You Asked, I Replied – Is MPI Still A Good Company To Invest In For The Long-Term?

A reader asked me this question in one of my posts about MPI last year.

Good day, I wanted to know if MPI is still a good company to invest in for the long-term. I saw that its stock price has gone down to almost Php5.90 which is almost the BBP recommended by COL . I have tried to follow the analysis you have done for MPI and other companies in your website but my calculations are a bit off. Hope you can do another review for this company.

Well then, here's another review of MPI.

In this post, I'll try to give the best possible opinion I can share about the company. So if you're looking to invest in MPI or you are wondering what to do with your current MPI shares, then this post is for you.

Let's begin.

MPI's Score In The Value Scorecard

I did run MPI on my value scorecard and got a score of 45/100 which is to my standard is an average score. Profitability & growth scores are ok (20/30) but analyzing its financial health puts me at a setback.

Looking at the Altman-Z score reveals that the company is in the distress zone (Score: 1.20). The main contributing factor is their total liabilities which is almost the same as their market capitalization based on 3Q16 filing.

The Piotroski F-Score also tells us that MPI is classified as an average business (Score: 6). The previous years are even worse registering scores of 4 in 2015 and 2014.

Having said that, investors should know what to expect from a company with an average valuation. To do that, let's analyze the business ability to generate earnings and its predictability to come up with an idea where the company is headed.

Predictability Of Earnings

Let me show you MPI's earnings for the last 10 years.

Period | Earnings Per Share |

|---|---|

2015 | 0.34 |

2014 | 0.30 |

2013 | 0.28 |

2012 | 0.23 |

2011 | 0.19 |

2010 | 0.14 |

2009 | 0.18 |

2008 | 0.10 |

2007 | -0.22 |

2006 | -0.74 |

MPI had bad earnings for the years 2006 and 2007 but notice that in 2008, earnings started to trend upward. 3Q16 TTM's EPS is at 0.38. Notice the predictability?

We can assume at this point that earnings for the next 10 years can continue to grow at a compounded annual rate of 19.1% calculated from the start of positive earnings which is in 2008.

Capital Allocation Of Retained Earnings

How did MPI managed to increase earnings year on year? We can say that it's because of their acquisitions.

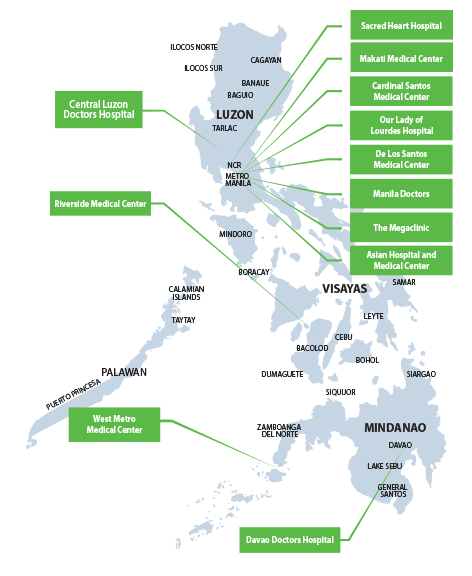

For the last couple of years, MPI is busy acquiring hospital businesses and one of their key priorities is to target 5,000 beds, expand coverage and create synergies.

Fig. 1 Hospital businesses acquired by MPI.

MPI is also investing in businesses in the power generation and logistics business. In May 2016, MPI acquired a 56% stake in tycoon George Ty’s power generation arm Global Business Power Corp. for ₱22.06 billion. It also completed the acquisition of the assets of four logistics companies in a deal valued at ₱2.17 billion.

There are many other acquisitions in the past. These acquisitions further increased shareholder's wealth.

To put this in a numbered perspective, from 2008 to 2015, earnings increased by ₱0.24/share. In that same period, retained earnings totaled to ₱1.56/share. We can assume that this increase in earnings resulted by the management's ability to deploy those retained earnings in acquiring businesses. This resulted to a 15.4% return.

Is MPI Conservatively Financed?

Acquisitions cost money and therefore MPI has a lot of debt. As of 3Q16, total long-term debt is at ₱3.11/share. Compare that to the company's 3Q16 TTM earnings of ₱0.38/share, you'll be needing 8x earnings to pay off all the debt which is not conservative.

But note that the company has maintained a healthy average D/E and current ratio of 0.65 and 1.09 respectively.

MPI has healthy debt levels but it will take them a longer time to pay off their debts. If their acquisitions produced more earnings in the future, they can pay this off at a faster rate and we hope they can lower down the ratio to at least 5x earnings.

Historical Return On Equity

What I don't like is the company's consistent low returns on equity. Return on invested capital is also the same.

Period | ROE | ROIC |

|---|---|---|

2015 | 8.54 | 7.16 |

2014 | 8.01 | 7.07 |

2013 | 8.28 | 5.36 |

2012 | 8.33 | 7.57 |

2011 | 7.91 | 8.17 |

2010 | 5.44 | 7.65 |

2009 | 6.55 | 7.93 |

2008 | 5.15 | 5.59 |

2007 | 11.84 | 47.99 |

2006 | -213.15 | -28.94 |

Earnings are increasing, but notice that the returns are low. Does that mean that the company is doing a poor job of generating good returns on investor's money? It can also mean that the businesses which MPI holds interest don't have a durable competitive advantage, does not possess a consumer monopoly, or are mostly commodity-type businesses.

What we know based on the numbers is that the poor returns on equity doesn't look good at an investor's point of view.

After analyzing its qualities, let's look at the qualitative side of the company.

Initial Rate Of Return

At 3Q16 TTM earnings of ₱0.38/share and a stock price of ₱6.08/share as of this writing, we can argue that we are getting a return of 6.3% which is much higher than the current rate of a 10-yr. LCY gov't bond at 5.4%.

At ₱7.10/share, you would get the same return as that of the gov't bond.

Historical earnings growth shows a rate of 19.1% annually (2008 to 2015). So we are in effect investing in a company that yields a 6.3% return and that will grow at 19.1% annualy.

We can argue that MPI today is undervalued relative to a gov't bond.

Projected Annual Compounding Rate Of Return

MPI paid ₱0.09/share worth of dividends from the 3Q16 TTM earnings of ₱0.38/share. The dividends are 23.7% of the earnings and the remaining portion are retained. Book value is at ₱4.74/share therefore return on equity for the period is at 8.0% (0.38/4.74).

ROE for the dividends and retained earnings is at 1.9% (0.09/4.74) and 6.1% (0.29/4.74).

Assuming these values, we can project the earnings in the 10th year to be ₱0.65/share, total dividends at ₱1.19/share and total retained earnings at ₱3.84/share.

The average P/E ratio from 2006 to 2015 is equates to 13.45. Using this ratio, we can get the projected future price to be at ₱8.72/share.

If you bought the stock at ₱6.08/share today and hold it for 10 years, you can effectively compound your money at 4.1% pre-tax without dividends.

If you sell it in the 10th year, you have compounded your money at 4.5% after-tax in that 10-yr. period including dividends you earned.

In my opinion, this is low and is not an ideal return for your money.

But historically, the price of MPI outperformed this estimate. In 2008, year-end price was ₱2.40. In 2015, it's now at ₱5.20. It equates to a CAGR of 8.97%.

At ₱6.08, it equates to a CAGR of 10.88%. If you invested ₱1M in MPI back in 2008, your money is now worth ₱2.531M today.

Final Thoughts

It seems like a tough decision if you'll ask me if MPI is worth the wait for the compounding effect to make you wealthy. You should ask this question to yourself, "Is 4.5% a year a good return on your investments?" If it is good for you, then MPI is the right investment for you. If it's not okay, then you should be looking elsewhere.

Also consider the scores it got in the value scorecard. For the best returns, it would be wise to apply a margin of safety should you ever decide to invest in MPI.

This concludes my MPI stock review. Feel free to share your thoughts in the comments section below.

Happy investing!

Thanks for the analysis Mark it helped me alot in deciding whether to invest or not in MPI. It didn’t just helped me but other readers of your blog. Also noticed that since this article was published MPI share price has lowered to 6.02… that has got to mean something 😉

You’re welcome Dimaz,

In my opinion, you shouldn’t concern yourself with the short-term market gyrations. You should think of it as a means to lower your risk. If you bought at a higher price, averaging down will lessen your risk. A stock price is tied to the company’s ability to increase shareholder wealth. Just be patient and let the company do its job. Believe in the management’s ability to compound earnings and soon stock price will follow. Just look at where JFC, BDO, DMC, MWC, MBT, ALI and all other companies out there that has outstanding management. Look at where their stock price now.

Cheers! 🙂

Kudos on another fine and detailed analysis!

As always, keep up the good work!

Thanks JRP. 🙂

Hi just read your great intelligent analysis was intrigued because on Spt.14,2020 in the PSEI this stock was listed at 3.54 maybe a good buy now to hold..I also like SMC due to their deal on the new upcoming Bulacan airport deal.