ALI Stock Review: Is It Now A Good Time To Invest In Ayala Land?

I enjoy valuing a company myself. Because when I do, I learn a lot.

I learn to become aware what a company is capable of. And by doing so, I also become aware of what my investments will be worth when I invest in it.

As Warren Buffett always says, “Never invest in a business you don’t understand“. That’s why I study financial statements; to understand what the business is all about.

So in my spare time, this is what I do, finding undervalued and overvalued companies to invest in.

So today, I looked up the financials to see if it is now a good time to invest in Ayala Land Inc. (ALI).

Valuations

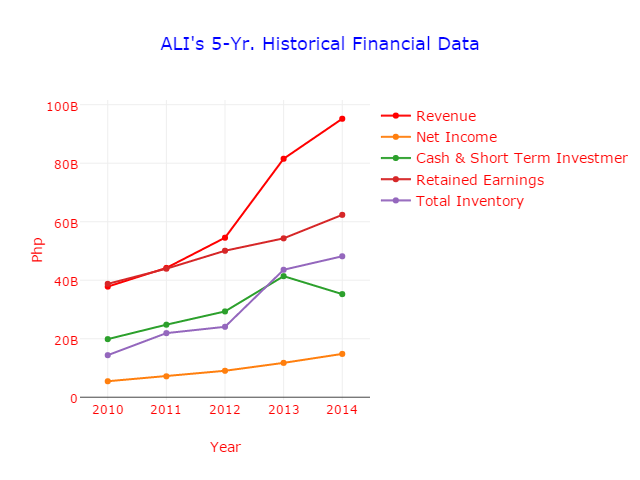

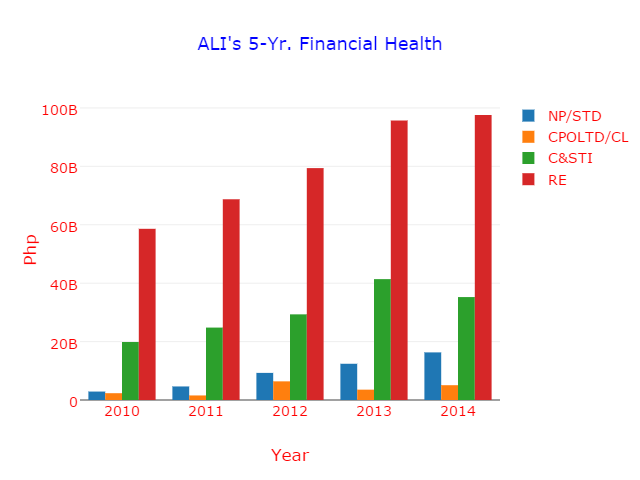

Fig. 1 5-yr Financial History

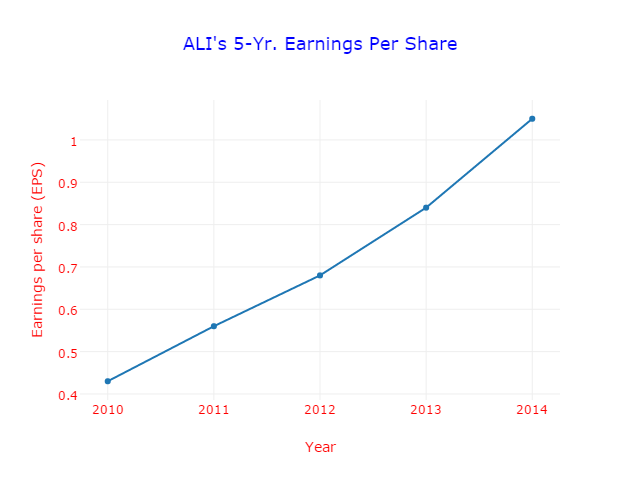

Fig. 2 5-yr Earnings Per Share

We can see that ALI has historically rising figures except for Cash & Short Term Investmentsbut it’s fine as long as it doesn’t show a consistent decline. The EPS also shows a consistent increase.

The most important thing is that we see consistent increase in the figures mentioned and consistent increase means that the company is continuing to grow bigger.

Now let’s see the income statement.

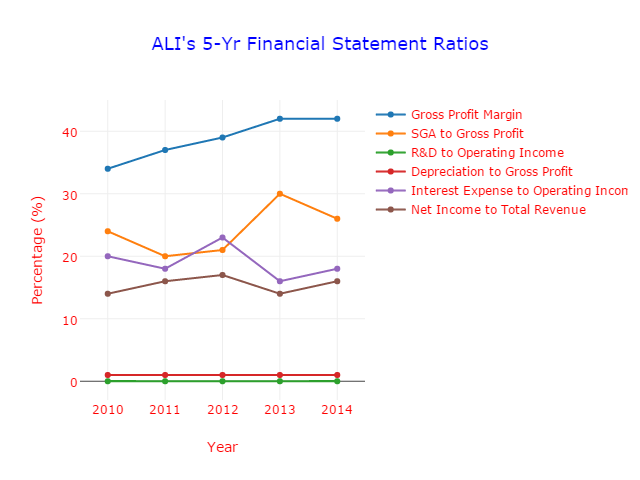

Fig. 3 5-yr Financial Statement Ratios

It appears that ALI is in a highly competitive industry last 2010 to 2012 as reflected by the low Gross Profit Margin but on 2013 and 2014, it went above 40% gaining a competitive advantage.

The Interest Expense to Operating Income percentage tells us that the company is in a fiercely competitive industry, it may be because ALI needs a lot of capital expenditures to remain afloat in the real estate business so they go into debt.

The key factor here is if there are less debts, there are also less interest expenses to be paid out.

The Net Income to Total Revenue tells us that she’s in the right spot for a fairly good investment. If ALI will show a percentage of greater than 20%, then ALI would be a really nice company to invest with.

If it shows less than 20%, then she’s experiencing a tough competition.

So based on the income statement, ALI might be in a durable competitive advantage.

Now, let’s check the balance sheet.

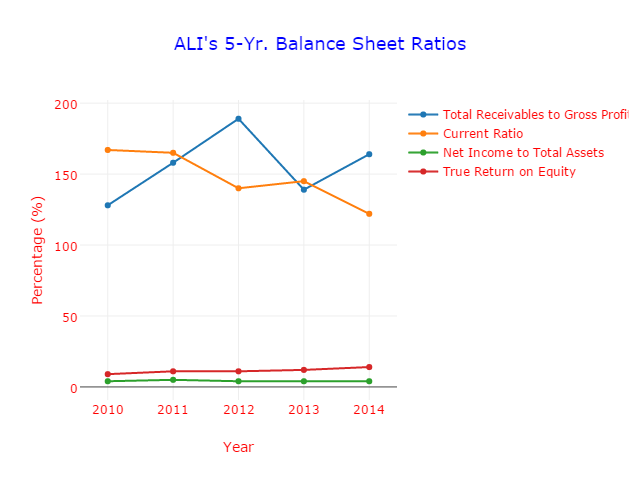

Fig. 4 5-yr Balance Sheet Ratios

What’s surprising in this graph is that ALI has so much receivables; that is money owed to the company. And if more people owed money to the company, there is a probability that some will not pay and that’s not good to a business.

The rule here is that we look for a company with a lower percentage of Total Receivables to Gross Profit. In ALI’s case, it’s consistently high.

The True Return on Equity doesn’t meet the minimum 20% expectation of a competitive business. This means that maybe, ALI’s is using debts to finance its operations or maybe they are buying back their stock using their retained earnings therefore lowering their equity.

The latter isn’t the case because as we see, their retained earnings are increasing every year. So it makes sense that it maybe that some of ALI’s operations are debt financed.

The rule is we look for companies with at least 20% TRoE. ALI’s case isn’t that way.

Now let’s see the company’s financial health;

Fig. 5 5-yr Financial Health

The data shows that ALI has large amounts of reserve cash and liquid investments. It also shows that they are capable of paying their short-term and long-term-due debts. This is a good sign.

Financial Health

We now see if the company can survive a recession. We get the ratio of cash & retained earnings to short and long-term-debt-due;

The data ratio is above 5 except in 2014 but that’s okay since the past data shows consistent high ratios.

Now, evaluating all of the data from the balance sheet, it seems that ALI might not be in an advantage but in a fiercely competitive industry for the past 5 years. We are now in a mixed decision, so let’s see what the ratio of capital expenditures to net income has to say.

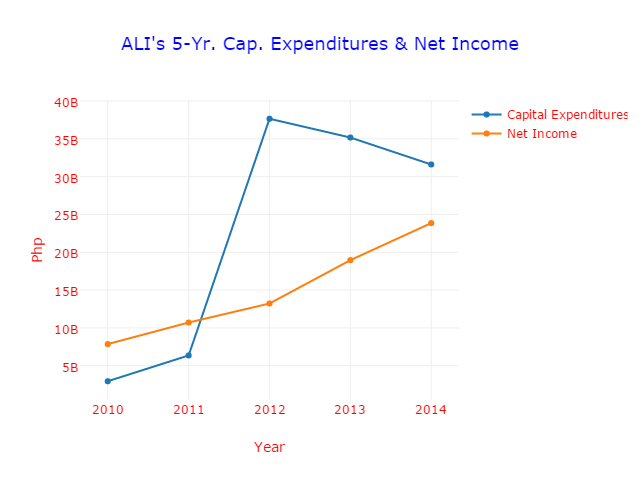

Fig. 6 Capex To Net Income

In the above chart, we now compute the capital expenditures to net income in a 5-yr. period. Based on the data given, we come up with a whopping 152%.

This tells us that ALI is spending a lot to operate its business. The rule is that we find companies with 25% or lower percentage.

In ALI’s case, it’s not but it’s still fine as long as the capital expenditures are used wisely.

Now based on all of the data provided, I’m at a mixed decision. ALI might be in an advantage but because of its high interest payments, low net income and low true return to equity, it suggests that ALI might be experiencing tough competition maybe with MEG, SMPH and other companies in the property sector.

Final Thoughts

My computation shows that as of today, ALI’s rate of return is only 2.66% compared to the 5-yr gov’t bond rate of 3.872%. In my opinion, I can say that the stock is overvalued.

It’s for these reasons that MEG in my opinion is the better investment instead of ALI. It’s also the reason why I chose MEG in all of the companies in the property sector.

But that’s just me. ALI is a very good company way back on 2011 because the stock is cheaper. Nowadays, the price of its stock is quite expensive and buying expensive stocks will not give as great returns on the long run.

Happy investing!

Hi Mark…do you follow a buy-below-price? At MEG’s current price of 5.29, is it still cheap to buy?

Thanks