FGEN Stock Review: Should You Buy FGEN Today?

This came in as a request from some of my readers a few weeks back. So for today, I'll look into First Gen Corporation (FGEN).

This article will help you analyze FGEN's earnings, financial health and cash flow among others.

If want to get a good insight on FGEN to help you decide whether to buy or sell, then read on.

What Is First Gen Corporation?

FGEN is a business that's primarily engaged in the business of power generation. FGEN is one of the stocks recommended in the SAM Table and has been bullish since Gina Lopez' acceptance of Duterte's offer to lead DENR.

I like the stock because they own 10.6% interest or 1.98B common shares of Energy Dev't Corporation (EDC). I find EDC to be a stable slow-growth dividend stock and knowing that FGEN owns it is a good sign.

Besides EDC, FGEN also owns the following power companies;

Competition

FGEN's competition include the Aboitiz group, San Miguel group, North Luzon Renewable Energy Corporation and other multinational power producing companies such as KEPCO Power Corporation, CalEnergy International Services Inc., Marubeni Energy Corporation and AES Corporation.

Management

Key members of the management include Independent Director Tony Tan Caktiong, who is known as the Chairman of Jollibee Foods Corporation (JFC); Eugenio Lopez III, Chairman of ABS-CBN Corporation; Jaime I. Ayala, President and CEO of Ayala Land Inc; and among others.

Margins

Here's what I have to say about FGEN's profit margins.

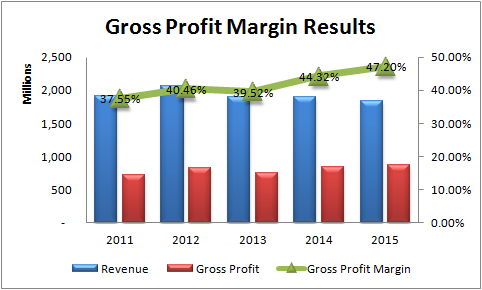

Gross Profit Margin

Due to lower fuel revenues caused by lower gas prices, Revenue didn't increase for the past five years. In fact revenue from 2015 was reduced by 3.72% compared to 2011. Although the performance was mediocre, the Gross Profit Margin performed better because of lower fuel costs. It has increased from 37% to 47% and averaged at 41%. But according to their annual reports, there are periods when their Maintenance Capex has increased which offsets the overall Cost of Sales.

Although the GPM results report good numbers, I'm not convinced because revenues didn't increase. At least, the reduction isn't substantial.

FGEN needs to improve its revenues this year but since they are dependent on gas prices, it will not be an easy task for them.

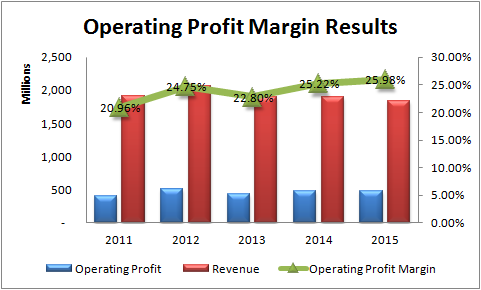

Operating Profit Margin

Even though revenues didn't grow, they have managed to keep the Operating Profit Margin attractive. At first glance, we can say that the company has managed their SG&A costs and Depreciation/Amortization costs fairly well. With that said, let's see what the figures will tell us about it.

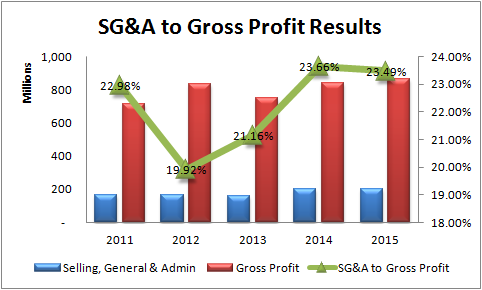

Selling, General & Administration Expenses Margin

Due to higher employee headcount, higher professional fees and a lot of miscellaneous factors, the SG&A costs increased to 23% in 2015 compared to 2011. Although an increase is observed, the average SG&A Margin at 22% still indicate a competitive ratio. Now if the Gross Profit were to increase, we should expect higher margins. That didn't happen because revenues didn't increase as well.

If the company can't increase its Revenues, then maybe they can cut down expenses to improve it to at least 30%.

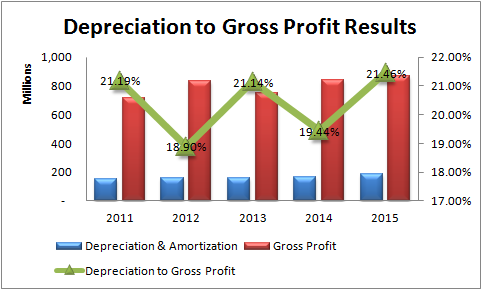

Depreciation & Amortization Margin

The high Depreciation Costs are normal since has a lot of power plants to maintain. FGEN's main depreciation costs mostly come from EDC's Bacman, Nasulo and Burgos power plants.

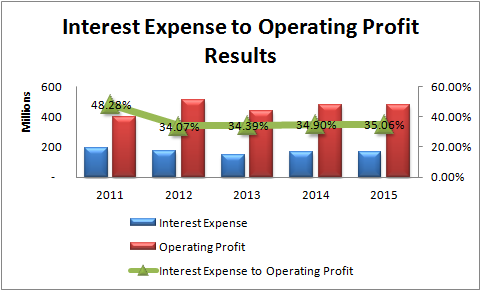

Interest Expense Margin

FGEN says that their main liabilities are composed of Loans Payable and Long-Term Debts used to finance growth and operations. This puts the company into a lot of interest rate and credit risks.

Because of the nature of their business, I guess this is normal.

If you'll look at EDC's Interest Expense Margin, they almost have the same range; 27% - 44%. This gives you a benchmark comparison on how much power generation companies take on debt and the amount of interest they pay relative to their operating profits.

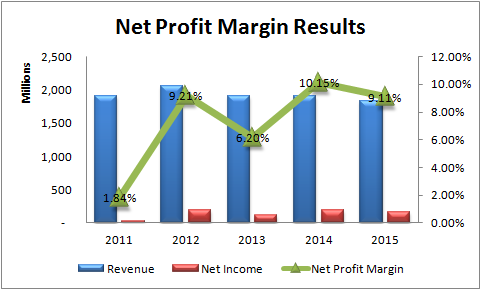

Net Profit Margin

FGEN's Net Profit Margins show mediocre results. This is because revenue remained stagnant and expenses almost remained the same if not, higher.

From what I can see here, FGEN is a good company but because FGEN has many subsidies some of which has mediocre performance, this eats up the profits of the subsidies with good performance.

With the Avion and San Gabriel gas plants now on the commissioning stage, we should expect revenues to increase once these power plants start their operations.

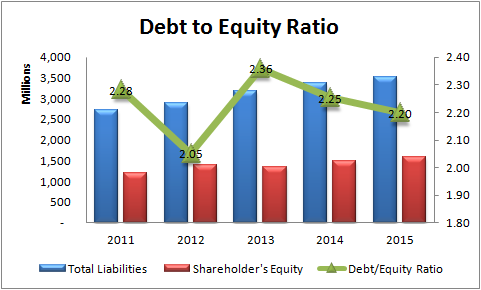

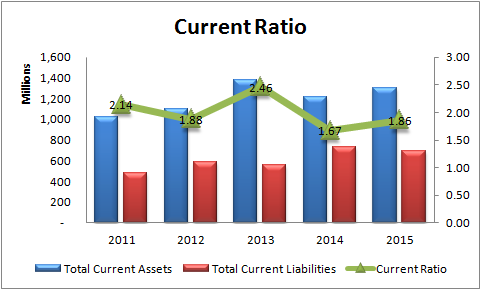

Financial Health

From what I can see here, FGEN is highly leveraged based on the D/E Ratio.

On the short-term, the company performs fairly well.

Here are some other things that I do to see the bigger picture of a company's leverage. I suggest you also try to use these comparisons.

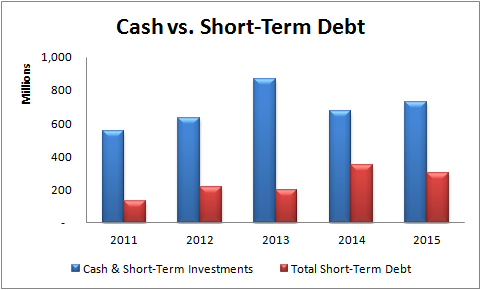

Comparison of Cash vs. Short-Term Debt. Cash should be greater than the Short-Term Debt.

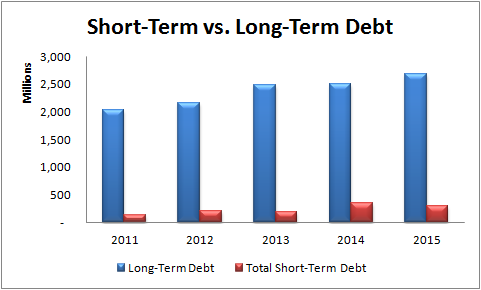

Comparison of Short-Term Debt vs. Long-Term Debt. Short-Term Debt should not be greater than Long-Term Debt.

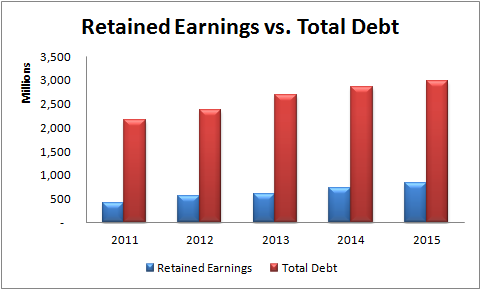

Comparison of Retained Earnings vs. Total Debt. Retained Earnings should be greater than the Total Debt.

From here, it looks like that FGEN's total cash reserves are lesser compared to total debts. Although the debts are greater, we should understand where do they really spend the money they raise whenever they take on loans.

One example is that, in the 2015 report, FGEN mentioned that their long-term debt increased by 4.1% due to numerous project finance loans and notes issuance.

Management Effectiveness

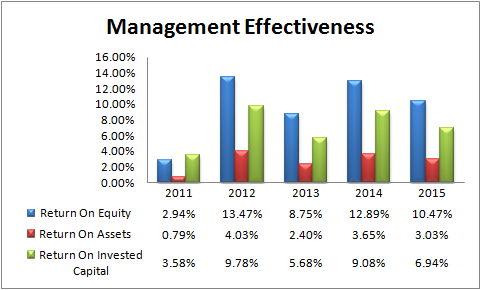

In here, we can see that FGEN doesn't show high returns on capital. RoE and RoA shows mediocre results.

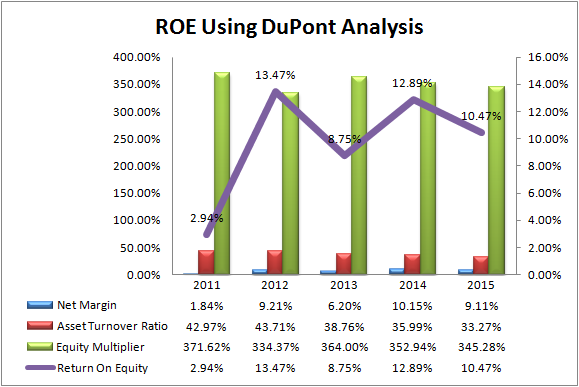

I've also analyzed RoE using DuPont Analysis and here's what the chart shows.

From what I see here, the Asset Turnover Ratio and the Equity Multiplier also decreased within the 5-yr. period. The Net Margin on the other hand, increased. But as you can see, it's not a consistent increase or decrease.

It's hard to interpret the numbers when you can't see consistency in the data presented. But by judging what the numbers say, FGEN's management effectiveness is right in the middle; not superb but not that bad.

In my opinion, even if FGEN is highly leveraged, I believe that the debts are managed just right.

Cash Flow Statement

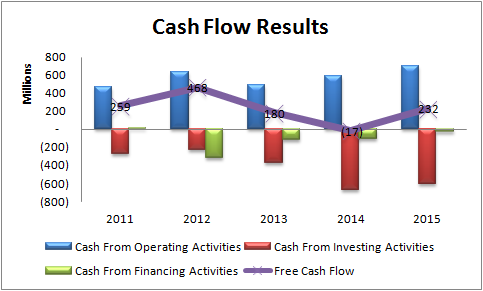

In 2014, FGEN didn't produce sufficient FCF to fund its operations. FGEN spent around $605.658 Million for rehabilitation and restoration costs of EDC's power plants and the damages done by the typhoons Yolanda, Glenda and Sendong. Other costs include the construction of the Avion and San Gabriel gas plants.

The FCF from the other years performed well but as shown above, we can't see any rising trend. It is also worth noting that the Cash From Investing Activities is rising. I can only conclude that this is due to increasing Capex and growth projects in order to sustain its operations.

From here, I want to break down the Cash From Financing Activities. I want to know where they are spending the capital they are raising.

In 2015, FGEN paid out cash dividends on preferred, common and non-controlling interests amounting to $35.78M, $28.029M and $43.247M respectively. The company also initiated a share buyback on their series "F" preferred stocks amounting to $85.639M. That's a total of $192.695.

Besides that, they also need to pay off their short-term and long-term debts amounting to $26.496M and $448.061M respectively.

Adding that in the previous figure, I got around $667.252M.

Now, where would FGEN get the remaining money? Well, FGEN availed short and long-term loans for a total of $642.38M and raised $167.856M by issuing common stocks for a total of $810.236M. In addition, FGEN's Total Comprehensive Income for the year was recorded at $134.305M.

Add the income and the total capital raised and I get a total cash of $944.541M.

Now subtracting all of the liabilities mentioned in the total cash, FGEN's cash remains at $277.289M capital. I can assume from here that this money will then be used to pay off operating expenses and other miscellaneous liabilities.

Now, I'll look at year-end 2014.

During this period, FGEN bought non-controlling interests in PTHC and EDC amounting to $0.111M and $6.832M respectively for a total of $6.943M

Adding all the liabilities, we get $455.355M.

Total Comprehensive Income for 2014 was recorded at $312.292M. As you can see, the income is not enough to pay off all these liabilities. To compensate, FGEN availed long-term debt amounting to $516.994M. So now we have total capital of around $829.286M.

Subtracting, FGEN's remaining cash is $373.931M.

The point of all these lengthy calculations is this; if FGEN will not raise capital, the company will not be able to pay its liabilities for the covered years.

Determining The Initial Rate Of Return

I'll calculate the initial rate of return from the formula below.

% Rate of Return = (Net Income / Market Capitalization) x 100

The stock price is ₱25.35 as of this writing. Market Capitalization is at ₱92,804,919,170. Since Income is stated at USD in the financial statements, I converted the currency by using today's exchange rate at 1 USD = ₱46.37.

Thus;

% Rate of Return = (7,758,535,660 / 92,804,919,170) x 100

% Rate of Return = 8.36%

8.36% is not so bad considering that a 5-yr. government bond pays at a rate of only 2.895%. But in my opinion, it would be much better to consider a return of at least 10%. If that's the case, then the stock should be purchased today at around ₱21.19. But if an 8% return is already enough for an investor, then today's stock price should be okay.

Another approach is by putting a 25% Margin Of Safety.

% Rate of Return = 8.36% * (1 + 25%)

% Rate of Return = 10.45%

By using that percentage, the stock should be purchased today at around ₱20.28.

Determining The Intrinsic Value

By using the sustainable earnings growth model without including the dividend per share, I arrived at a projected 5-year price of ₱54.70. Discount that to the present value today using 10% growth, we'll get ₱33.96.

Present Value = PHP 54.00 / (1 + 0.10)^5

Present Value = ₱33.96

COL's investment guide lists FGEN as having a fair value of ₱35.00 and a buy below price of ₱30.00.

Should you be buying FGEN today? Well in my opinion, FGEN is undervalued and has fairly stable financials so definitely, yes.

Final Thoughts

First Gen Corporation is one of the largest independent power producer in the Philippines. The idea of owning shares of this wonderful company feels good. But as a value investor, We must be keen on the company's financial risks especially now that FGEN hasn't shown a noticeable increase in their Revenues for the past 5-years.

I believe that FGEN can manage its debt effectively based on the data I presented. I also believe that the capital they raise are used effectively in rapid growth expansion projects. It's also worth mentioning that FGEN will not be included in the Truly Rich Club stock picks if it doesn't have a strong moat around it.

This concludes my FGEN stock review.

How about you? What's your opinion on FGEN's performance? Do you believe that it's a good investment or should we look at some other options? I want to hear your thoughts. Let's learn from each other and share your thoughts below.

Happy investing!

Great review!

I do try to cross-check your figures/calculations on my own, but sometimes I couldn’t find some of the info specified in your articles/blog. Is there a site that you go to get these figures?

Keep up the good work!

Hi JRP,

Thank you! For this article, I relied heavily on the annual reports. But sometimes, I look up data on Morningstar.com and WSJ. I also use COL’s data if I’m feeling lazy.

Thank you for your time

You’re welcome Valiant. 🙂

Heard that there’s a big chance that the company will be delisted in the pse. Thoughts on this?

There’s no disclosures released regarding this yet. Any news clips about this rumor?

no news clips. Just got a tip to sell on rally. Wondering what others think about it