Philweb Stock Review: What Does The Future Hold For WEB?

Philweb (WEB) is on a rollercoaster ride. The recent turn of events has led the company into an immense pressure resulting to shareholder panic.

So here’s what happened, Roberto V. Ongpin resigned as Chairman and Director of Philweb (WEB) Corp. Shares fell from P8.95 to P5.23 or 36.88% that day. According to him, the reason behind it is to “save the company” because he was tagged by President Duterte as among the oligarchs embedded in the government.

Yesterday, PhilWeb Corp. lost P5.569 billion in market capitalization, after its shares plummeted from P5.13 down to P3.88 or 43.06%. The risk of the company shutting down is imminent due to the President’s directive to end online gambling in the country.

The events that took place these past days is a perfect example of how a government can influence a business’ economics. If Digong didn’t make a statement like that, shares would not tumble that huge.

But Philweb’s President, Dennis O. Valdes said that “PhilWeb is merely a software provider to PACGOR for its network of e-Games outlets. We are not online gaming. Our software cannot be played from homes or offices“.

In a statement, Mr. Valdes felt that Digong may have been misinformed that’s why they seek to meet with PAGCOR’s chairperson to fully explain their side.

But their last minute’s appeal to renew their licence was rejected by PAGCOR.

For now, we can’t predict what will happen to the company next month or the next three months. We don’t know what will the effect of this dilemma do to their revenue and net income for the next coming months.

All we know right now is that the company has a lot of assets and cash. If the management can’t continue their normal business starting on Aug. 10, then they have to think of other ways to continue doing business. While doing that transition, I want to know if the company can survive using the cash they have right now for the next couple of months until they come up with a better decision what to do with the company.

So let’s dig in at the numbers and analyze.

Valuations

Today’s price closed to P4.25 per share. This puts it at a current P/E (TTM) of 5.35. Last month’s market price closed to P19 which puts it at a P/E of 26.39. From a fairly valued company, it has now become an undervalued company.

The P/BV of WEB is at 5.61 based on the recent quarterly report. This means that for every P5.61 you spend purchasing WEB’s stock, you get P1 of equity. This equates to a 17.82% margin of safety. Considering what has happened for the past few days, buying at today’s closing price of P4.25 I think is still risky at this point theoretically.

If you’ll base your purchase price on the book value, then a market price of P1.13 or P1.14 will bring your P/BV down by 1.5 and will raise your margin of safety by around 67% which is fairly a good deal.

But that’s not the point. The important thing we need to know is WEB’s financial health because we know that WEB’s revenues will decline for sure. Does WEB have enough cash to survive the issues that’s plaguing the company for a few months or years? We don’t want a company declaring bankruptcy don’t we?

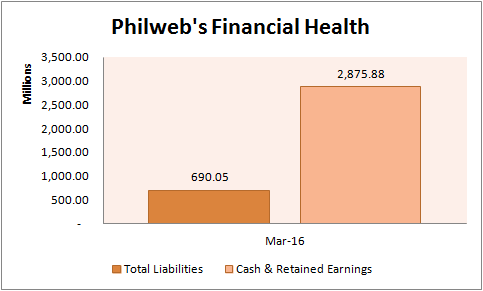

By looking at their Cash and Retained Earnings and compare it with their Total Liabilities, we can see a clearer picture of their financial health.

Their total liabilities for the recent quarter consists of Accounts Payable and Accrued Expenses, Notes Payable and Income Tax Payable totaling at P690.05M. Cash & retained earnings totaled at P2,875.88M.

If total liabilities are paid, WEB would have roughly P2,185M of cash available to reorganize the company in the coming months.

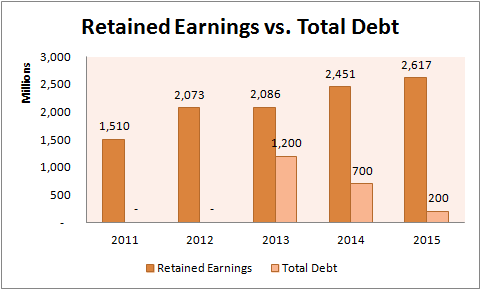

We also don’t have to worry about short-term and long-term debts because Philweb doesn’t have a lot as shown in this 5-yr chart.

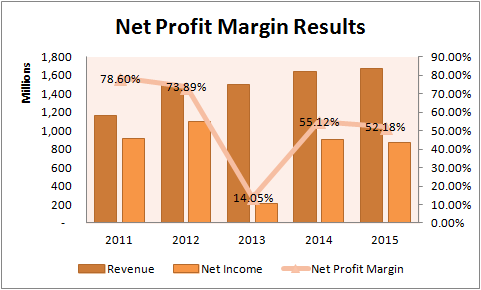

I think one of the reasons they don’t need to borrow a lot of cash is because their Net Margins are so high as shown below.

With such high margins, they were able to buy back P4,211.14M worth of treasury shares and maintain a 25.33% retained earnings compounded annual growth rate from 2010 up to 2015.

With these data, I think WEB has a lot of cash to manage in the short-term. Depending on what the management will plan for the next couple of months will determine the ultimate fate of the company. I also think that buying the stock at around the P1 range based on book value pose a sizeable opportunity once tables are turned.

What’s Next For Philweb?

We can’t predict exactly what will happen. We saw how the stock continued to plummet and we don’t know when will it bottom out. Traders can profit from this volatility while long-term investors should be cautious.

It’s during this time that we need to know every bit of news about this company. If WEB can somehow persuade the President and PAGCOR to continue their operations normally, then what we have now at P4.25 per share is a very attractive buy price.

If they do manage to persuade the government (which is unlikely I think), then I would take a second look at their financials once again. I’m seeing some pretty numbers here based on their recent Income and Cash Flow Statements.

So what do you think? Can Philweb solve this dilemma they are right now? What do you think the management will do to maintain their business operations? Will they sell the company or move on to other business opportunities? I want to know what you think. Share your thoughts below.

Happy investing!

UPDATE: Philweb shutting down today.

Hi,

I’ve been a follower of your stock reviews. Can you please do a review for X (Xurpas)? Thanks for your helpful insights!

Hi. Sure I’ll look into it. 🙂

I always look forward to your stock reviews and I become getting more familiar with financial lingo. Your analysis is easy to understand and It helps me a lot to understand better about the stock market. However, I always have difficulty looking at the bar graph in distinguishing the different color of the font you used. I guess, I do not have a keen eyes on colors and I hope for a better contrast.

Hey Isay thanks for the nice compliment. I guess I’ll have to change the colors of my graphs. Thanks for suggesting that. 🙂

This is really a good review, if I only saw this few months back,I surely put all my pot into that PhilWeb haha, thanks for the insigth.

You’re welcome Edfran.

The stock market sure has many ways on how it can make you rich in just a short amount of time.. I envy those who took the risk. I was almost going to buy during those days but too risky I suddenly thought of myself. WEB’s fundamentals are good but the macro risk during that time was so high that’s why I opted to stay away.