How To Use P/E And P/BV Ratio The Graham Way

The Price To Earnings Ratio (P/E) and Price To Book Value Ratio (P/BV) are one of the most common financial ratios used by investors when deciding to buy stocks. Yet, most investors don't know what these numbers mean.

The lack of knowledge with these numbers presents a problem for an aspiring value investor. But if the investor is well-informed of the importance of these numbers, then the stock selection process will be much easier. The investor will be able to screen stocks which are worthy of a deeper valuation.

This tutorial will teach you all you need to know about P/E and P/BV ratios and how Benjamin Graham use these numbers in his The Intelligent Investor book to determine a good investment.

Price To Earnings Ratio (P/E)

The P/E Ratio is a number used to measure a company's market price relative to its earnings.

The formula for the P/E Ratio is this;

P/E = Market Price / Earnings Per Share

Where;

- Earnings Per Share = Net Income / Shares Outstanding

If earnings are negative (net loss), then we would arrive at a negative P/E. Negative earnings don't make sense in the equations so if ever you encounter a company with consistent negative EPS, then skip that company and find other ones that are worthy.

To illustrate the formula, if stock ABC selling for ₱5/share and the earnings is ₱2.50/share, then the P/E would be;

P/E = ₱5 / ₱2.50

P/E = 2

The easiest way to understand what P/E means in this example is to tell yourself exactly these phrase.

"For every __ pesos I invest, I would get one peso in return within a year."

In the above example, if you bought 20 shares of stock ABC for a total of ₱100.00, you would expect a ₱50.00 return within the year.

P/E Ratios can also be used to determine the Rate of Return if you take its reciprocal.

% Rate of Return = [1 / (P/E ratio)] x 100

In the above example, the Rate of Return would be 50% based on the calculation below.

% Rate of Return = (1 / 2) x 100

% Rate of Return = 50%

Where Do We Get The P/E Ratio In The Annual Report?

To get the P/E ratio, we need to find the two variables contained in the formula which is the Market Price for the given period and the Earnings Per Share.

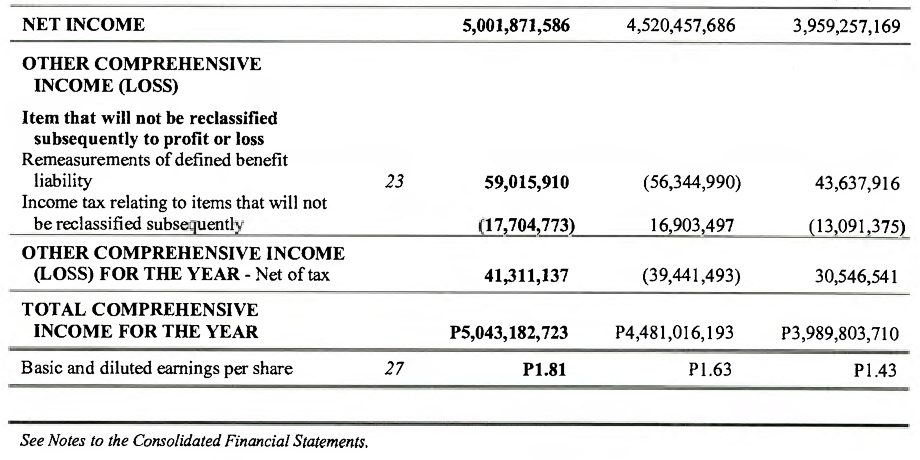

The EPS can be found on the annual report as shown on Fig. 1. It can also be calculated by using the EPS formula mentioned above.

Fig. 1 PGOLD's Earnings Per Share for 2015, 2014 and 2013

In the example at Fig. 1, PGOLD's EPS in 2015 is ₱1.81/share. Let's see how this number is calculated by analyzing note 27.

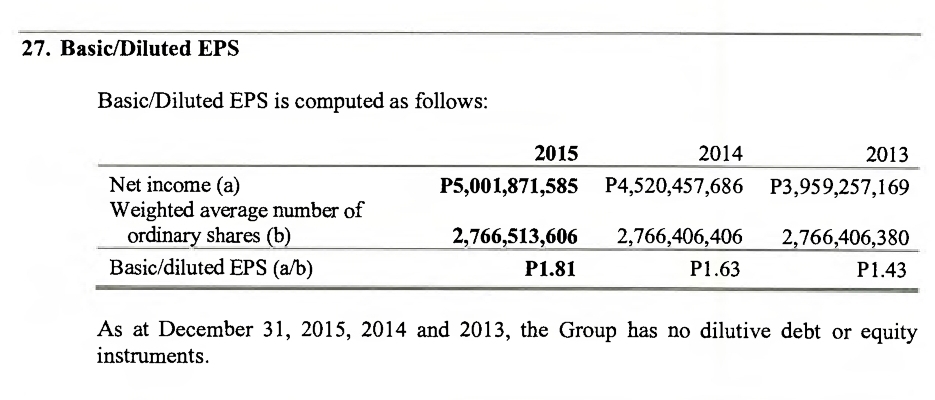

Fig. 2 Note 27 PGOLD's Earnings Per Share

Fig. 2 shows the computation for the Basic/Diluted EPS. Let's check the values by applying the EPS formula;

Earnings Per Share = ₱5,001,871,585 / 2,766,513,606

Earnings Per Share = ₱1.81

So there you have it. It's very easy.

Now to get the market price, you can go to any finance website that displays historical prices. I would recommend Wall Street Journal for that.

In this example, ₱34.70 is the last trading price for the year 2015.

Let's now calculate the P/E Ratio. Applying the formula, we have;

P/E = ₱34.70 / ₱1.81

P/E = 19.17

This means that for every ₱19.17 I invest in the stock, I'll get one peso of earnings. That's a return rate of 5.22%.

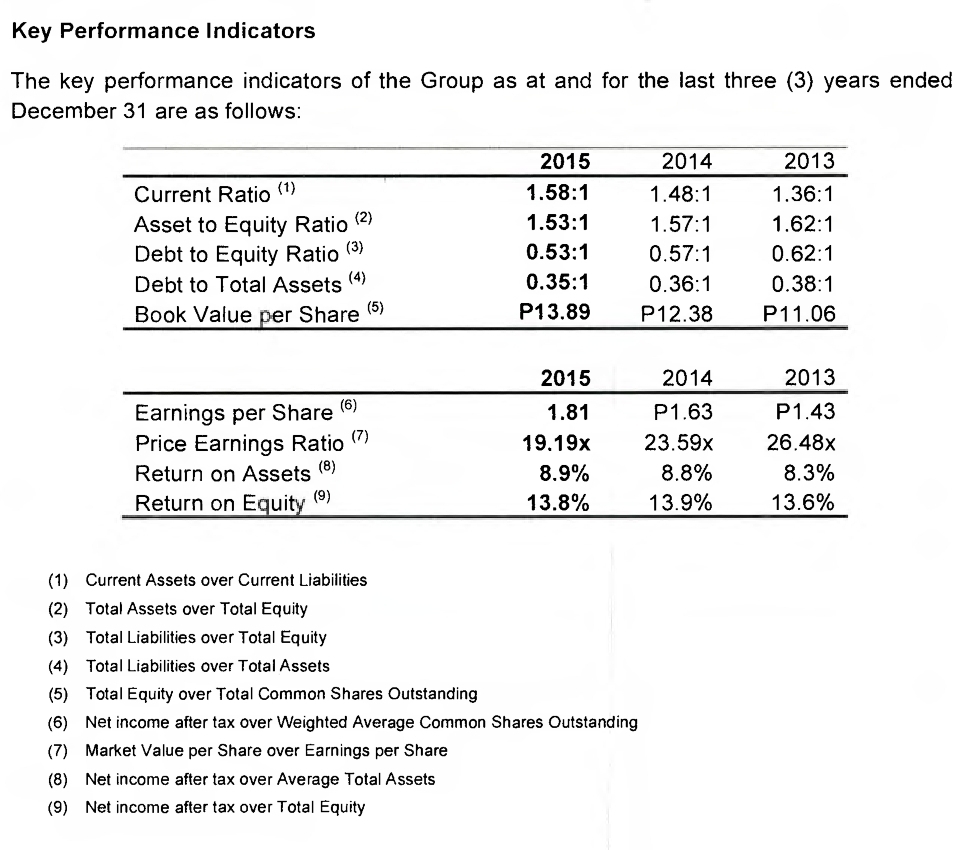

Now sometimes, the P/E ratio is mentioned in the Key Performance Indicators in the Management's Discussion of Financial Position section of the annual report.

In PGOLD's case, the number is shown.

Fig. 3 PGOLD's Key Performance Indicators

We can see from the data that the P/E Ratio in 2015 is 19.19. There's a slight difference in the computed value but you get the point right? Technically, that's how you get the ratio.

So to summarize, there's 2 ways to get the P/E ratio;

Price To Book Value Ratio (P/BV)

P/BV Ratio is a financial ratio that measures the market price relative to its Book Value Per Share.

Here's the formula;

P/BV = Market Price / Book Value Per Share

Book Value Per Share is calculated as;

BVPS = Common Equity / Shares Outstanding

In layman's term, just say this phrase every time you see P/BV.

"For every __ pesos I invest, I would get one peso worth of equity in the business."

To illustrate the formula, let's say you bought ₱100.00 worth of shares from stock ABC with a P/BV of 2. That would mean that you now have ₱50.00 worth of equity in the company.

Take note that some companies can have P/BV Ratios lower than 1. A company with a P/BV of 0.5 means that if you buy the company at ₱100 million and liquidate it, you will make money from the sale of all its assets.

P/BV can be also used as a measure for the company's Margin of Safety.

Here's the theory behind it; A company with a P/BV of 1 means that if the company is worth ₱100 million and you bought it, you can liquidate it and get back 100% your investment (₱100 million). That's a 100% Margin of Safety.

A company with a P/BV of 4 means that the company's Margin of Safety is equal to 25%.

By taking the reciprocal of the P/BV, we can get the Margin of Safety formula. The lower the P/BV, the higher the Margin of Safety will be.

Margin of Safety % = [1 / (P/BV)] x 100

How To Calculate P/BV Using A Financial Statement?

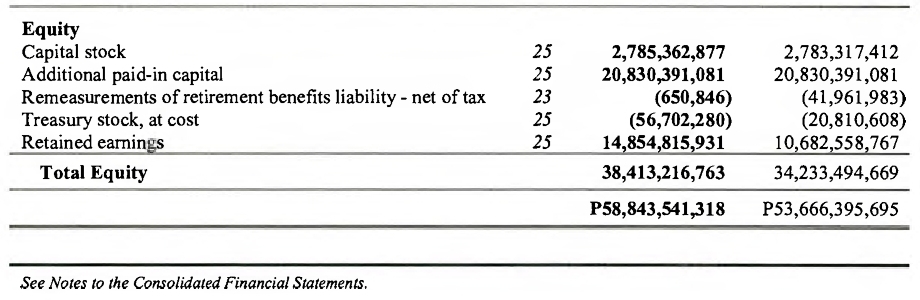

To get the Book Value of a company, we now go to the Balance Sheet and look for the Equity Common To Shareholders. Let's see PGOLD's Balance Sheet as shown in Fig. 4.

Fig. 4 PGOLD's Equity for 2015 and 2014

Fig. 4 shows the Equity to be ₱38,413,216,763. The Shares Outstanding is shown in Fig. 2 to be 2,766,513,606. Applying the formula, we get the Book Value Per Share to be;

BVPS = ₱38,413,216,763 / 2,766,513,606 shares

BVPS = ₱13.89/share

Calculating P/BV;

P/BV = ₱34.70 / ₱13.89

P/BV = 2.50

At this ratio, the Margin of Safety would be;

Margin of Safety % = (1 / 2.50) x 100

Margin of Safety % = 40%

The Graham Number And How To Use It To Screen Undervalued Stocks

In chapter 14 of Ben Graham's Intelligent Investor book, the 6th and 7th criteria in the stock screening process for the defensive investor are as follows;

In layman's term, this means that a stock's P/E should not be greater than 15 and the P/BV should not be greater than 1.5.

P/E ≤ 15

P/BV ≤ 1.5

Now, as a rule of thumb Graham mentioned that the product of the two should not exceed 22.5. This 22.5 is what we call the Graham Number.

P/E x P/BV ≤ 22.5

How Do We Use The Graham Number?

Now let's do some basic math here. If you turn the statement above into a mathematical equation and solve for the Market Price (P), we get an equation something like the one below.

P/E x P/BV = 22.5

P^2 / (EPS x BVPS) = 22.5

P^2 = 22.5 x EPS x BVPS

P = √(22.5 x EPS x BVPS)

To further understand the concept, let's put this equation into work and set First Philippine Holdings (FPH) as an example.

FPH's P/E and P/BV Ratios in 2015 are 6.79 and 0.52 respectively. Based on the Graham Number, FPH pass the 6th and 7th criteria as shown in the calculations below.

6.79 x 0.52 ≤ 22.5

3.53 ≤ 22.5

The EPS and BVPS is 9.58 and 126.03. Applying the formula, we get;

P = √(22.5 x ₱9.58 x ₱126.03)

P = ₱164.82

FPH's last traded price is at ₱72.50. From here, we can see a huge price difference. The next thing we need to do is to determine if FPH will pass the other 5 criteria mentioned in the Intelligent Investor.

The 7 Ultimate Criteria - Stock Selection For The Defensive Investor

FPH passed the 6th and 7th criteria but still, we have to consider the other five as well.

I'll list down the complete 7 criteria that Benjamin Graham mentioned in his book. These are;

Adequate size of the enterprise

$100M in annual sales. Adjusted to inflation and converted to PHP currency, that would be ₱22B.

A sufficiently strong financial condition

Current ratio > 2; Long-Term Debt < Working Capital

Earnings Stability

Earnings should be positive for the last ten years.

Dividend Record

Must have a consistent dividend payments for the past twenty years.

Earnings Growth

EPS should have increased by 1/3 for the past 10 years.

Moderate Price To Earnings Ratio

P/E ≤ 15

Moderate Ratio of Price To Assets

P/BV ≤ 1.5; P/E x P/BV ≤ 22.5

According to Graham, all these 7 standards should satisfy the stock for him to make a purchase. If one fails, he'll transfer to a new set of criteria which is explained in the Stock Selection Process for the Enterprising Investor (chapter 15).

Final Thoughts

I have explained in simple terms the P/E and P/BV ratio and its importance to stock valuation. Graham uses these price multiples in his stock screening selection criteria for the Defensive Investor which includes the Graham Number to identify undervalued stocks.

In my investing strategy, I don't focus so much on the stock screening selection criteria because I think some of it needs to be adjusted based on Philippine market conditions. I think it would be better to adjust the parameters based on your own risk profile or whatever values that will suite you.

I use the Graham Number in conjunction with Buffett's investing style. I believe that the Graham Number is the first step in identifying stocks that are worth looking at. The number basically gives me a shortlist of what stocks to look for and study.

I hope you learned a lot in this article. Do you have any thoughts and ideas you would like to share to contribute in this article? If you do, please share it in the comments section. I love to hear your ideas because from there, I can learn from you too.

Happy investing!

Hi mark, please explain the significance of the price calculated using derived equation and last traded price which are 164.82 and 72.50 respectively. Why is there a big difference?

There’s a big difference because if you’ll go back to the graham number, 3.53 is so much greater than 22.5 which indicates that FPH is so much undervalued.

Now according to the Intelligent Investor book, if a stock is priced below the Graham Number, the stock is considered undervalued. Now going back to FPH; P72.50 is less than P164.82, which in Graham’s criteria, is undervalued.

Hi Mark,

I have a question in mind. Does the gravity of graham number should be weighed the same to all sectors? Other sectors have higher P/E ratio compared to the other, which is why we are not advised to compare two stocks from different sector in terms of their P/E ratio. Could this not be considered a factor affecting the value of the resulting graham number?

Thanks!

Good question,

During Graham’s time, his strategies are mostly inline with the market conditions of his time (1929 Great Depression). He bought stocks regardless of what industry/sector. For him, the important thing is the return rate and the safety margin. He’s focused on buying stocks that are so depressed that even if the company goes bankrupt, he’ll earn from the liquidation. The only risk is falling in a value trap.

In a bull market, Graham’s ideas will not be as effective because stocks will be expensive. In my case, I more into Buffett’s idea of finding stocks with economic moats.

The technology sector is an example where Graham’s ideas don’t exactly apply. Instead of P/E, I think analysts use Price/Sales Ratio.

AWESOME READ! GOD BLESS YOU