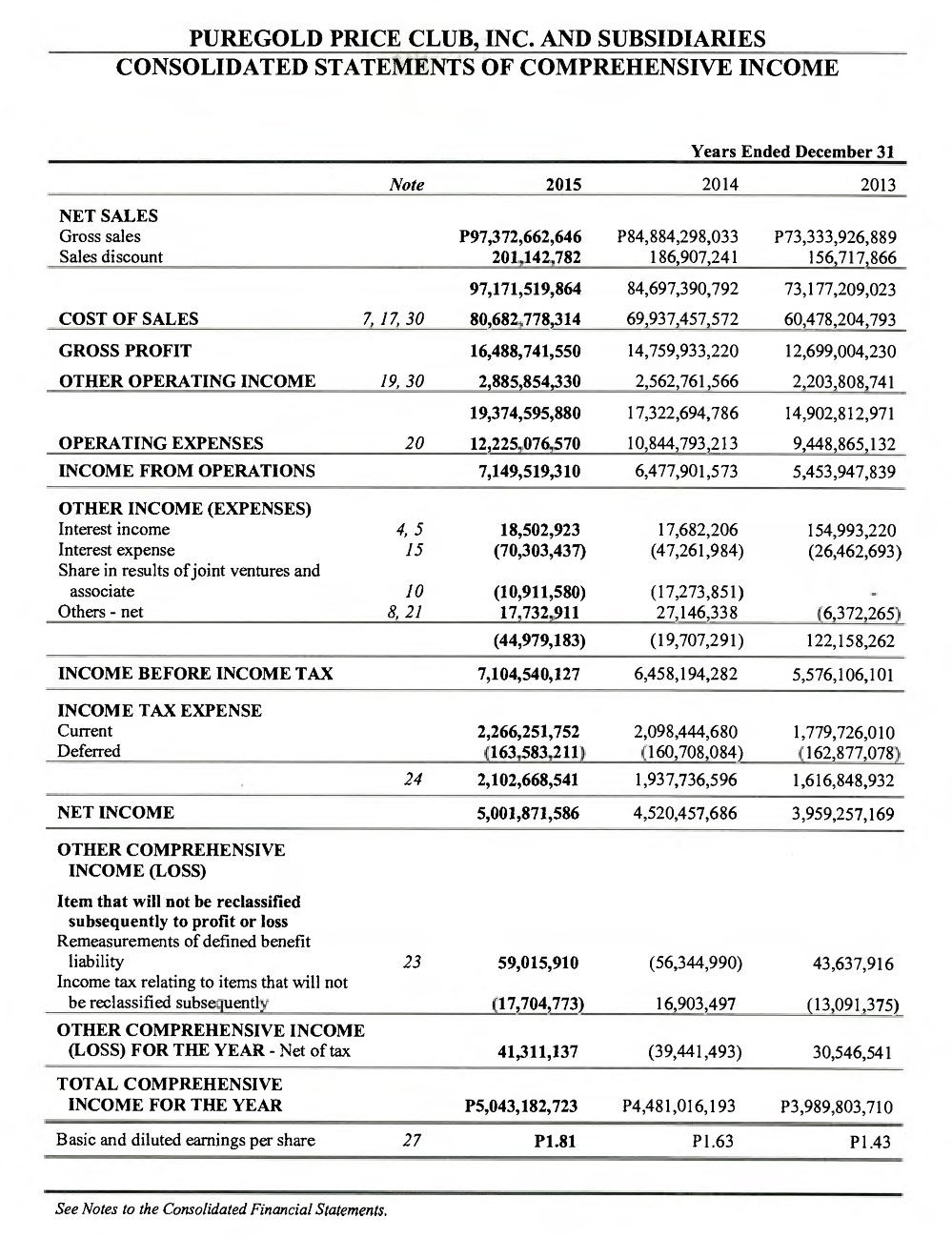

#1 Income Statement

Here’s what an Income Statement looks like. It lists all the income and expenses a company made in one fiscal year. It is where we can find important figures such as the Revenue, Net Income and the Earnings Per Share.

The Income Statement basically shows how profitable a company is.

By getting the Revenue and subtracting all of the Expenses, you’ll get the Net Income or how much money was left.

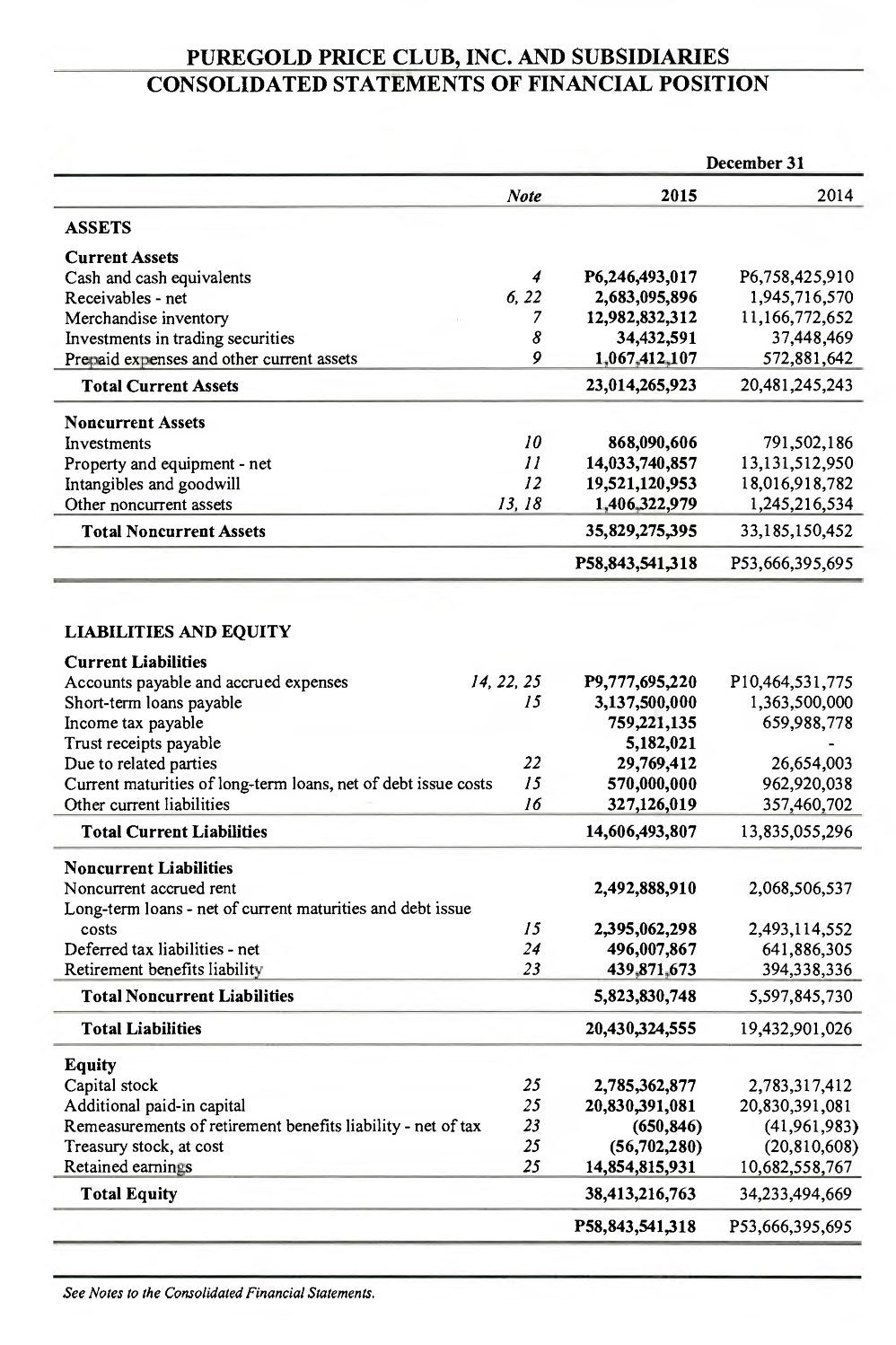

#2 Balance Sheet

A Balance Sheet lists all the assets, liabilities and equity at the end of the fiscal year. Here’s what it looks like.

Fig. 2 Example of a Balance Sheet

The Balance Sheet is where you can find how much a company owns which are called Assets, how much a company owes which are called Liabilities, and what the company is worth by subtracting the Assets and Liabilities which is the Equity.

I look at the balance sheet to determine one thing; a company’s financial health. You can find a lot of information regarding a company’s debt, cash and inventory turnover in this document.

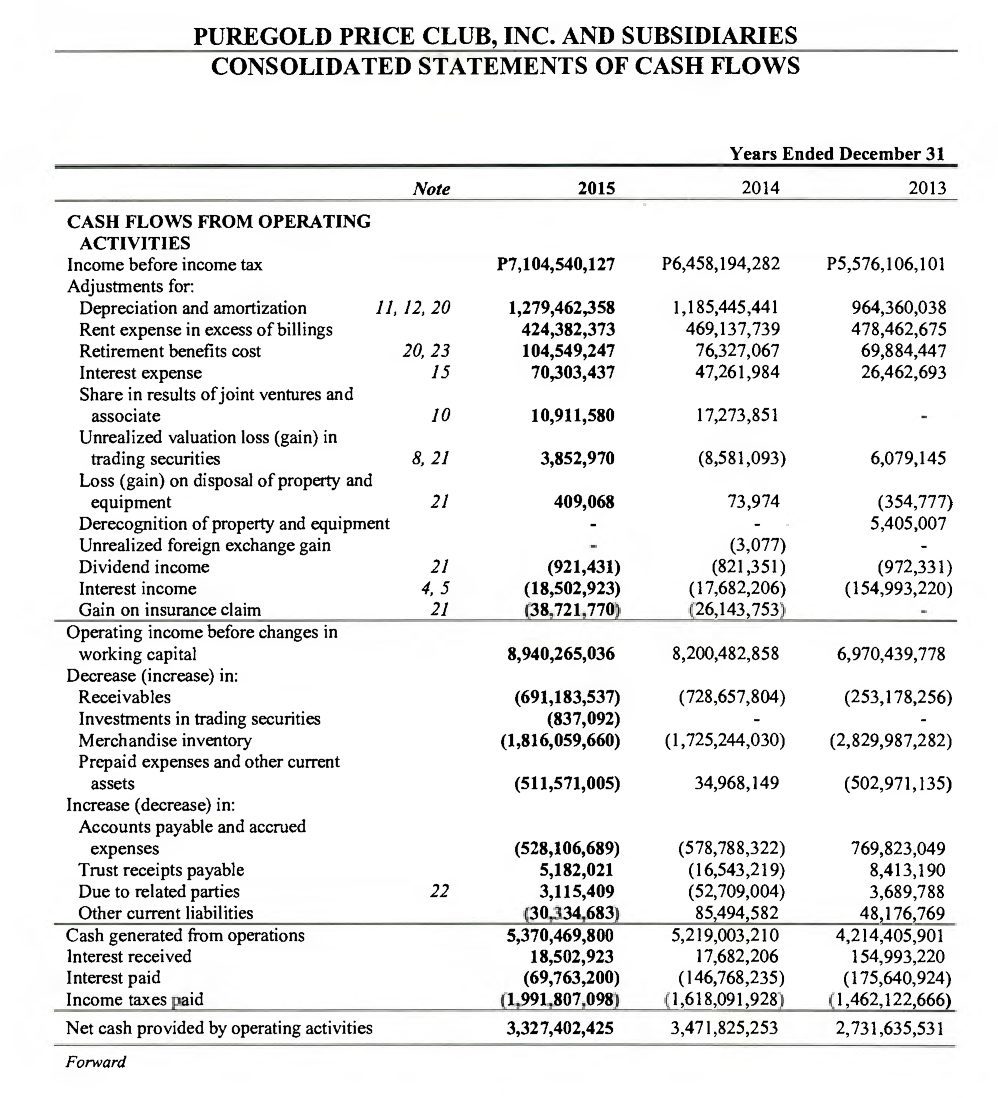

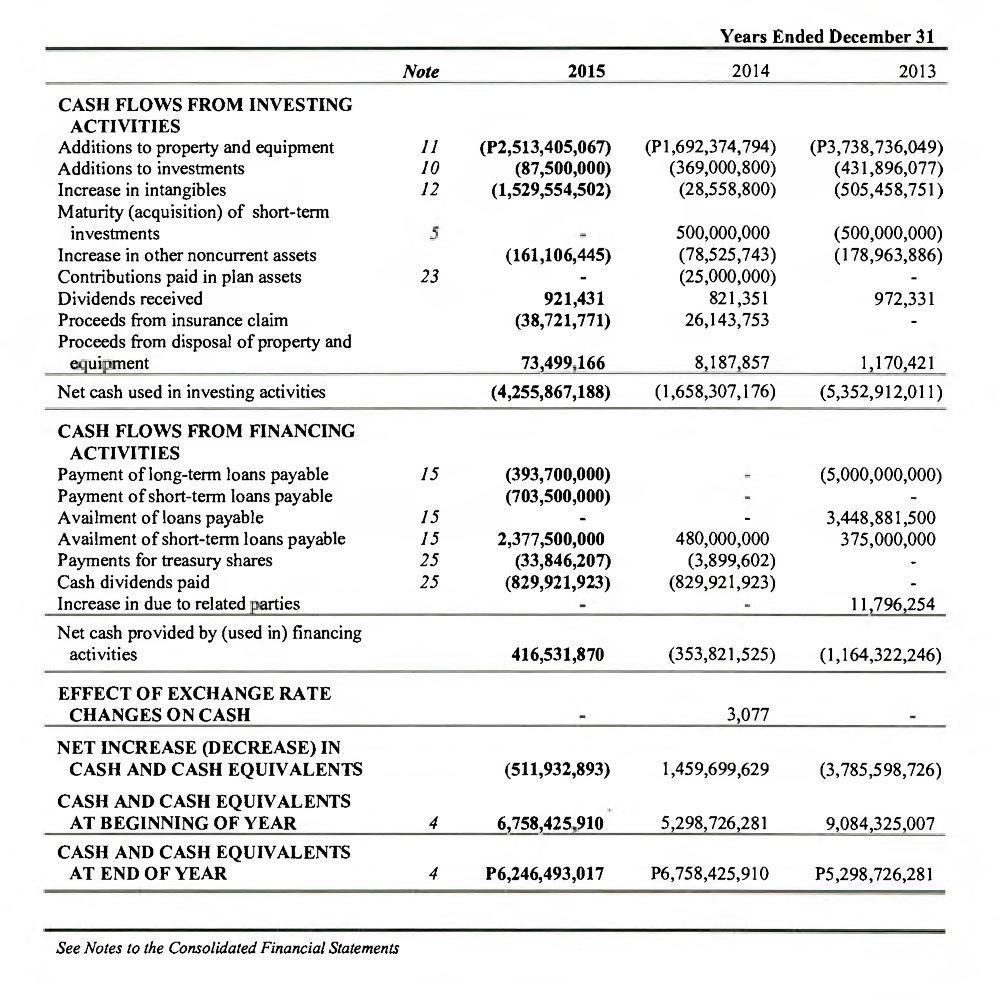

#3 Cash Flow Statement

Lastly, a Cash Flow Statement is where you can find the total cash coming in and coming out from the company. You can find data such as the cash generated or spent due to operating, investing and financing activities.

I want to stress that Net Income is not the same as Cash. Let me explain.

Let’s say that a car manufacturing company sold a car for P1,000,000. The cost of making that car is P500,000. In the Income Statement, that would be reflected as a P500,000 Net Income.

That sounds very simple but in the Cash Flow Statement, it has a different story.

To sell a car, the company needs to manufacture it first. To do that, it needs to spend P500,000 and a certain amount of time to manufacture it before it is sold at P1,000,000 to a potential buyer to get the profit.

To simplify, the Cash Flow Statement shows how cash changes hands through the company and its customers. Cash enters when customers pay for its products and services. Cash leaves when the company pays it suppliers, creditors and bills.

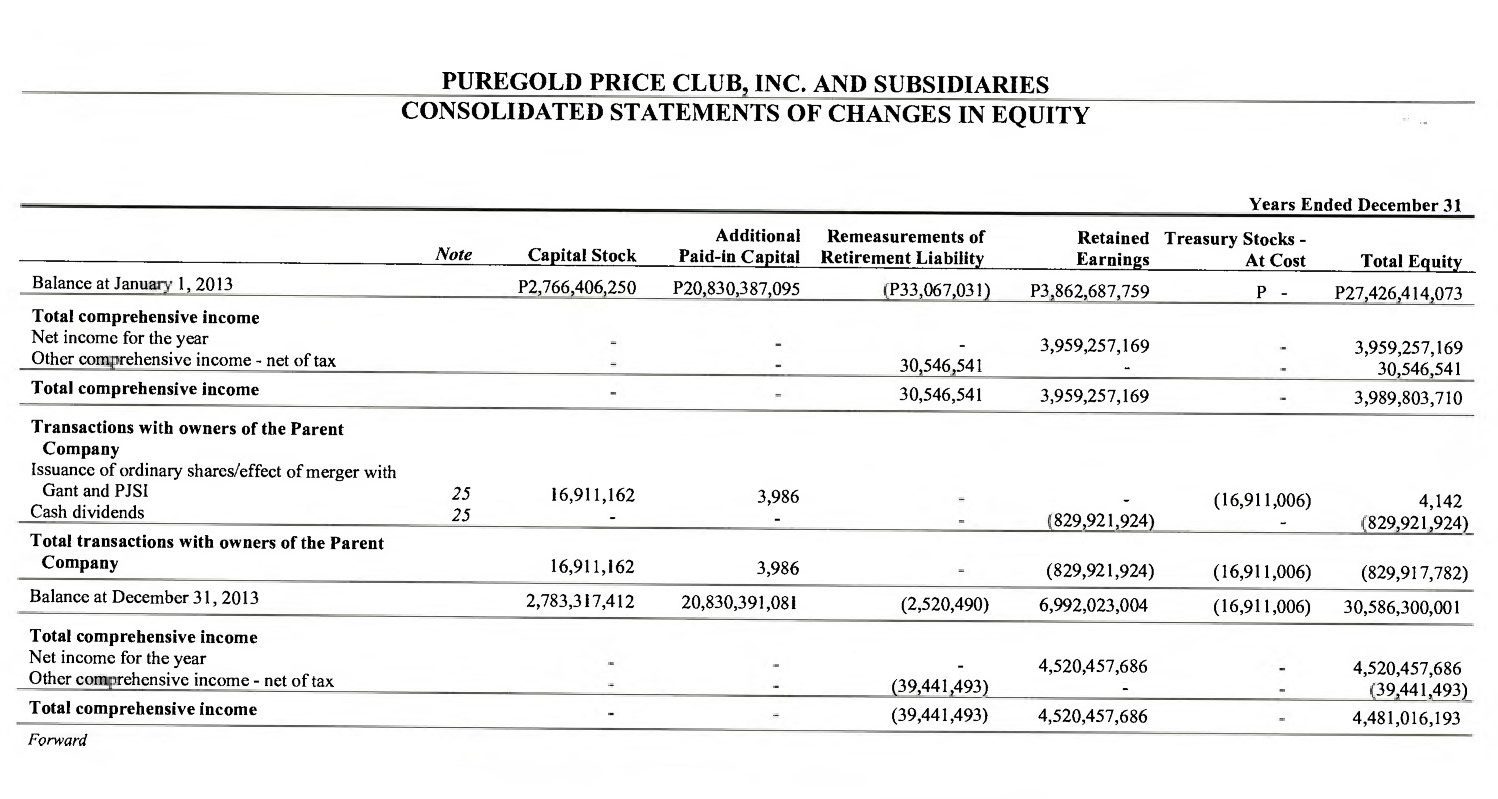

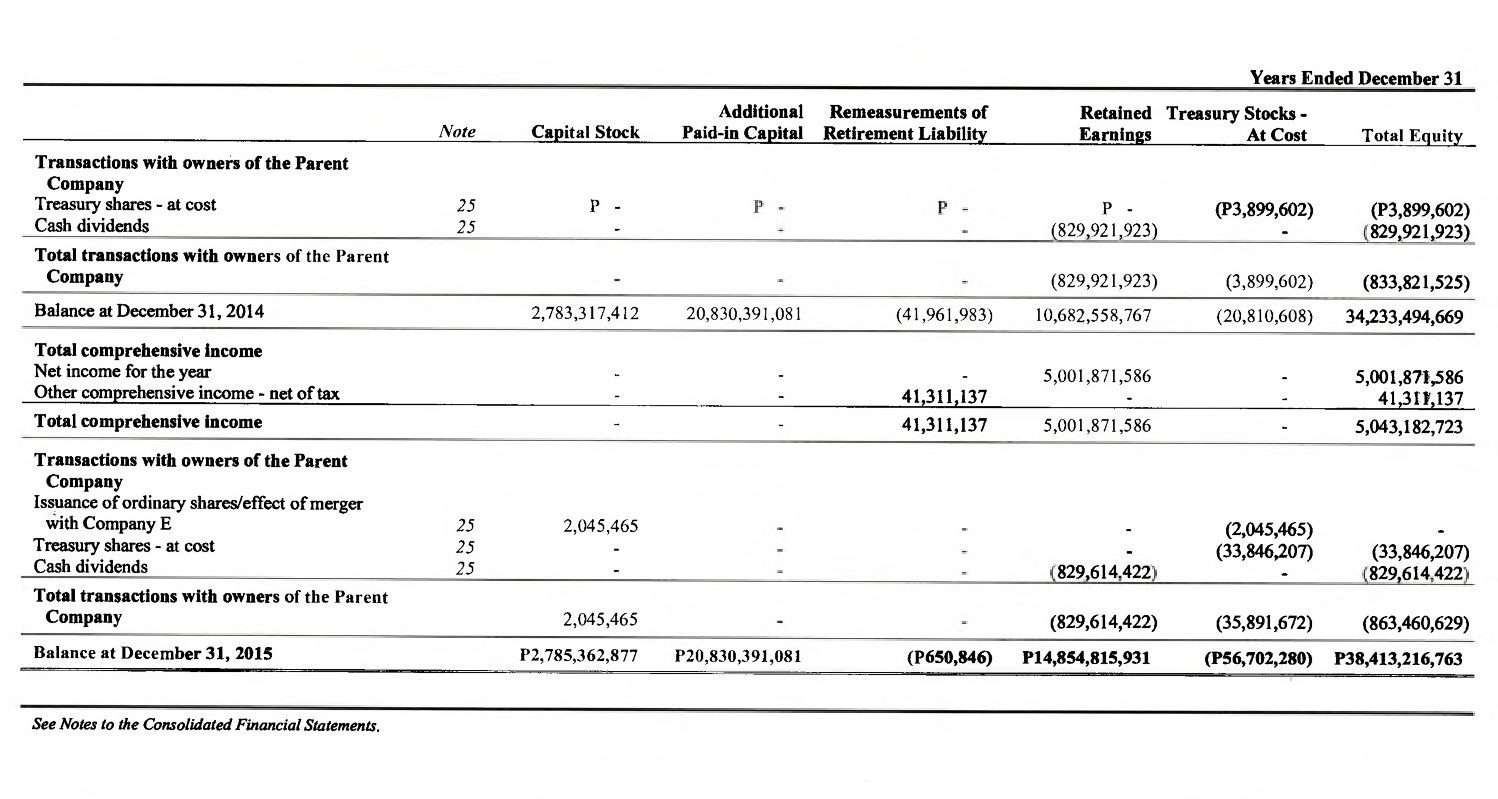

#4 Statement Of Changes In Equity

There’s also another document called the Statement of Changes in Equity which I also read in order to determine how the equity is broken down in the company. I read this document to find out how much dividends are paid, or if there’s an issuance or redemption of shares.

These four documents is where I get all of the data I use in my stock valuations. You can find these documents in the PSE Edge website; or you can directly go to a company’s website and download it from there.

What To Do Next

If you’re getting your data on finance websites such as MorningStar or Wall Street Journal, I suggest you stop and consider reading directly into the financial statement. In my experience, it’s much more easier to understand the numbers presented in these websites if you know how to derive them from the actual financial statements itself.

For now, I want you to go to your favorite websites where you get your data, and try to compare them in the actual documents. You’ll discover that some of the numbers are not reflected directly and you’ll need to do some quick calculations to get the figures.

I also relied on financial websites when I was starting out. But I eventually realized that to be a good value investor, you should know how to read and interpret these type of documents without relying on these sites.

I encourage and challenge you to do the same.

For my next post, I’ll discuss about the 7 important income statement ratios and how to use them in your stock valuations.

Happy investing!

This is very helpful for us to better understand the stock market and which stock to buy at a reasonable price and right reason to pick a stock for long term. I always very grateful to your blogs. It is very educational for people whose forte is far from finance and business stuff.

Thank you Isay. I’ll be posting a series of long comprehensive tutorials on how to read and interpret financial statements on a Philippine based setting this coming days. So stay tuned. 🙂

I posting my comment to let you know how valuable this information you’re providing to us fellow investors. I’ll be on the lookout for more of your posts! Thank you and God bless! 🙂

You’re welcome Mooy. I’m glad that my blog has helped you in some way. Cheers. 🙂