MPI Stock Review: MVP’s Undervalued Holding Company

After almost a month of very hectic schedule at my day job, I now had the time to go back and do what I enjoy doing; valuating companies.

Last month was a very busy month for me because we had so many cost estimates that needed to be finished and submitted on time. We estimated 2 projects; Suntrust Asmara by Megaworld Corp. (MEG) and Symphony Tower 2 by Vista Land & Lifescapes, Inc. (VLL). We labored so many extra hours just to finish our bid proposals so that we can submit it on time.

I’m glad that was over.

Before I become busy again, I’ll take the opportunity to valuate a company requested by one of my readers in one of my previous posts. This company is none other than MVP’s Metro Pacific Investments Corp. (MPI).

What took me the initiative to value this company is because I learned that it’s being managed by Manny Pangilinan. Management does really play a big role when choosing a company to invest with.

So What Is MPI All About?

According to their website, MPI is a Philippine based, publicly listed investment and management company, with holdings in Manila Electric Company, Maynilad Water Services, Inc., Metro Pacific Tollways Corporation, Makati Medical Center, Cardinal Santos Medical Center, Davao Doctors Hospitals, Riverside Medical Center, Lourdes Hospitals and Asian Hospital.

In a nutshell, it’s like a Philippine version of Warren Buffet’s Berkshire Hathaway but is more focused on utilities and the hospital business.

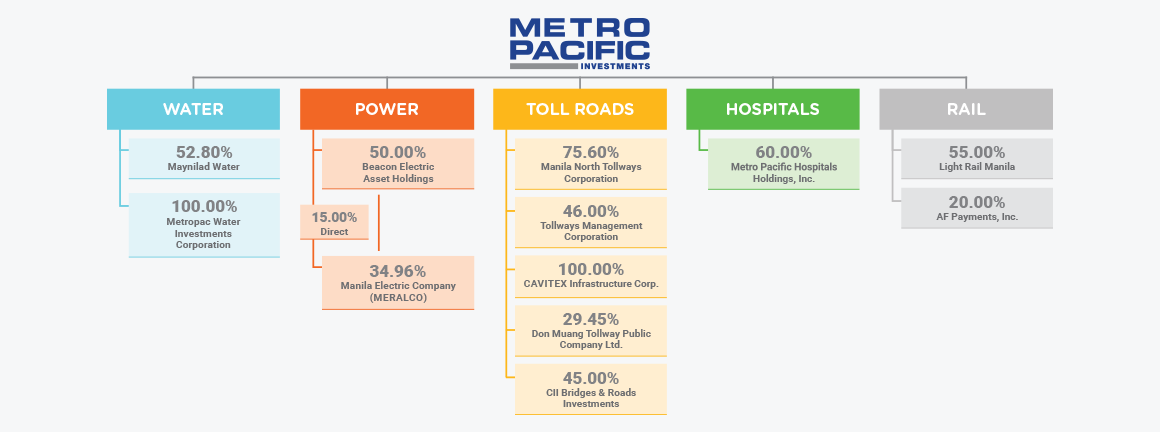

Here’s a brief overview taken from their website of what the company has in its portfolio.

Let’s first understand MPI’s business by answering 3 simple questions:

- How does the company earn money? Looking at the MPI’s portfolio above, we can say that MPI earns money by managing the many different businesses it owns. Meralco (MER) and Maynilad (MWC) are profitable utility companies and as you can see, MPI owns 52.80% of MWC and 34.96% of MER.

- Does the company pay dividends? Looking at COL Financial’s data, MPI paid dividends since 2010.

- Is the company well-known or has a brand name? The company is not well-known I guess because you don’t see any ads about it and I think they don’t carry any brand name either so that’s one competitive trait that the company doesn’t have.

Now that we know some basic stuff about the company like what the business is all about and how do they make money, let’s now dig inside their financial statements and see if we can find shiny gold bars.

Analyzing The Income Statement

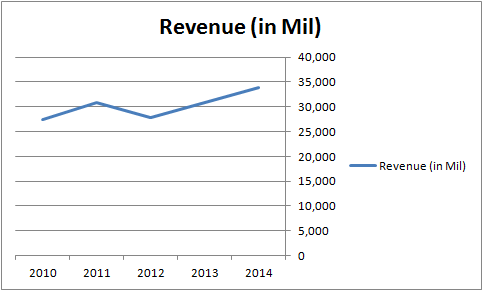

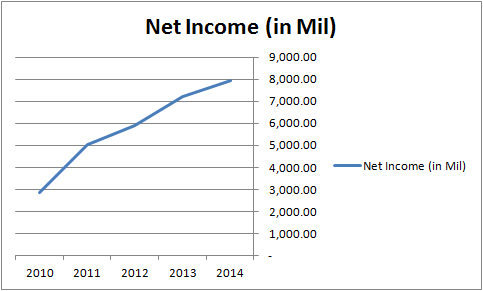

Let’s find out if the company is consistently growing their revenue and net income for the last 5 years.

In the above chart, we see consistent growth on these two parameters. The company did a great job of increasing its revenue and income for the last 5 years.

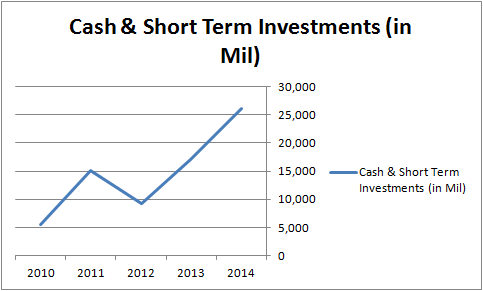

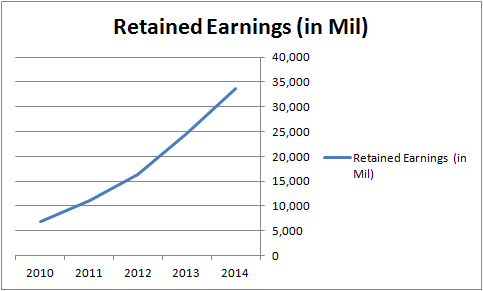

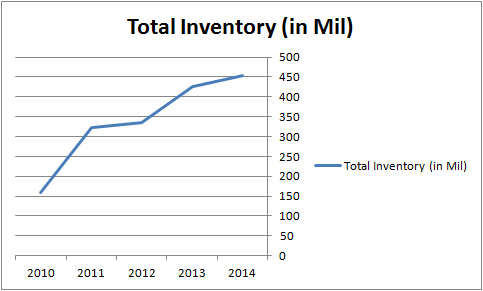

The company’s cash & short-term investments, retained earnings and inventory also showed consistent growth for the last 5 years which is a good sign as shown below.

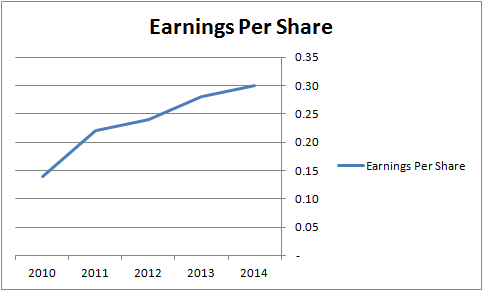

Also, the company shows an increasing EPS for the last 5 years.

With these charts that I’ve shown you, we can clearly see that this is a company that we know will consistently grow.

What we want to know now is that if the market is already realizing the true value of this company. I’ll test it with Buffett’s criteria to see if it can pass up as a company with a durable competitive advantage.

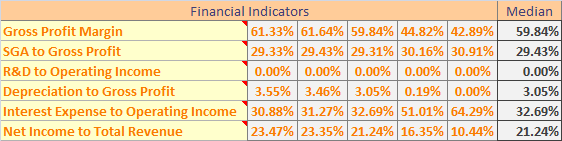

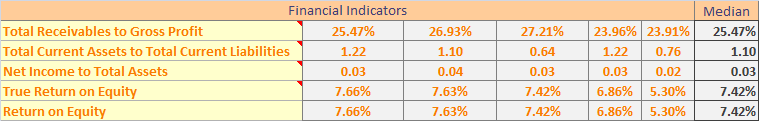

What I did is that I computed the ratios described below and took the median of the ratios within the 5-year period.

The Gross Profit Margin, R&D to Operating Income, Depreciation to Gross Profit and Net Income to Total Revenue shows indication that the company might have a competitive advantage.

The SG&A to Gross Profit just fall short of the 30% minimum required but since it’s only a matter of less than a percent to be qualified, we can assume that it also indicates a competitive advantage.

Analyzing The Balance Sheet

The balance sheet financial indicators below tells us that the Total Receivables to Gross Profit and the Current Ratio indicates a company with a competitive advantage.

The return on equity of 7.42% is a low number. Normally, if we want to invest in a business, we want a high ROE.

High ROE means that a company can invest its funds to improve its business operations without having the need to borrow money or invest in more capital. But as you can see, from 5.30% in 2010, it rose to 7.66% last 2014.

This is a good sign and tells us that the company is starting to grow.

Analyzing The Cash Flow Statement

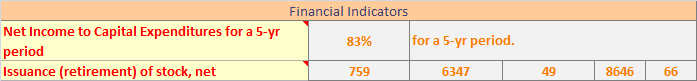

The chart below show the ratios taken from the Cash Flow Statement.

The Net Income to Capital Expenditures shows a large number. It’s because the company spent huge on capital expenditures totaling to 41.669 Million pesos compared to its net income of 50.379 Million pesos for the past 5 years.

We like companies with low capital expenditures as possible and the ideal ratio that we would look for is 25% or lower.

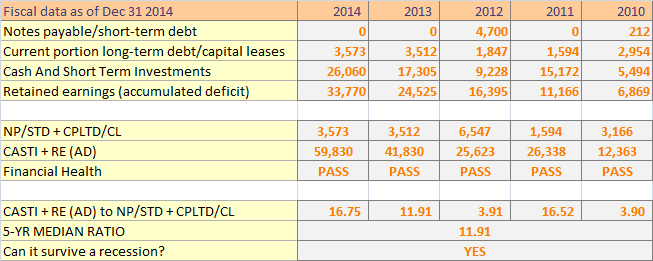

The company’s financial health is good as shown below.

MPI has very little short-term debts and current portion of long-term debts. It also shows that the company has a lot of cash and with a ratio of 11.91>5.

We can say that the company can survive when a recession comes.

With all that data presented, I can say that the company has good fundamentals and worth investing with. With that said, the question we want answered now is if its stock price today is undervalued or not.

We now attempt to get the fair value using the Graham Formula, Discounted Cash Flow and Sustainable Earnings Growth Model.

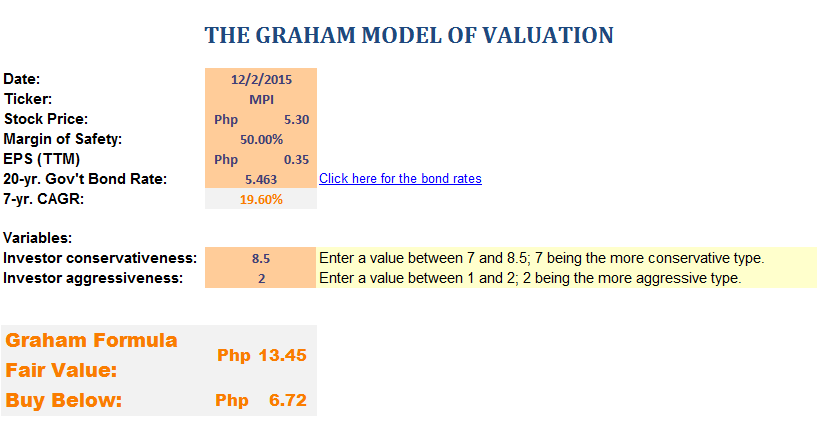

What The Graham Formula Says About The Stock

To be utterly safe, I used a 50% margin of safety and ended up with a buy below price of 6.72 Php. The fair value computed is 13.45 Php.

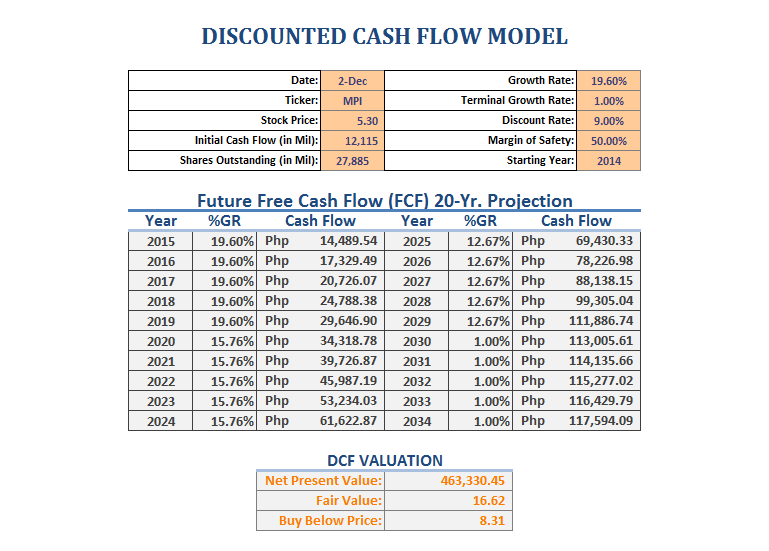

When I use the discounted cash flow method, I end up with a fair value of 16.62 Php and a buy below price of 8.31 Php using the same 50% margin of safety as shown below. Take note that I used the same growth rate of 19.60%. This was computed using the compounded annual growth rate formula.

Discounted Cash Flow Valuation

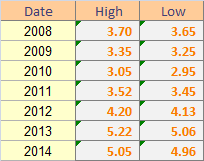

The figures I got from these computations make sense because if you look at the historical stock price of the company 7 years ago, we can see that the stock price is gradually growing year by year. To prove that, I got all the daily historical prices in every year from the WSJ site and computed for its median in each year as shown below.

As you can see, the stock price shows a volatile upward movement.

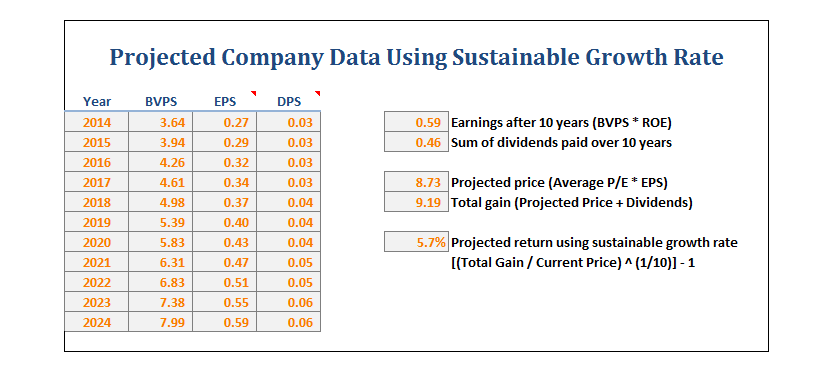

Sustainable Earnings Growth Rate Valuation

When I try to value it using the sustainable earnings growth model, it gives me a total projected price of 9.19 Php for the next 10 years. It still didn’t reach the fair value computed by DCF and Graham formula.

Final Thoughts

As a result of the valuations that I just did, I think that MPI is an undervalued company with a promising rate of return for the next 5 to 10 years. The valuation models I used shows its stock price as being undervalued as of today.

Happy investing!

Hi! Please share naman your thoughts on Max’s group! Thank you so much for the wonderful content!

Hi Luis, I’ll try my best to do some stock valuations next week. Medyo busy kasi sa blog optimization and content building para sa free email course na irerelease ko on Value Investing. 🙂

Engineer, what would be the intrinsic value of MPI for the Year 2020, 2021 and 2022?

What would be the Buy Below Price as of February 26, 2020?

Thank you.

Hi Mark,

Good day, I wanted to know if MPI is still a good company to invest in for the long-term. I saw that its stock price has gone down to almost 5.9 which is almost the BBP recommended by Col.

I have tried to follow the analysis you have done for MPI and other companies in your website but my calculations are a bit off. Hope you can do another review for this company.

i think mpi has low ROE because its net income comes from mostly equity only. what i mean is you can see its ROA and ROE is almost the same. unlike others which have like for example very good 10 ROE but has poor 3 ROA.

anyways, thanks for boosting my confidence in this company.

Thanks for your insights Bobby. You may also want to look at this other posts about MPI.

https://investingengineer.com/mpi-stock-review/

https://investingengineer.com/mpi-stock-analysis/

Hi!

I am thinking of diversifying my portfolio by looking into buying into MPI. I currently am holding ALI stocks for long term investing. Since ALI is now on the upswing I am not selling as I am in the long term although it is tempting…

So I was thinking of adding MPI since I am looking at diversifying. It is currently at 6.37 per share is it still a good buy as of now?

I currently have ALI as my only stock but I have MF & BPI Short Term Fund as well as VUL with 100% on Index Fund.

Can you advise me please

thanks!

Hi My,

Based on my assumptions using 5 years of data including the recent annual report, MPI is valued at around P229.6 billion. The business is generating cash estimated at P7 billion a year and manages to make an average of 3% and 3.5% cash return on invested capital and cash yield respectively. On a per share basis, this equates to an intrinsic value of P7.63.

Please do note that this is not a recommendation to buy or sell MPI stock. I strongly suggest you exercise due diligence and only make a buy decision if your valuations deem satisfactory on your part.

Good luck My. 🙂

Hi Sir. I just want to ask kung saan po kayo nakakakuha ng info ng historical data ng mga companies. Like po ng P/E ratio for the past years. Thank you po ?

Hi Sai,

Tingin ka sa Financial Times, Wall Street Journal or Morningstar. You’re welcome.

Hi sir pwede po bang makakuha ng recommendation niyo

Hi Arya,

Hindi ako nagbibigay ng recommendation. I only give my personal opinions/views on a stock. It’s still up to you to decide on whether you’ll buy a stock or not.

Thank you sir. I just want some help. Any suggestions will help thank you 🙂

You may want to check LR and WPI. Bullish ako sa gaming industry and these two have cheap statistics. 🙂

LR: https://investingengineer.com/lr-stock-review/

WPI: https://investingengineer.com/wpi-stock-review/

Good luck Arya. 🙂

Hi Mark,

Thank you kasi I really learned a lot from your ebook Value Investing. I am really interested to learn more about it.

Regarding sa topic na to “MPI Stock Review: MVP’s Undervalued Holding Company”, tri-ny kong i-reverse engineer yung mga calculations mo, kaso di ko mahanap sa internet saan yung sources mo ng data example dun sa Total Inventory, Gross Profit Margin%, SGA to Gross Profit, etc. Di ko makita sa net, chineck ko na sa wsj.com, COL at investing.com. Wala dun kasi. Pwede mo bang maishare sa amin saan makukuha yung data na gamit mo?

Ey Rolex,

Yung mga data nito I think sa Financial Times ko pa nakuha and rounded-off na siya. Matagal na din kasi itong post na ito. Iba-iba din kasi minsan yung figures depende sa site na pagkukuhanan mo. One suggestion is to use na lang yung annual filings para mas matutunan mo saan kinukuha mga values.

Hi Mark,

Thanks! Ang galing!