PETRON Stock Review: Is It A Better Investment Than Shell?

Because of the Shell IPO, many are asking for a comparison between the two major players in the oil industry - Petron (PCOR) and Shell; PCOR being the largest of the two based on market share.

If PCOR gets the bigger pie, then why invest in Shell's IPO? Sounds a valid argument right?

Some argue that PCOR is still the better investment while others are skeptical and are looking more on to Shell's IPO.

In this post, I'll put together what I think are very interesting points about PCOR's financial health, cash flow and earnings capability.

If you need to compare Shell's IPO to PCOR to make a better investment decision, then this post might help you quite a bit.

So without further adieu, let's get right into it.

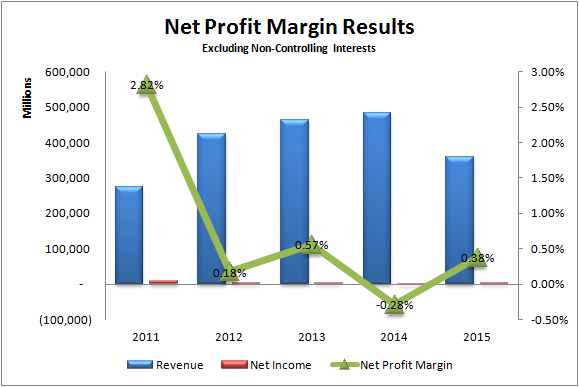

Profitability

Petron's average 5-year Net Profit Margin is at 0.73%, 2011 being the best performing year. That's an average Net Income of ₱2.2 billion that can increase the company's cash reserves per year.

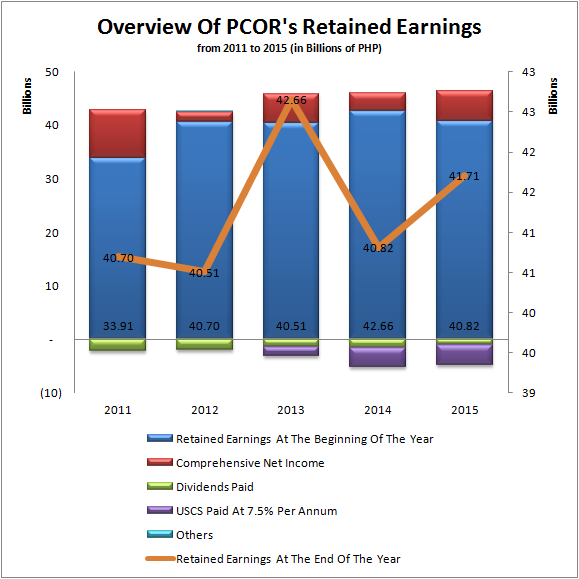

During the same period, Retained Earnings only increased by ₱1.02 billion. That's a very slow compounded annual growth rate of 0.61%.

The ability of a company to retain a large amount of their earnings is what makes it grow. At that rate, it's not attractive.

What seems to be the problem?

Well, one of the things I see that eats up the profits is the distribution payments to the Undated Subordinated Capital Securities that started in February 2013.

Just last year, PCOR paid ₱3.607 billion to the USCS holders. Last August 5, 2016, PCOR paid about ₱1.889 billion.

Add this to the yearly dividend payments that average around ₱1.6 billion, there's really not much left for PCOR to retain.

The positive thing is that the sale of this bond increased PCOR's equity from ₱59.555 billion in 2012 to ₱93.964 billion in 2013.

According to PCOR, the proceeds from the sale of the USCS were used to fund the Refinery Master Plan Phase 2 Project (RMP-2).

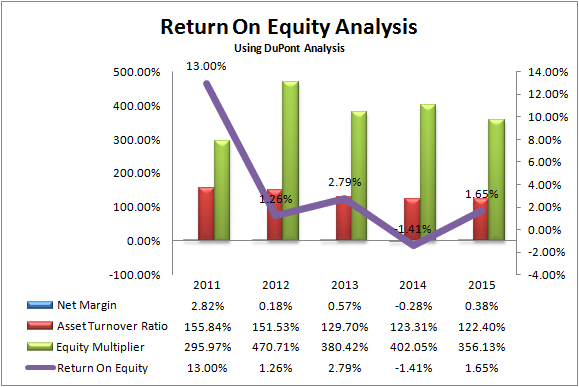

Did the increase in equity resulted to good returns? To find out, let's check the Return On Equity.

Observe that from 2011, the Asset Turnover Ratio and Net Margin declined the following years while the Equity Multiplier increased. The ROE decreased from 13% in 2011 to a merely 1.65% last year.

This could only mean that the increased leverage coupled with declining Net Income has something to do with the drastic drop in Return Of Equity.

Comparing Petron's 1.65% to Shell's 13.62% ROE last year, we can see that Shell had used its equity more effectively than Petron to generate profits.

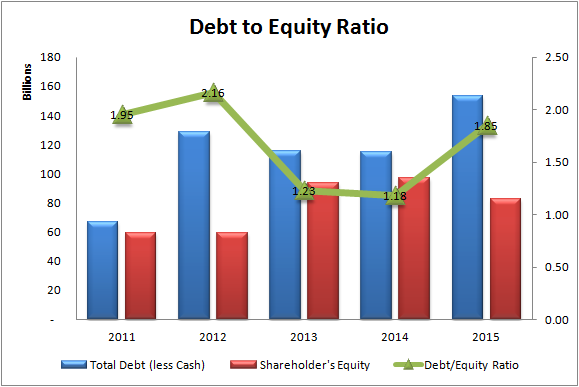

Petron's Debts

PCOR has a high D/E Ratio which an investor should look out for.

The long-term loan proceeds were spent to different things such as;

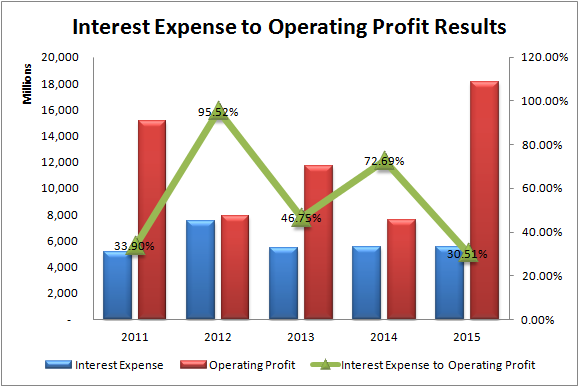

This tells us that most of its capital spending is fueled by debt. Where there is debt, there's Interest Expense and this doesn't look good if you'll consider a benchmark of less than 15%.

If you'll take a closer look at 2012, it's almost as if they paid all of their Operating Profit to interests on loans.

If debt is being used, we can guess that PCOR's earnings might not be enough to sustain operations alone.

However, there's something that you should look at in the Cash Flow Statement. This might turn the tables around.

Free Cash Flow

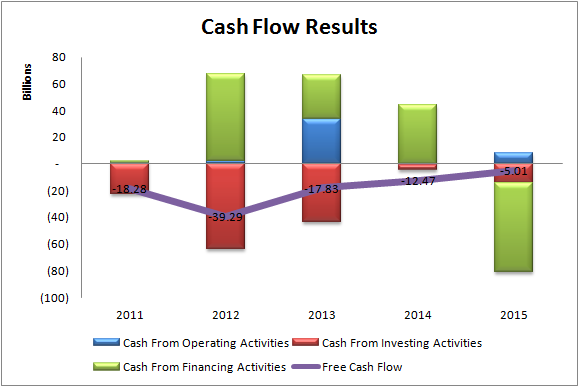

The Free Cash Flow for the 5-year period has been in the negative. You can see that there's almost no cash being generated through operations except in 2013.

You may have also noticed that in 2012, 2013 and 2014, some of the cash generated came from the company's financing activities. This is the reason why PCOR has a high D/E Ratio.

But have you noticed that the negative cash is trending upward towards the zero mark? If the trend continues, then we could expect positive cash for the next coming years.

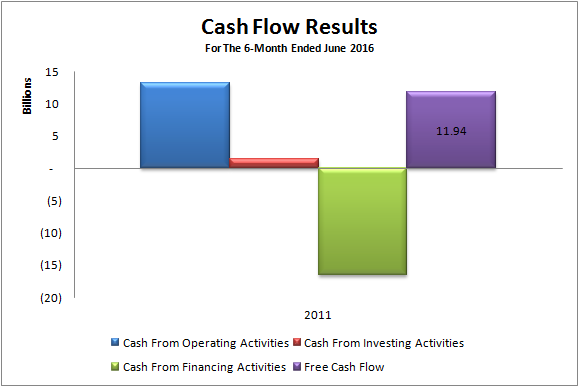

Well actually, FCF is already positive right now.

The recent 6-month ended June 2016 Financial Statement shows a positive ₱11.9 billion Free Cash Flow.

This is something to consider because it turns out that PCOR now has a surplus of cash. With positive cash, they would be able to minimize borrowing. They can now pay more debts, or use that cash to further grow the business.

As long as the trend will continue, this will speed up growth and therefore increase net earnings in the coming years.

Using Altman Z Score

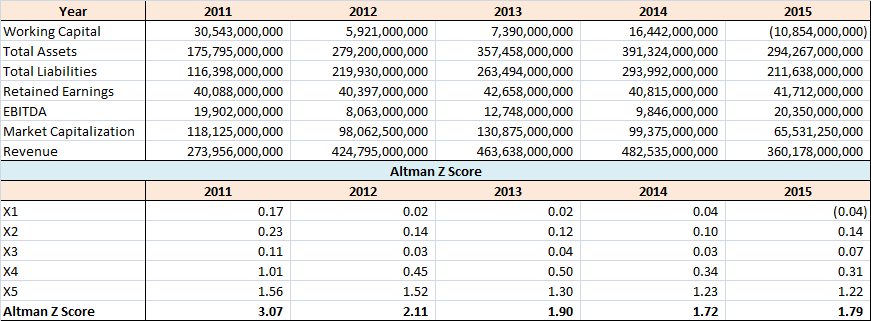

Just to give a basic understanding on how this works, the Altman Z Score is used to determine the level of financial distress a company has. It is a fairly distinct straight approach using the Income Statement and the Balance Sheet in determining the financial health of a company.

You can learn more about it here.

Now getting the values, I wasn't surprised that it failed the screen test because of too much leverage.

Clearly, the leverage slowly pushed down the score to dangerous levels since 2011. We have yet to see the next couple of years if the positive trend of cash will raise the score to greater than 3.

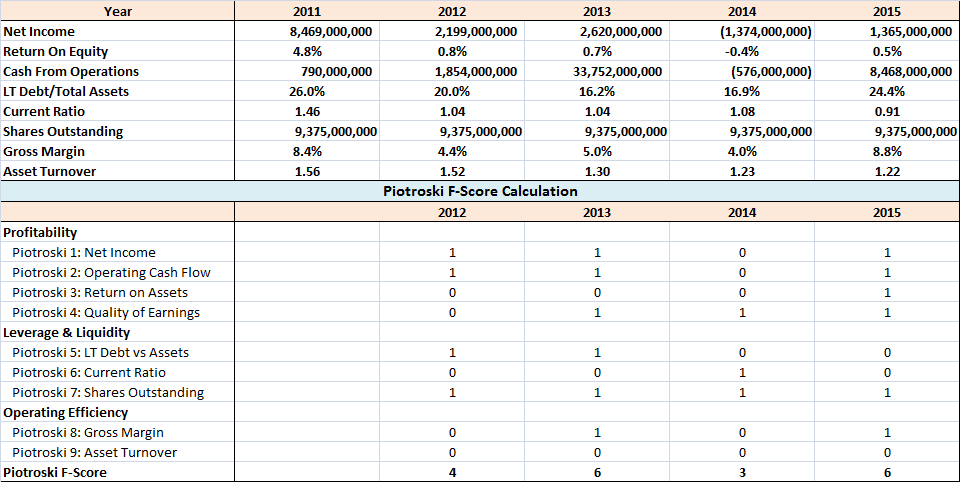

Using The Piotroski F-Score

The Piotroski F-Score screen places PCOR in the mid range. At the current score of 6, it just needs 2 points to place it at an attractive score.

My Thoughts On Petron

Petron is the leader when it comes to the oil refinery business in comparison to Shell. However, you should consider some of these things before putting your hard-earned money in Petron's stock.

Initial Rate Of Return

Based on a price of ₱10.68/share and a trailing twelve month P/E of 71.2, this equates to a 1.404% return rate which is lower than the 5-year government yield of 3.789% and the PSEI's return of 5.34% based on a P/E of 18.7.

I find PCOR overvalued for now.

To be safe, one recommendation is to apply a Margin Of Safety. At ₱10.68/share, you can assume a 25% safety which will put it at a price of ₱8.01/share. I find this a much better price to consider if you want to get a higher upside.

Final Thoughts

I hope I made some clear points on some of the important aspects of Petron's business regarding its earnings and financial health.

To answer the question on which of the two is a better investment, it will really depend on how much you are willing to pay for the stocks.

Shell might have a higher upside potential than Petron, but I think the latter is the better choice in terms of profitability and growth once they are done with their RMP-2 spending.

Now that Shell has finalized their IPO price at ₱67/share, you can now decide which to buy or just move on to find cheaper stocks now that the PSEi has dropped close to 7,300 levels.

This concludes my Petron stock review.

I love to hear your thoughts. If you have some points on which of the two is a better investment based on prevailing fundamentals, then kindly leave your comments below.

Happy investing!

Hi Sir,

What are your thoughts on Phoenix? Is it relatively safe to invest in it as well?

Hi Chris,

I haven’t looked at PNX yet, I’ll look into it in the future and maybe make a post about it. Thanks for your comment. 🙂

Hi Mark,

I am Danmark. An Electrical Engineer here in Petron Bataan Refinery. Just to give you heads up on your analysis, Petron is actually planning expansions in the near future and my colleagues are recently reviewing project specifications. With that, two or more process units will be constructed in the next 2 years. Aside from that, additional crude tanks and products tanks were also evaluated. As Petron already acquired the power plant from SMC, I believe that said acquistion puts Petron to a level where it wants a long term plan to have more growth in income. Last December 2016, our President announced that 2016 is a good year for Petron. With our performance last year, we can say that RMP-2 is already operating efficiently and generating income far beyond our previous years. For year 2016, our KPI target for operating income (in billion pesos) was 16.7 (threshold) and 18.1 (stretch). Related to the December performance said by our president and hearsay in our management, we are only lack of 500 million pesos to reach the stretch with 19 days remaining for 2016. However, even though we reach the stretch target, my supervisor said that portion of it may be paid to debts.

To contribute in your website, all I can say that Petron is a very good company. It will just take time and patience to reap what Petron sow.

Our CEO, Ramon S. Ang is currently having more expansions and projects in the coming years that will make Petron gain more profits once all of these are completed.

PS: Me and my colleagues subscribed to your website. We are lucky to have an Electrical Engineer like you who are already successful not in our field but in Financial Freedom. 🙂

God Speed and God Bless

Sincerely,

Danmark

Hey Danmark, such a wonderful piece of information. Thanks for sharing your thoughts and for the nice compliment too!

Pcor still falling i bought this stock late last year hoping that its a stable and a stong company only to find out its expensive at that price point. Now im stuck.

Hi Gerald,

This is why it’s important to buy at a certain margin of safety in conjunction with your risk appetite. PCOR is a good company but depending on the price you pay, it might become a bad investment.