How To Calculate The Average Price In A Stock Portfolio

One way to reduce your paper losses in the stock market is to lower your average price per share or simply to do cost averaging down.

Here's a simple illustration on how I reduced my losses by averaging down my average price per share. See the screenshots below;

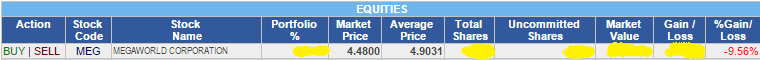

Fig. 1 Portfolio screenshot before

This is my MEG's average price at 4.9031 with a loss of 9.56%. I decided to buy MEG a while ago at 4.49/share. Here's the screenshot of MEG after I bought it.

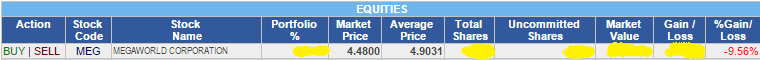

Fig. 2 Portfolio screenshot after

If you'll notice, my average price went down by 0.195 points and my %loss was reduced by 3.96 points.

So for those first time value investors who bought blue chip stocks, don't panic if your stocks stays red and don't turn green on the first few months. What you just need to do is to accumulate buying power and wait for the right time to buy at a much lower price to lower your average price.

Now how do you know when it's the right time to buy?

There are very simple ways. You can use the investment guide provided by COL Financial. As of now, COL's investment guide states that MEG's buy below price is at 5.00 pesos.

In the Truly Rich Club's SAM Table, MEG has a buy below price of 4.54 Pesos. Having confidently valuated the company myself previously (refer to this post here), I bought it wholeheartedly because I know within myself that the price I paid for it is cheap without any doubts.

Let's Now Calculate The Average Price In A Stock Portfolio

Now to give you a basic mathematical equation on how COL Financial computes for the average price, see the formula below;

New Average Price = [Previous Ave. Price + Average Price Of New Stocks Bought] / 2

Let's take my investment for example;

To determine your previous average price, just look at your portfolio and look under the average price column. In the screenshot above, my previous average price was 4.9031.

To compute for the average price of the new stocks you just bought, you have to compute for the total costs including charges and divide it by the total number of shares bought.

In my example, I bought MEG at 4.49/share for 1000 shares. That would be 4,490.00 pesos. But you still have to add the total charges incurred. The charges are as follows;

At 4.49/share for 1000 shares, here are the charges I paid for;

The total charges I paid amounts to 23.07 Pesos. Add this to the total bid price and you get 4,513.07 Pesos (4,490.00 + 23.07). Divide this figure by the number of shares bought and you get 4.5131 Pesos; which is the average price of the new stocks I bought.

Now applying the formula above;

New Average Price = [4.9031 + 4.5131] / 2 = 4.7081

So that's how you get the average price.

Final Thoughts

In conclusion, by lowering our average price, we can effectively decrease our paper losses especially if we bought these blue chip stocks at an expensive price. We just have to know when to buy and at what price we should buy. The cheaper we buy, the lower our average price goes and the lesser our losses would be.

There are many guides on where to look for buy below prices. So just to be sure, you may use COL Financial's investment guide and the SAM Table if you're a member of the Truly Rich Club.

Happy investing!

wow. learning how to analyze.

Great tip. Thank you!

Great! You have just shared what investors need to know in the investing journey. Thank you for sharing such great tips for us. Have a happiest new year ahead..

try nyo po ito guys Average Down/ Up calculator using Google sheet

https://youtu.be/gdz1yaZ6gwY

Based po sa ibang average down calculators. Mali po un formula nyo.

Can you share the updated ones so that I can update the post ty.