How To Invest In Mutual Funds Using COL Fund Source

For most people, investing in mutual funds is a better choice because these people don’t want the hassle of monitoring and making active decisions on their investments.

Instead, they trust a fund manager to do all of this stuff. While it gives us the freedom to do other things that matter most, investing directly on individual stocks can be a better option for you if you meet all of this criteria:

If you don’t meet this set of criteria, then you’re better off investing in mutual funds instead.

COL Fund Source

At COL Financial, you have a choice to either invest directly on stocks or on mutual funds using the COL Fund Source.

COL Fund Source is the first and only mutual fund supermarket in the Philippines that provides investors instant access to a wide array of mutual funds. With Fund Source, COL Financial now gives investors the convenience of managing their investments in one account.

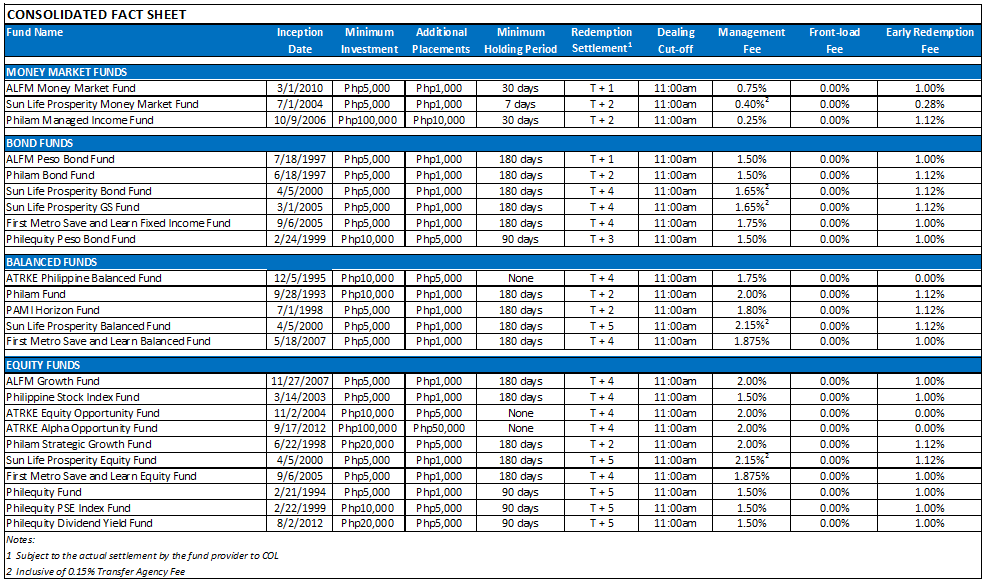

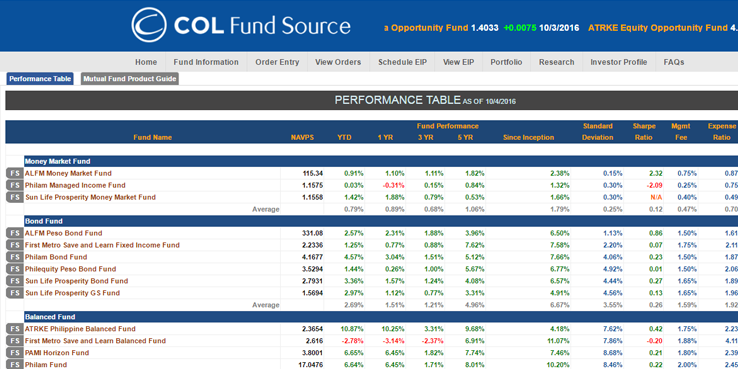

Listed below are all of the available mutual funds that you can invest with COL Fund Source;

If you want to invest in mutual funds using COL Fund Source, then read the simple guide I’ve written below.

How To Invest In Mutual Funds Using COL Fund Source

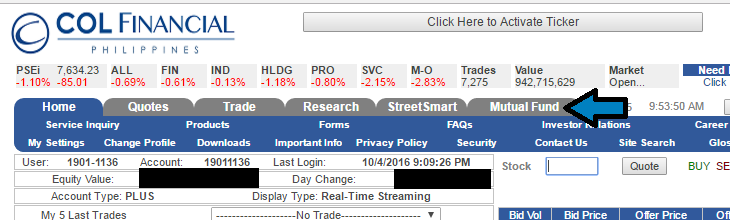

To access the mutual fund dashboard, click the mutual fund in the COL home navigation tab.

In the mutual fund tab page, you’ll see the navigation tabs below the header logo. Here’s some of the brief explanation of each of the tabs.

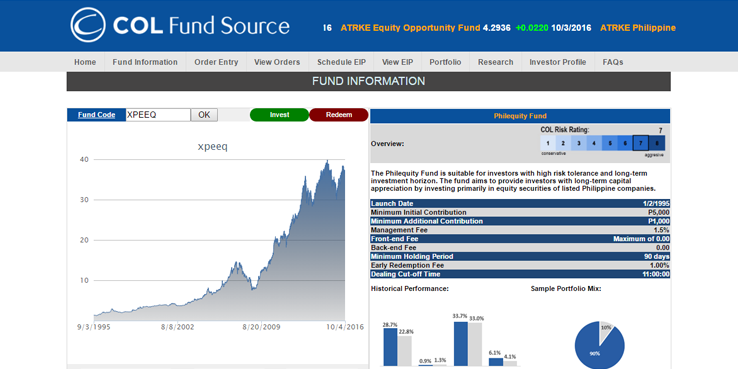

#1 Fund Information

Here’s where you can track the fund’s performance and some brief overview of what the fund is all about. I’ve entered the fund code XPEEQ which is the code for Philequity Fund and as you can see, it displayed useful information that can help you decide to invest.

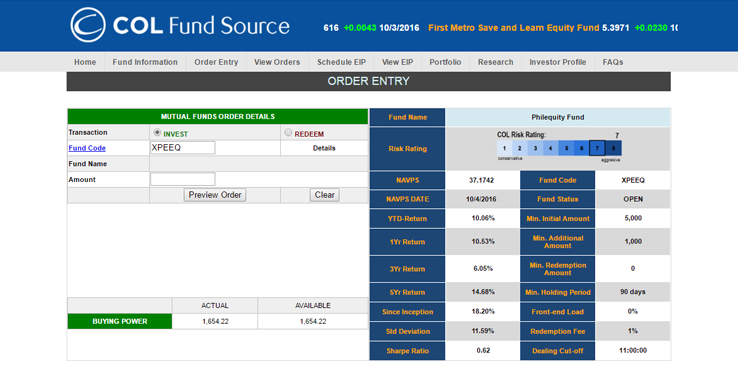

#2 Order Entry

You can place you buy order in here. Tick Invest and input the fund code and amount. Preview your order and confirm your purchase. Minimum required buying amount ranges from P5,000 to P100,000 depending on the mutual fund you choose.

You can also redeem your funds in this tab. Tick Redeem and enter the fund code. The amount option will change to shares. Enter the number of shares you want redeemed, click preview and confirm.

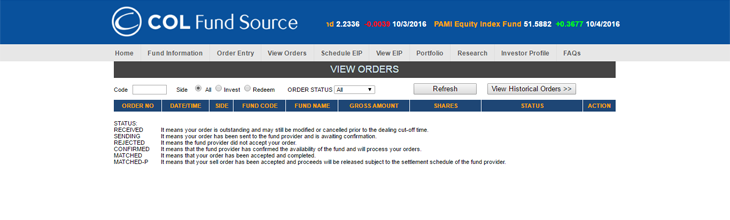

#3 View Orders

This is where you can see the status of your order. If you haven’t purchased anything, this will show a screen similar above.

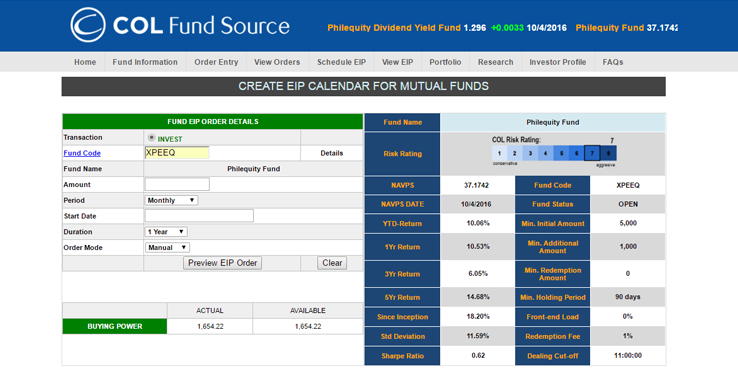

#4 Schedule EIP

EIP stands for Easy Investment Program. COL offers EIP not only on stocks but also for mutual funds.

If you want to automate your mutual fund investing activities, then this is the right solution.

Just enter your the fund code, amount and the period. This could be weekly, monthly, quarterly or semi-annually. Set your start date and the duration. It can be 6 months, 1 year, 2 years or 3 years. Set the order mode, preview and confirm your purchase.

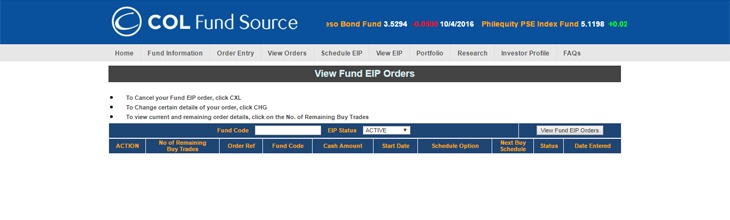

#5 View EIP

If you have existing EIP orders, you can view the details here. You can also cancel and change your EIP orders in this tab.

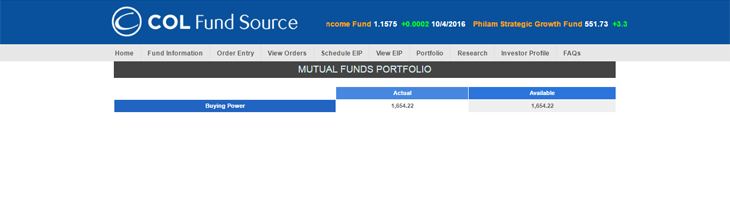

#6 Portfolio

Just like the stock portfolio, this is where you can see your mutual funds portfolio. I don’t have any mutual fund position that’s why you see nothing except my buying power.

#7 Research

You can see all the available mutual funds that are available to purchase based on your risk profile. If you click the fund name, you’ll see the fund information.

#8 Investor Profile

When you access this tab for the first time, it will let you define your investor risk profile. You’ll be taken to a series of questions. You’ll be asked to submit those questions and after that, your risk profile will be defined.

COL defined my risk profile as moderately aggressive. You can see which funds are suitable in my risk profile. If I want to buy a mutual fund that’s not in my recommended list, I’ll have to sign an online waiver form so that I can be allowed to buy a more riskier fund.

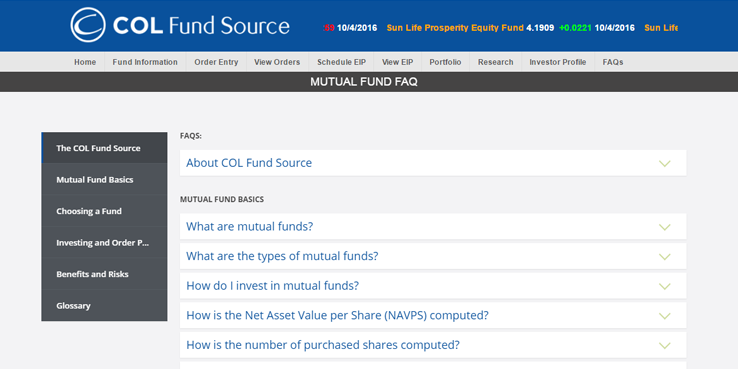

#9 Frequently Asked Questions

Here’s were you’ll find more information and answers to common questions about mutual funds and COL Fund Source.

Recommended Mutual Funds To Invest

Bro. Bo recommends investing in mutual funds for Truly Rich Club subscribers. Here’s the list:

I’ve made a separate review post regarding that here. The estimated returns and action to take can be found if you subscribe to Truly Rich Club.

Final Thoughts

Investing in mutual funds can provide you with almost the same results as compared to stock investing. If you don’t want to acquire the knowledge and experience of the individual stock investors, and you want an investment that is less risky, then a mutual fund best fits you.

The COL Fund Source is an excellent platform to buy mutual funds in one click of a button. This platform saves a lot of time in sorting out and finally choosing which fund suits your risk profile.

At Truly Rich Club, Bro. Bo has a list of recommended funds to buy with estimated returns and recommended action to take. You can take advantage of this by being a TRC subscriber.

Happy investing!

how to withdraw earnings from mutual funds?

How to apply

COL Financial has a platform to buy/sell mutual funds. Please visit their site.

I WANT TO JOIN TRULY RICH CLUB SOON