Truly Rich Club Mutual Fund: What Funds To Buy?

I received a stock alert by Truly Rich Club yesterday informing me to buy four mutual funds that are being recommended because of the global financial market’s decline. As you know, global markets went down these past few days and mutual funds aren’t any exception.

These are the Truly Rich Club’s mutual fund picks;

As I have been investing in individual stocks for quite some time now, it would be difficult for me now to allocate a portion of my salary to a mutual fund.

Since my stock positions have also dropped tremendously these past few days, I’m more inclined into adding my existing positions and considering buying some undervalued stocks in the months to come.

For those investors who are quite confident of managing and re-balancing their own portfolio, this is a much better choice I guess.

But for starters who want to invest in a less risky environment, mutual funds is the better choice.

Now before buying into these funds, I suggest that you do your research first to know more about its portfolio, performance and the fund’s direction. So what I did Is that I made a brief summary of the fund facts about each fund to help the beginner investor decide.

PHILEQUITY FUND

The investment objective of this mutual fund is to seek long-term capital appreciation through investing in less risky and liquid stocks. Most of the stocks it holds are blue chip companies.

NAVPS (as of Jan. 8, 2016) = 32.1512

Here are the top ten holdings of Philequity Fund as of Nov. 27, 2015.

The top ten holdings comprise 49% of the total percentage holdings. The asset allocation of the fund comprises of 86% equities and 14% cash/cash equivalent. The fund holds equities in different sectors such as holding firms (26%), industrial (20%), property (19%), financials (11%), services (9%) and mining & oil (1%).

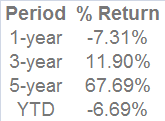

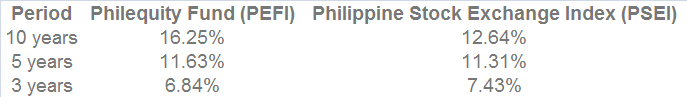

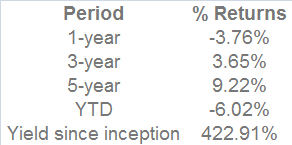

Here’s the summary of the fund’s performance;

The compounded annual growth rate of the fund as of Nov. 27, 2015 compared to the PSEI is shown below.

PHILEQUITY INDEX FUND

This fund is geared towards tracking and matching the performance of the PSEI by buying and selling proportionate number of stocks that compose the PSEI.

NAVPS as of Jan. 8, 2016 = 4.3709

Here are the top ten holdings of Philequity PSE Index Fund as of Nov. 27, 2015.

The top ten holdings comprise 61% of the total percentage holdings. The asset allocation of the fund comprises of 95% equities and 5% cash/cash equivalent. The fund holds equities in different sectors such as holding firms (36%), property (17%), industrial (16%), financials (14%), services (11%) and mining & oil (1%).

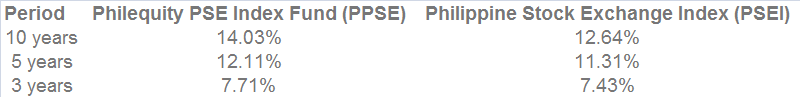

Here’s the summary of the fund’s performance;

The compounded annual growth rate of the fund as of Nov. 27, 2015 compared to the PSEI is shown below.

FIRST METRO SAVE AND LEARN EQUITY FUND

The objective of this fund is long-term capital growth by aggressively investing ins stocks listed in the PSE.

NAVPS as of Jan. 8, 2016 = 5.0067

Here are the top ten holdings of First Metro Save And Learn Equity Fund as of Dec. 18, 2015.

This fund has a typical portfolio mix of 22% properties, 12% holding companies, 7% telecoms, 10% power, 2% transport and 47% fixed income & other stocks.

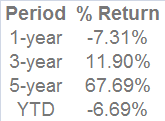

The computed returns for each period are computed as follows;

SUNLIFE PROSPERITY EQUITY FUND

The fund’s objective is to generate long-term capital growth through investing in diversified high-quality investments across different sectors. The fund is suitable for aggressive long-term investors with high risk tolerance.

NAVPS as of Jan. 8, 2016 = 3.6152

Here are the top ten holdings of Sunlife Prosperity Equity Fund as of Nov. 30, 2015.

The asset allocation of the fund comprises of 92.54% equities and 7.46% cash and other liquid investments. The fund holds equities in different sectors such as holding firms/conglomerates (31.43%), consumer/retail (15.35%), real estate (12.56%), banks/financial services (11.17%), utility/energy (8.69%), telecoms (8.69%), mining (2.41%), gaming (0.14%) and other equities (2.10%).

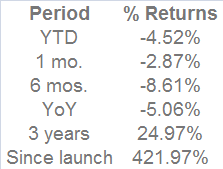

Here’s how the fund has performed;

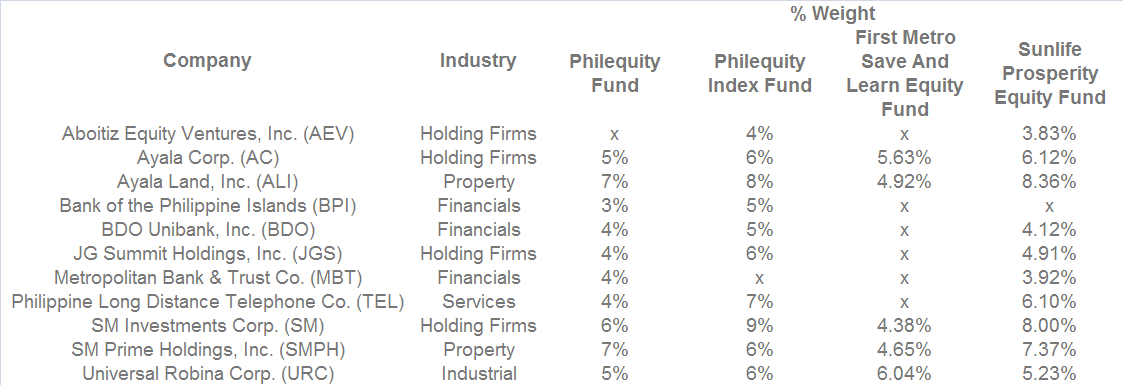

The Most Common Stocks These Funds Hold On Their Portfolios

Using quick analysis, I made a chart below of the most common stocks these mutual funds hold and their portfolio stock positions;

What To Do Now?

After you’ve chosen a suitable fund that fits your risk profile, the next thing you need to do as per Bro. Bo is to invest small amounts to these funds each month for the long-term because when the market recovers, these funds will bounce back up.

According to him, he will be updating Truly Rich Club members on the next steps in the coming stock updates.

If you’re using COL Financial as your broker, you can buy these funds now with just a few mouse clicks. That’s what I like about COL Financial. Everything is online and convenient.

Just keep in mind that when investing in mutual funds, you have to pay yearly management fees from 1.5%-2% of your invested money depending on the fund. I hope that’s clear.

Happy investing!