Stock Picks for the week by First Metro Securities

Check out the Stock Picks for the week by First Metro Securities in this special report which you can find only here in PinoyInvestor. (Needs premium access.)

READ REPORT

9 Helpful Investment Tips for Newlyweds in 2020

They say the easiest part of being married is the wedding. So if you’re among the COVID-19 couples who decided to get married despite everything, then cheers to you! That means you’ll have bigger challenges to face and difficult decisions to make. Decisions like where to live or how to manage your business or who decides […]

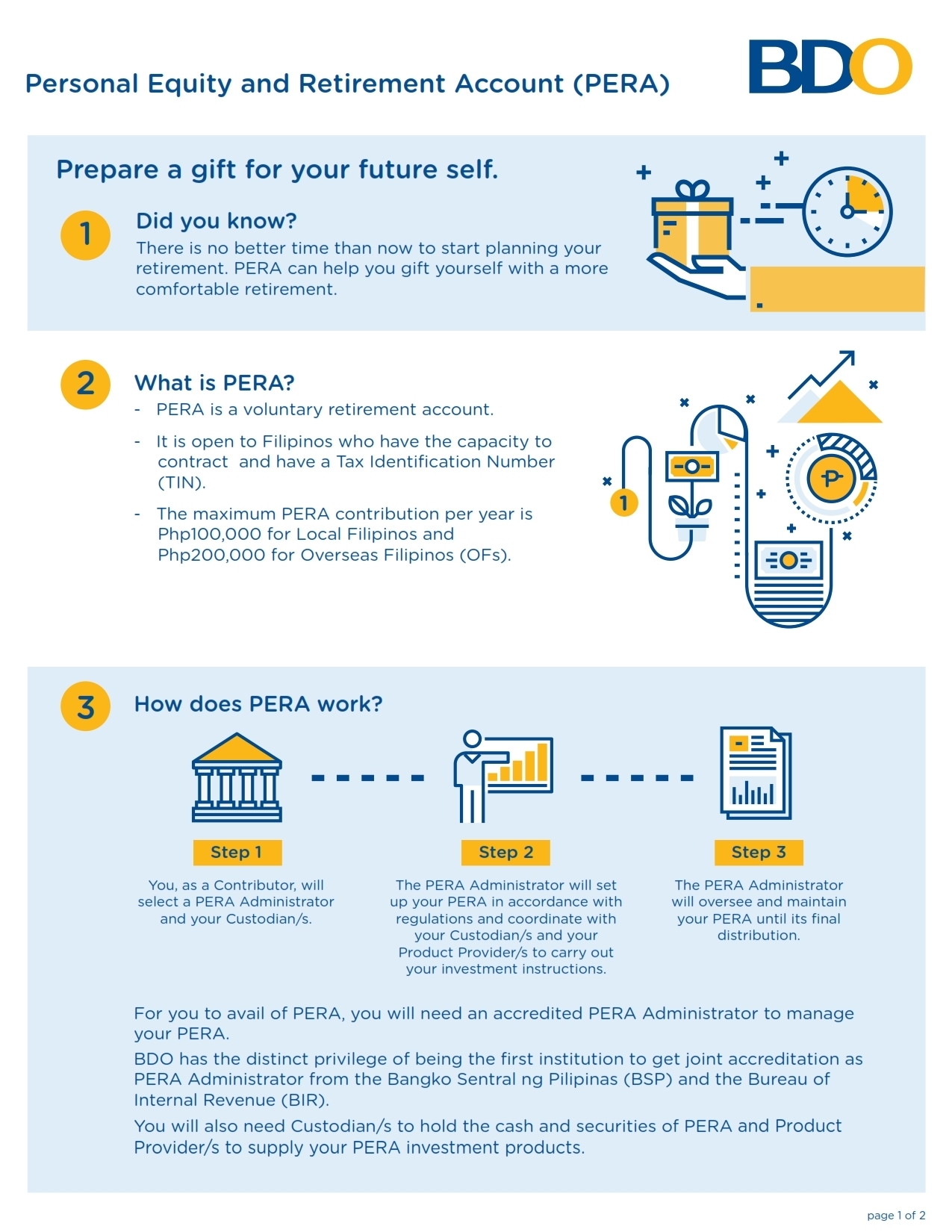

Read more...PERA – The First Step To A Wealthier Retirement

Filipinos are a hardworking society, always ready to log long hours of work for the benefit of their families. Seeing the parents, siblings and children enjoy the fruits of their labor is a source of happiness and pride. Typically, one would save up for a home, a car, children’s education and the ever present celebration […]

Read more...Take Control Of Your Own ATM Debit Card Security With BDO Lock/Unlock

There’s no better comfort to experience in life than knowing you are at the helm of your own financial security, especially if you are backed by an enabling technology provided by the institution you partner with. BDO Unibank has found ways to give you peace of mind and give you—and only you—control of your own BDO […]

Read more...Investing In Retail Treasury Bonds Supports Nation-Building

Every Php 5,000 investment made in retail treasury bonds (RTBs) makes a difference for the country. According to the Bureau of the Treasury (BOTr), the government agency responsible for issuing RTBs, a retail investor capable of allotting a minimum amount of Php 5,000 can positively influence as every peso invested in RTBs is used to fund […]

Read more...How OFWs Earn Extra Cash To Send Home

play Overseas Filipino Workers (OFWs) are well known multi-taskers, performing several duties at the same time. This delicate balancing act requires not just skills but a deep sense of commitment and focus to make life better for their loved ones. This perhaps is best illustrated in “Europe”, a short film by BDO Kabayan, about a female […]

Read more...My Ipon Diary: How To Save ₱100k And Become A Certified IPONARYO!

Meet and greet with coach Chinkee Tan and Ms. Donita Rose w/ fellow bloggers and yours truly after the #MyIponDiary book launching seminar last January 20. FACT: 90% of Filipinos don’t know how to save money. It’s true. And do you know that there’s a 50% chance that you might be one of them? Crazy isn’t it? Have […]

Read more...Beware Of BPI Phishing Scams!

Have you ever received an e-mail from BPI telling you that there are suspicious activities that’s being conducted in your account? And that you need to ‘secure’ it by updating your private information? I hope you didn’t fall for that. Because if you do, stop whatever you are doing, call your bank, inform them of this and […]

Read more...7 Ways You Can Earn Passive Income from Your Condo

Having a passive income is everyone’s ultimate goal. Who does not want to earn money even as they sleep? A growing number of entrepreneurs are turning to real estate for a sustainable source of passive income. If you already own a condo unit, then you should be all set. The Philippines’ booming economy and thriving tourism […]

Read more...My Financial Freedom Journey 2016: Updates And What I Expect This Coming 2017!

As the year 2016 ends, I just want to share an update of my financial freedom journey that started the same time I built this blog. I was inclined to write this post after I read Bro Bo’s Year-end letter to Truly Rich Club members. In the letter, he discussed where his financial journey is right now and […]

Read more...Read This Infographic About Facts On Filipino Money Habits

An interesting infographic by PawnHero shows interesting facts about Filipino money habits on spending and saving money. I once belonged to the 80% of the Filipinos who doesn’t practice the habit of saving. I know a lot of people, most of them are like me too before I learned to be financially literate. Too bad that […]

Read more...