RFM Stock Review: An Unseen Opportunity Or A Pitfall?

I noticed that RFM Corporation (RFM) has been buying their stock since February 2016. As of this writing, the company has already bought back 0.25% of the Outstanding Shares. The stock price also rose from PHP 3.84 last February to Php 4.35 as of today.

I wonder what the Board of Directors are thinking. Is today’s markets presenting an opportunity to buy back the shares at a cheap price? That’s what I want to know.

Before I dive into the numbers, I’ll just give a brief background on what RFM’s business is all about.

RFM’s business revolves around the food and beverage system industry in the Philippines. They manufacture flour, bread and flour-based products. They sell a lot of brand products like SELECTA (fortified milk products and ice cream), SUNKIST (ready-to-drink beverages), WHITE KING, FIESTA and ROYAL pasta. The company is also involved in the bottled water business.

Besides the food and beverage business, they also operate non-food businesses like barging services and leasing of commercial/office spaces.

Now let’s take a look at the numbers.

Valuations

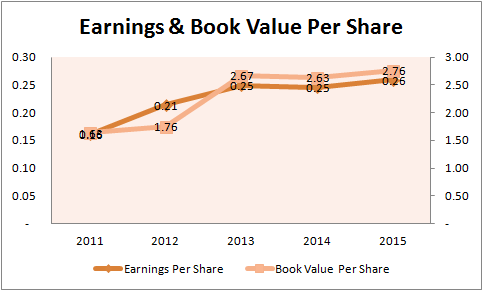

EPS and BVPS shows an upward trend. CAGR is computed at 12.58% and 14% respectively.

Fig. 1 Earnings Per Share and Book Value Per Share

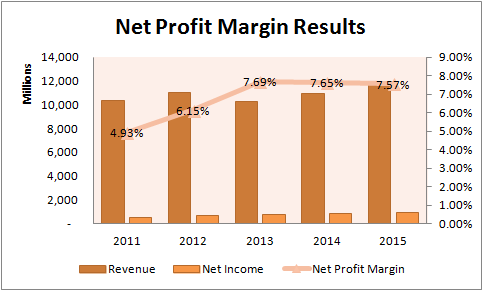

Looking at last year’s performance showed that it has increased its Net Income by around 9%. According to their CEO, the increase in earnings can be attributed to the strong sales of their ice cream and pasta business.

This resulted into a Net Profit Margin of approximately 8%.

Fig. 2 Net Profit Margin Results

For the last 5 years, it’s evident that RFM’s profit margins had improved from 2011 to 2013 but became sluggish after 2013. On a 5-yr average, they had only pocketed around 8% of their Net Sales.

I compared it to Universal Robina Corporation’s (URC) average of around 10% and realized that RFM still has a lot of selling to do.

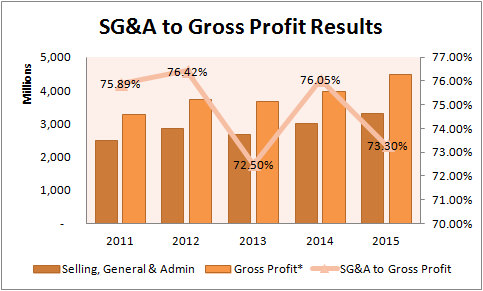

Profit Margins that low could mean one thing; the company might be spending a lot in Operating Expenses. Actually, they are. On a 5-yr average, RFM had spent around 74% of their Gross Profit to SG&A Expenses. Compare that to URC’s spending of only 54%.

Fig. 3 Selling, General & Admin Expenses to Gross Profit Results

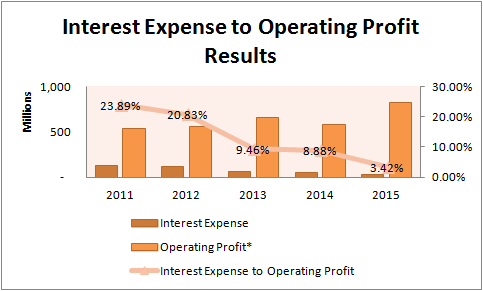

What I like about RFM is that they have reduced their Long-Term Debts to zero last year making it a long-term debt-free company. From 2015, RFM is paying approximately 24% of its Operating Profit to Interest Expenses. They have reduced that ratio to just 3.42% last year.

The company is really serious in paying off its debts.

Fig. 4 Interest Expense to Operating Profit Results

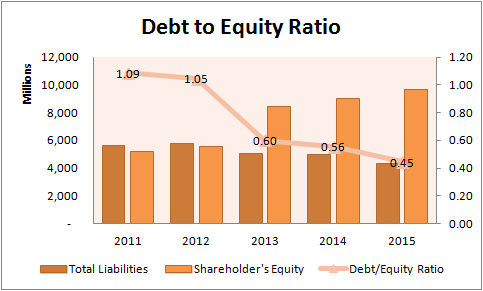

This reduction also affected the D/E Ratio. From 1.09 in 2011, it has now dropped to 0.45 last 2015.

Fig. 5 Debt to Equity Ratio

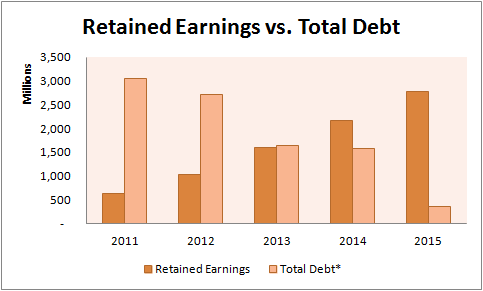

Now observe this, for the last 5 years, RFM is steadily increasing its Retained Earnings while reducing its Total Debt.

Fig. 6 Retained Earnings vs. Total Debt

In 2011, RFM recorded Retained Earnings of 622 Million Pesos. Last year RFM recorded 2.766 Billion Pesos. This computes to an annual compounded growth rate of 45%! On the other hand, debt has declined at an annual rate of 42%! I love how this company manages its debt.

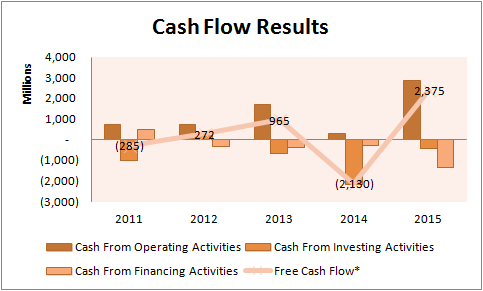

The reduction of their debts year by year strengthened RFM’s Free Cash Flow. From negative 285 Million in 2011, it has increased to 2.375 Billion last year.

Fig. 7 Cash Flow Results

Notice the large negative FCF in 2014? This is due to the acquisition of the Royal Pasta trademark from the Unilever Group for 2.1 Billion Pesos. Since this is an Intangible Asset, I can’t really say for sure if the company paid a reasonable price for it or not.

In my opinion, Royal Pasta is a good trademark. I always see the Royal Pasta brand when it comes to cooking the common Filipino household spaghetti.

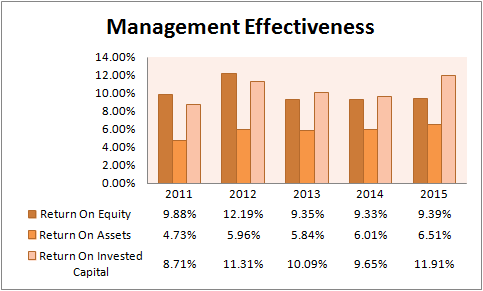

The chart below shows how the management is good at generating returns on equity, assets and invested capital. The average RoE, RoA and RoIC is computed at 10.03%, 5.81% and 10.33%.

Fig. 8 Management Effectiveness (RoE, RoA, RoIC)

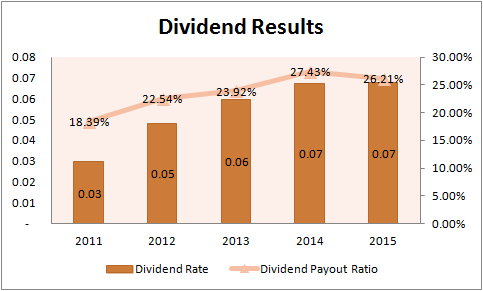

When it comes to dividends. RFM paid out approximately 18% of its earnings to investors in 2011 and it has grown since then. Just last year, it paid out around 26% of its earnings.

Fig. 9 Dividend Results

If I’m after dividends, then RFM is a much better investment than URC. The dividend yield of RFM and URC is at 2.5% and 0.8% respectively based on Morningstar.com data.

Based on the data above, I’m now starting to like this stock because of the management’s ability to increase sales and equity without taking too much debt. The share buybacks will surely go on because of the company’s strengthening cash flow.

RFM will surely grow if it will continue to do what it’s doing. Once investors begin to gain confidence and be bullish about its future prospects, the stock will surely perform better.

Is RFM Stock Undervalued?

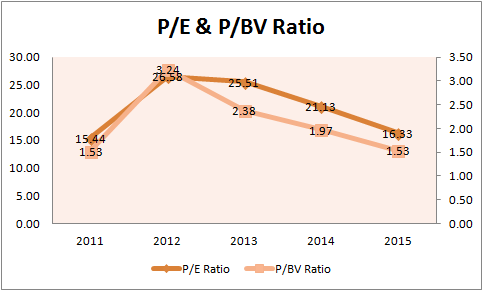

Based on the average 5-yr P/E and P/BV of 21 and 2.13, I can say that the stock is fairly valued in my opinion.

Fig. 10 P/E and P/BV Ratio

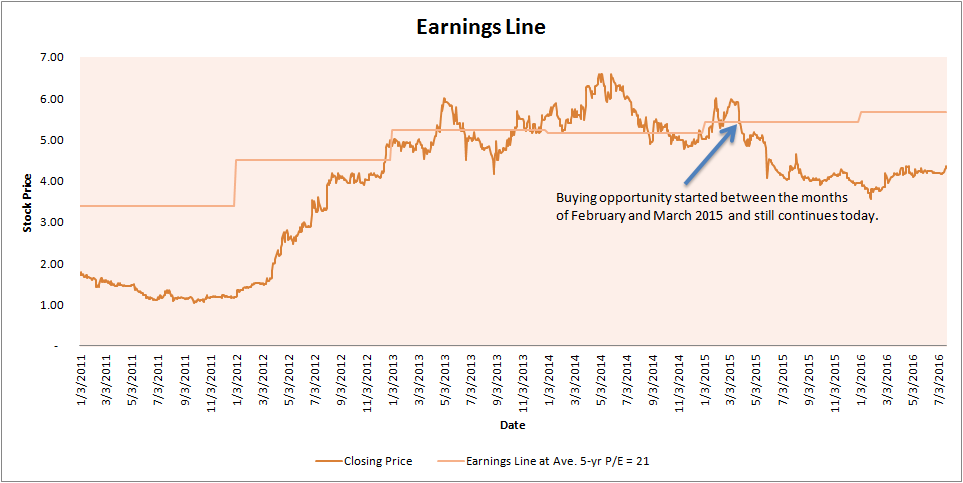

The best thing to determine if RFM is a good buy today is to plot an Earnings Line and use the average P/E of 21 for the 5-yr period.

Fig. 11 Earnings Line

The closing price went below the earnings line somewhere between February and March. This presents a buying opportunity. If you’ll notice, RFM also started their share buyback program around the same period. Is this coincidence? I bet not.

Initial Rate Of Return

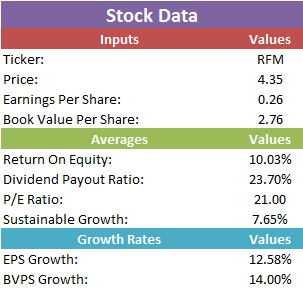

So what if I decide to buy this stock? If I buy this stock today at a price of PHP 4.35 per share, I would get a return rate of around 6.21% which is better than a 10-yr gov’t bond paying at a rate of 3.212%.

Projected Price After 10 Years

I used these data to get the estimated projected price.

Fig. 12 Stock Data

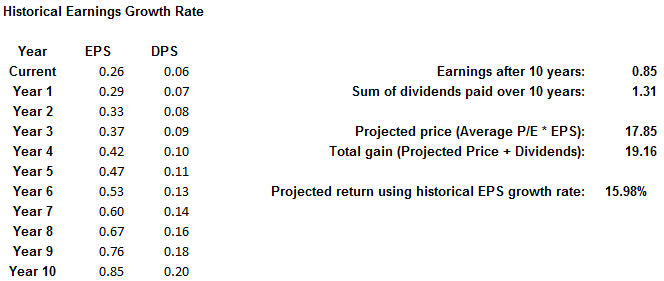

Using the Historical Earnings Growth Rate Model, I got PHP 17.85 per share.

Fig. 13 Historical Earnings Growth Model

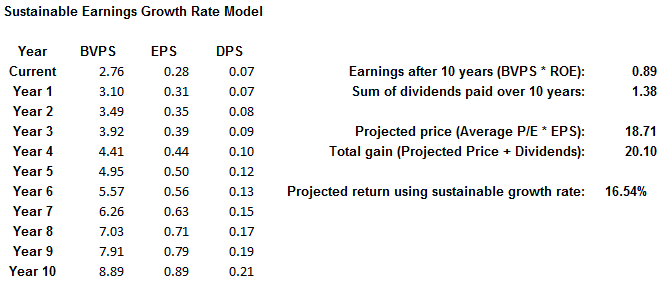

Using the Sustainable Earnings Growth Model, I got PHP 18.71 per share.

Fig. 14 Sustainable Earnings Growth Rate Model

Remember that these are just estimates and are not 100% accurate.

Final Thoughts

RFM Corporation doesn’t sound a bad company at all. Although it’s lagging on growth and earnings compared to its competitors, it doesn’t mean that it’s not competitive.

The management has done a good job for the past 5 years. Long-Term Debts have been paid and earnings, cash flow & retained earnings are now starting to gain momentum.

Soon, the management might acquire other good businesses and expand therefore putting in more cash. It’s only a matter of years before these things will happen. I just hope I’m right.

This concludes my RFM stock review. Do you think that RFM is a good stock to buy? I want to hear your opinions. If you have any questions or reactions, please don’t hesitate to leave a comment below.

Happy investing!

thanks a lot dear 🙂 too bad I can’t sit on a stock for a long time but will still try.. I had bought this stock below 4 pesos before and sold it with at least 1000 peso gain after a week… lols..

Hi Karen, as they always say.. Gain is gain! 🙂

Goodluck and Godbless.

If I only have a budget of 5,000 pesos per month, is it better to buy individual stocks or just invest it in a mutual fund for diversification?

Hi Maybel,

It depends on what amount of risk you can tolerate. I suggest you focus more on the risk before you think about the gains. It’s best to diversify if you’re not sure on the specifics on how an investment will perform.

I focus more on the risk because I don’t want to lose money. I take volatility as an opportunity to buy stocks on cheap prices. I also don’t diversify either; I focus my portfolio on certain securities that I have analyzed well. I don’t buy mutual funds because I want full control of my investments. But that’s just me.

On your case, you have to decide for yourself on how much risk you want to take and the goals you want achieved.

Good luck Maybel. 🙂

A bit late, I know, but…

I bought RFM last August 2016 at P4.20/sh. We all saw how its share price went sideways for the next couple of months.

As of yesterday’s (11 Jan 2017) closing price of P5.01, a 5-month investment has yielded a nice 17% (unrealized) return. Unrealized, i.e. I haven’t sold it yet, since I’m holding on to this one for a while.

Thank you for your stock reviews. Your blog has been a go-to for me ever since I stumbled upon it.

Keep up the good work!

Nice JRP! Thanks for the feedback!