Shell IPO Analysis: Is It Fairly Valued Or Undervalued?

Are you planning to invest in the upcoming Shell (SHLPH) IPO?

If you’re screaming “YES” at the top of your lungs, then you should read this post.

In this post, we’ll dive deep inside Shell’s IPO prospectus to find out the company’s financial health, cash flow and earnings power.

Even if you don’t have any plans to invest in Shell, you still might want to learn some useful information about the Petroleum business. This post might provide you with that information.

Just keep in mind that the valuations and opinions I’ll explain below does not constitute a sound professional advice. After reading this post, you should still do your own research so that you can have a better investment decision.

With that said, let’s dive in.

Some Important Facts About The Petroleum Industry

There are 3 major players in the petroleum business; Petron, PSPC (Shell) and Chevron (Caltex). Of the 3, Petron has the highest refined petroleum products market share by 35%. This is followed by Shell which is at 24% and Caltex at around 7%.

The other players combined like Seaoil, Phoenix, Unioil, Total and PTT captures 34% of the market share.

There are 2 refineries in the Philippines, the first is a 180 kbpd refinery (thousand barrel per day) operated by Petron and the other is a 110 kbpd refinery operated by Shell. Caltex used to have a 72 kbpd refinery in Batangas but was closed down and converted into an import terminal in 2003.

The remaining oil players in the country don’t have their own refineries.

Demand for petroleum products continues to grow since 2011 and is driven by the consumption of gasoline, diesel and jet fuel. Demand grew at a CAGR of 5.2% from 2010 to 2015. This is expected to continue to grow at 3.9% CAGR until 2020 and 3.6% CAGR from 2020 to 2025.

The growth in demand suggests that the oil refining and distribution business will become profitable in the next 10 years. This makes perfect sense to invest in the oil refining business today.

As per Shell, it has now a total of 966 Shell stations – 583 in Luzon, 160 in Visayas and 223 in Mindanao as of June 30, 2016.

Where Will Shell Spend The IPO Proceeds?

Shell will offer 30 million Primary and 270 million Secondary shares w/ over-allotment option of 30 million shares for ₱90/share. This would raise a total net proceeds of ₱21.74 billion.

But a recent news said that Shell will trim down its IPO from P90/share to P64 – P70/share. This would raise around P17.6 billion to P19.2 billion pesos.

The 30 million are Primary (new issued shares) which would raise approximately ₱2 billion. The remaining 270 million shares or 90% which are worth approximately ₱18 billion are Secondary (previously issued). The proceeds will go to the selling shareholders.

Shell plans to use 90% of the ₱2 billion to capital expenditures while the remaining 10% will be allocated as working capital and corporate expenses.

Of that 90%, 60% of it will be allocated to expand the existing retail network. 25% will be spent to refinery turnaround works and the remaining 15% would be used to enhance distribution network.

Financial Health

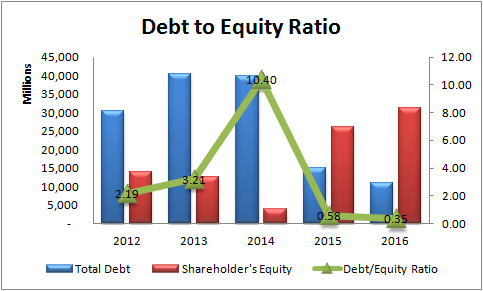

What caught my attention while studying the company’s historical performance is the very high D/E Ratio in 2014.

In 2015 and 2016, it suddenly went down to an attractive 0.58 and 0.35 respectively.

If you’re wondering how did that happened, here’s a simple explanation about it.

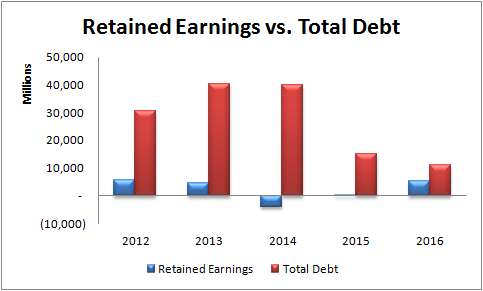

In 2013, the recorded Retained Earnings amounted to ₱4.524 billion. When a sharp decline in oil prices hit the global markets in the fourth quarter of 2014, Shell took a Net Loss of ₱8.488 billion.

This loss resulted to a Retained Deficit of ₱4.184 billion which brought down the Shareholder’s Equity to ₱3.830 billion.

With a Total Debt of ₱39.828 billion from short-term borrowings and loans payable less cash, this resulted to a D/E Ratio of 10.40 in 2014.

Here’s an illustration comparing the Total Debt to the Retained Earnings.

To finance operations this 2015, Shell issued shares and the proceeds amounted to ₱17.852 billion.

In 2015, the Comprehensive Income amounted to ₱4.394 billion. Add this to the last year’s Equity and the proceeds from the issuance of shares, we arrive at an Equity of ₱26.095 billion.

Now the latest report for the 6-month period ended June 30, 2016 recorded a Comprehensive Income amounting to ₱5.101 billion which increased the Equity at ₱31.197 billion.

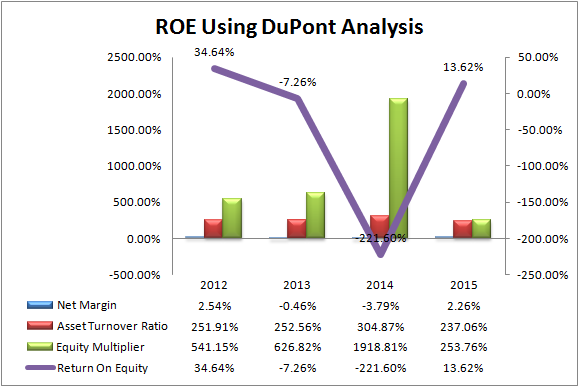

Analyzing Return On Equity

Shell’s 2015 Net Income was recorded at ₱3.553 billion. Return On Equity is as follows;

% ROE = (3.553 / 26.095) x 100

% ROE = 13.62%

At this point, the 13.62% Return On Equity is good because Shell chose to finance its operations using equity instead of debt. The advantage is that they don’t have to repay the ₱17.852 billion and no interest charges will be paid off.

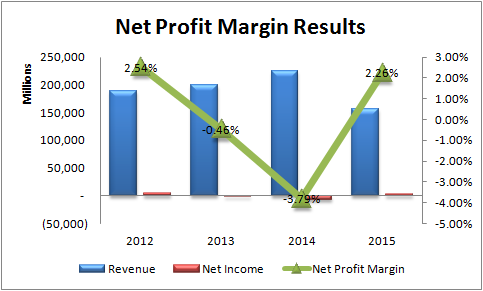

Net Profit Margin

While Petron shows a Net Profit Margin of 1.55% in 2015, Shell displayed a much better 2.26%. But unlike Shell, Petron recorded a 0.68% Net Profit Margin in 2014 compared to Shell’s -3.79%. Petron also recorded a 1.12% in 2013 compared to Shell’s -0.46%.

This only proves that Petron is a much competitive oil player than Shell. Petron can consistently make more than twice the Revenue of Shell because of its market share.

But this doesn’t discount the fact that Shell would be a good investment like Petron. Take note that Shell is the market leader when it comes to commercial fuel oil but falling second to Petron when it comes to diesel and jet fuel.

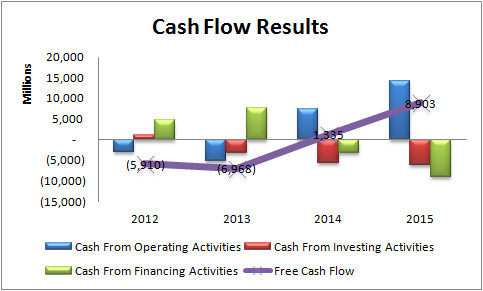

Free Cash Flow

Even though Shell reported a Net Loss in 2014, it still manage to report a positive Free Cash Flow of ₱1.335 billion. One of the reasons I see is the ₱2.299 billion in Depreciation & Amortization since it increases Net Loss but doesn’t include a payment of cash.

What I Like And Don’t Like About Shell

What I like in Shell;

What I don’t like in Shell;

Valuations

At ₱90/share, the company will be priced at ₱145.43 billion. It would have a P/E of 25.8 and P/BV of 3.53.

This sounds expensive to me.

Since there’s news that Shell would trim down its IPO offer at ₱64 to ₱70 per share, Shell would be priced at ₱103.42 to ₱113.12 billion pesos. P/E would play around 18.39 to 20.11. P/BV would be 2.51 to 2.74.

I believe that Shell is a business that can generate an average of ₱4 billion pesos Net Income per year. At a risk-free return rate of 3.793% which is based on today’s 5-yr. gov’t bond rate and a total of 1.615 billion shares outstanding after the firm offer, I would value the business at ₱65.26/share or roughly ₱105.457 billion.

Now, assuming that Shell will pay a ₱0.689/share of dividend just like in 2013, this would give a 1.08% dividend yield which is higher than what Petron has paid last year which is 0.72%.

If the IPO offer would be finalized at ₱64/share, then this would already be a fairly valued business in terms of earnings power.

Final Thoughts

If you’re planning to invest in Shell, consider some of the items I mentioned above. I see positive expectations once the company starts allocating the IPO funds.

In my perspective, I believe that the proposed IPO price of ₱64 to ₱70 per share is a fair price to take. However, it would be better to buy it at a much lower price to provide a safety net to compensate for valuation errors.

This concludes my Shell IPO analysis. Do you think that Shell deserves a much lower IPO price? Or do you think that at ₱90/share, you’re already buying at a bargain price?

If you have something to add or share in the valuations that could help potential investors decide, then let me know your thoughts by leaving a comment below.

Happy investing!

Thanks for the Shell IPO review. I was considering to participate in their IPO. You’ve made some good points that I’d have to do further study on.

Keep up the good work!

You’re welcome JRP.

Just to add, you may also consider the recent news regarding the P5.7 billion peso back taxes issue below.

http://business.inquirer.net/215228/shell-ordered-to-pay-p5-72b-in-back-taxes

If Shell will be forced to pay this tax, this might affect their earnings and therefore will affect future projections.

Hi,

This may sound a cliche but do you happen to have a link for the annual financial report of PSPC last year (or in 2014)?

As of now, my estimates suggest Shell is capable of giving at least 4B PHP for this year. Although based from the primary and overallotment shares announced by the company, my guesstimate is around 900M+ outstanding shares will be given by the company post-IPO. At 67 pesos, with forward 4B PHP net income and 900M+ O.S, possible forward P/E of shell is around 15x-16x. Compare it to its peers like Petron, they are at par with one another.

And yes, hopefully, there’s a dividend announcement next year to entice more investors 😀

Hi Magnum,

Thanks for the valuable input. 🙂

I think this link has all the data you need.

http://pilipinas.shell.com.ph/investors/financial-reports.html

Thanks for the info..

You’re welcome Rolando. 🙂

P/E ration and P/BV is quite not proportion.

Hi Blitzkrieger,

What do you mean not in proportion? Do you mean calculation errors? I re-checked P/E and P/BV and I find no errors nonetheless.

i really like how you do your analysis. since my knowledge in stock is relatively limited, your insights are very helpful.

i initially wanted to invest my 1st stock to SHELL but i opted to get FRISTGEN instead.

thank you!

Hey Anne,

You’re welcome and I’m glad my blog has helped you in your investing decisions. 🙂

Thanks for this!

$SHLPH final IPO price is P67 per share.

You’re welcome Rose. 😀

Oil business is very volatile..simply because it is dependent on world market price dictated by oil producers… foreign exchange…in a few years other sources of fuel will come in… therefore oil industry’s future is not promising..

True. The volatility may pose good buying opportunities though. I would still bet on it if the price is too attractive to ignore. 🙂