PERA – The First Step To A Wealthier Retirement

Filipinos are a hardworking society, always ready to log long hours of work for the benefit of their families. Seeing the parents, siblings and children enjoy the fruits of their labor is a source of happiness and pride. Typically, one would save up for a home, a car, children’s education and the ever present celebration of milestones in life. However, because of this selflessness, some often forget to take care of themselves especially when it comes to retirement.

Oftentimes, you will hear some say “Retirement is still years away, I will just start saving for it in 10 years” or “I keep a bit in savings for my retirement, and my kids will take care of me when I retire.” Some solely depend on the retirement benefits from government pension agencies or the corporate retirement pay mandated by law. Some, including millennials, do invest for their retirement albeit irregularly.

When it comes to retirement, people are usually short in discipline and planning mainly because only a few think about retirement at an early age then face the reality of retirement without a retirement plan. If you want to have a happy retirement and reside somewhere like a san francisco assisted living facility, then you need to plan for it during your working years.

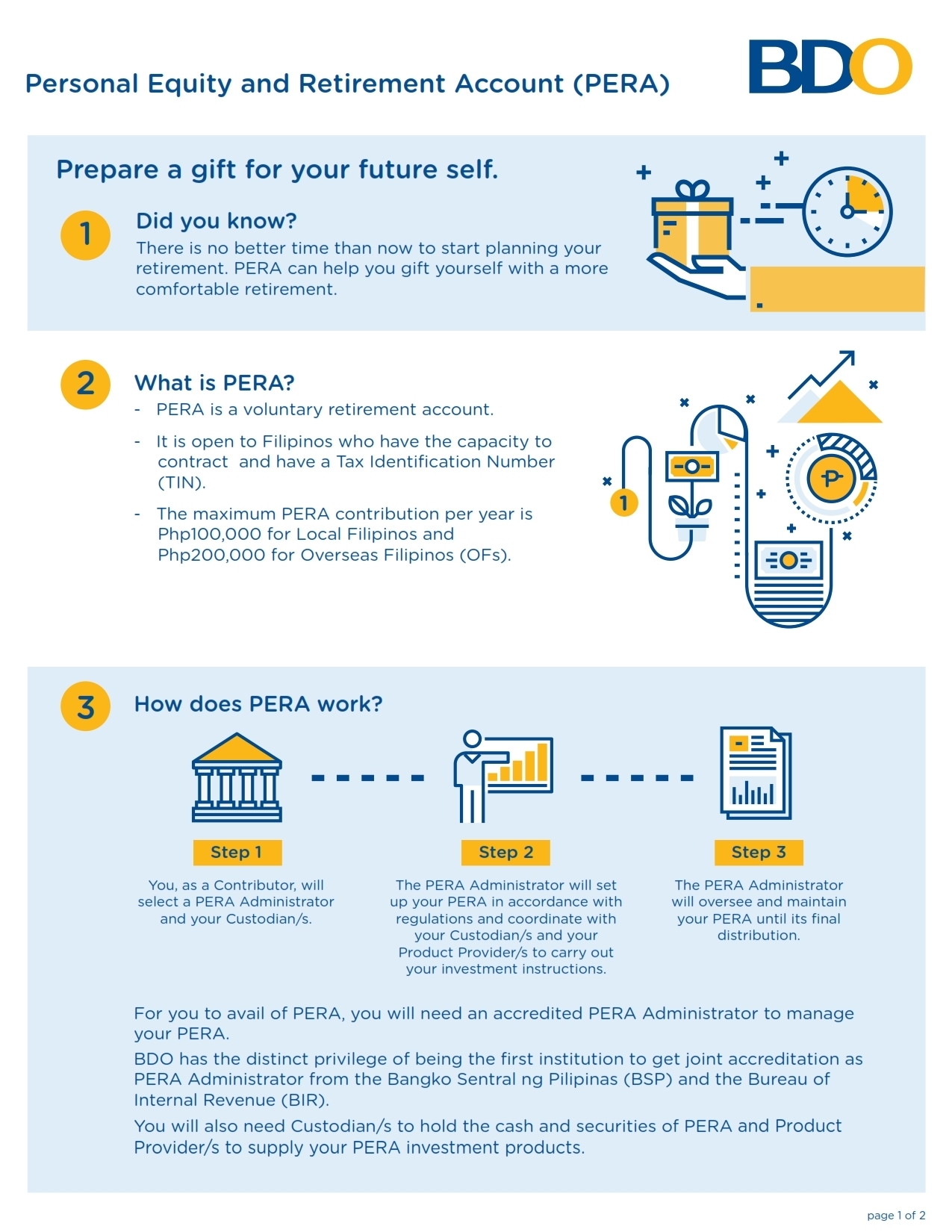

What Is PERA

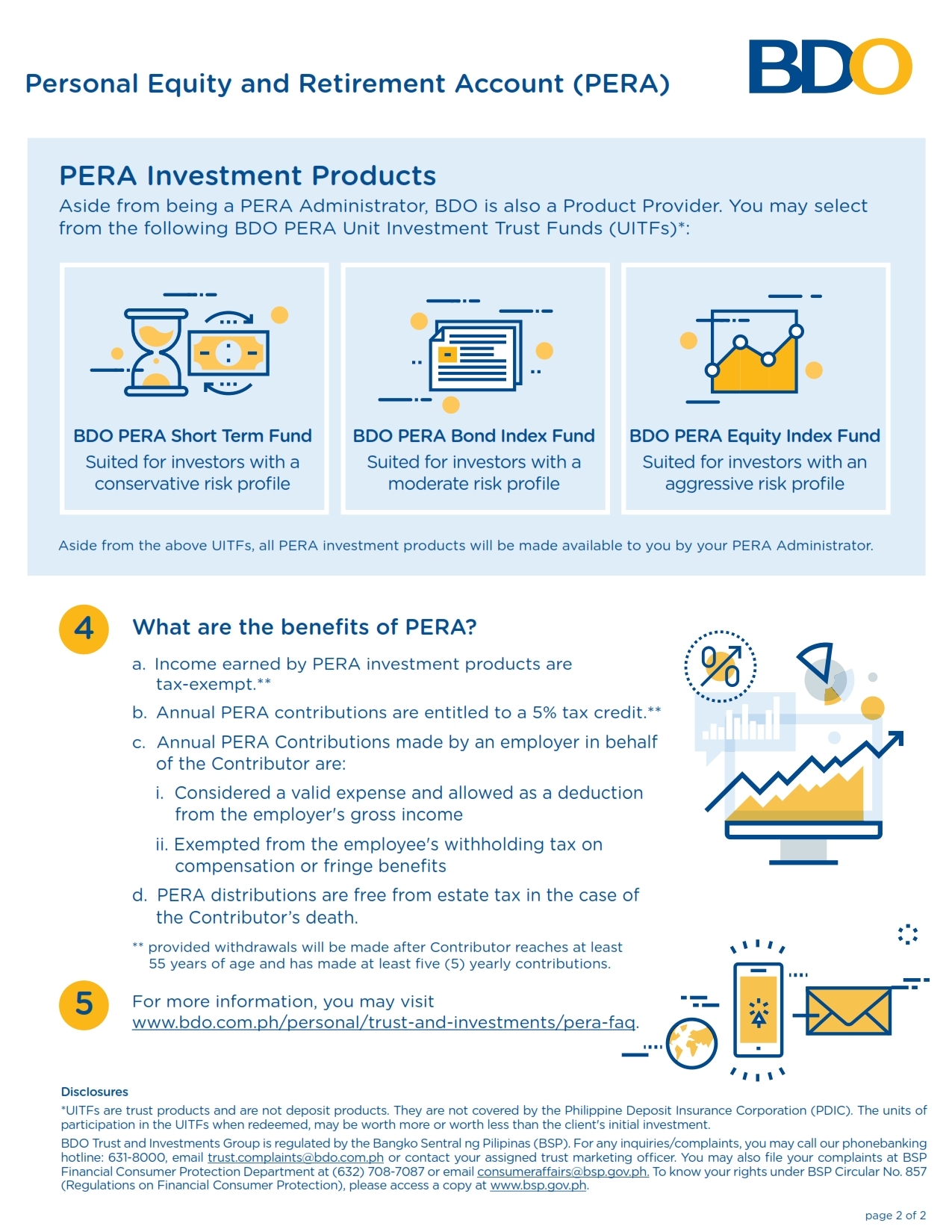

This is where the Personal Equity and Retirement Account or PERA comes in. PERA is a voluntary retirement savings plan that encourages individuals to save and plan for their retirement while enjoying tax incentives both from the amount contributed and the income from investments. Any Filipino, of legal age, earning income locally or from abroad, and with a Philippine Tax Identification Number (TIN) is eligible to open a PERA. An individual may invest up to P100,000, and for those living and working overseas, up to P200,000 per year.

As PERA Contributors, one will receive the following benefits through PERA:

How To Invest Your Money Through PERA

PERA, being a voluntary retirement plan, allows anyone to make all the investment decisions, giving them control over their retirement goals.

BDO Unibank, being the first accredited PERA Administrator in the country, helps Filipinos reach a wealthier retirement through PERA. The Bank now offers PERA through its BDO Invest Online, so individuals can invest conveniently for a comfortable retirement. To know more, visit www.bdo.com.ph/PERA.

About BDO

BDO is a full-service universal bank which provides a wide range of corporate and retail banking services. These services include traditional loan and deposit products, as well as treasury, trust and wealth advisory, investment banking, private banking, rural banking, cash management, leasing and finance, remittance, credit card services, insurance, and stock brokerage services.

BDO has one of the largest distribution networks, with more than 1,200 operating branches and over 4,000 ATMs nationwide. It also has a full-service branch in Hong Kong as well as 24 overseas remittance and representative offices in Asia, Europe, North America and the Middle East.

BDO ranked as the largest bank in terms of total assets, loans, deposits and trust funds under management based on published statements of condition as of March 31, 2018. For more information, please visit www.bdo.com.ph.