Read This Before You Consider Buying NOW’s Preferred Shares

Roughly two years ago, I made a valuation of NOW. Market conditions have changed since then especially that NOW plans to participate in the 3rd Telco bidding. I may now have a valid fundamental reason why I think NOW has a potential to become a good investment.

I'm not talking about it's common shares. What I find attractive is the preferred shares.

In this post, you'll discover why.

I just finished reading the NOW preferred shares offering prospectus and found some interesting points... possibly a good investment idea.

The preliminary prospectus is dated February 5 which is still subject for final revision.

Here's What We Know So Far..

So here's the thing: NOW Corporation plans to raise 500 million pesos by issuing 5 million preferred shares.

If the demand is high, another 5 million shares will be added for a total of 10 million shares.

Maximum gross proceeds will amount to 1 billion pesos.

One thing that attracts my attention is the warrants offered.

Why is that?

NOW went up to as high as Php 20.00 before closing at Php 13.98 last Friday. If you noticed, Php 20.00 is also the convertible rate of the offer shares.

Assuming that NOW wins the bidding and becomes the 3rd Telco player, the price could possibly shoot past Php 20.00.

If it maintains a price above the strike price (Php 10.00) for the next three years, then you win if you exercise the warrants before the third year ends.

Still confused? Here's an easier way to understand it.

Case No. 1: NOW trades above the strike and convertible price.

Suppose you buy 500 shares. Those shares will have detachable warrants equal to 1,000 common shares. If NOW wins the bidding, price may possibly shoot upward given the enthusiasm and exuberance of the market players.

For example, if the stock shoots up to Php 30.00 per share at the end of the third year, you can exercise the warrants and buy 1,000 common shares at Php 10.00. Then you can sell it at Php 30.00.

That's 200% profit on the warrants alone. And you still have the preferred shares that's convertible at Php 20.00 common shares.

If you decide to convert at the third year, that's an additional 50% gain not mentioning the dividends you already earned within the first two years.

Case No. 2: NOW trades below the strike and convertible price.

If NOW loses the bidding, exuberance may fade and the price may drop back to where it was.

According to a Morningstar Research I read, NOW's fair value rests at Php 8.57. It's probably the price where most of the buy and sell decisions will be based.

If the price stabilizes at Php 8.50 before the third year ends, the warrants are worthless because you'll lose money if you exercise them.

Same thing will happen if you convert the preferred shares.

But remember, you still have the dividends. You still get returns. I just hope that NOW pays it consistently.

Case No. 3: NOW trades above the strike price but below the convertible price.

In this case, you'll make money on the warrants and dividends, but if you convert your shares, you'll lose money.

All you have to do is to just keep the preferred shares and exercise the warrants. You still make money in the end.

The Unclear Part

There's no mention of the conversion ratio of the preferred shares. The prospectus only mentions that it is convertible at Php 20.00 per share. This information should be made clear. Otherwise, there's no reason to buy these shares because you basically need the common shares to trade more than Php 100.00 to gain profit from the conversion.

In the cases above, I assumed a conversion ratio of 5. That's five common shares for every one preferred share (100/20 = 5).

Update 2-19-2018: I just confirmed the conversion ratio and it's right, 5:1.

How About The Dividends?

Take note that NOW has no defined dividend policy. And we know that earnings play an important role in issuing them.

Can they really pay their shareholders? Let's take a glance on the financials and decide for ourselves.

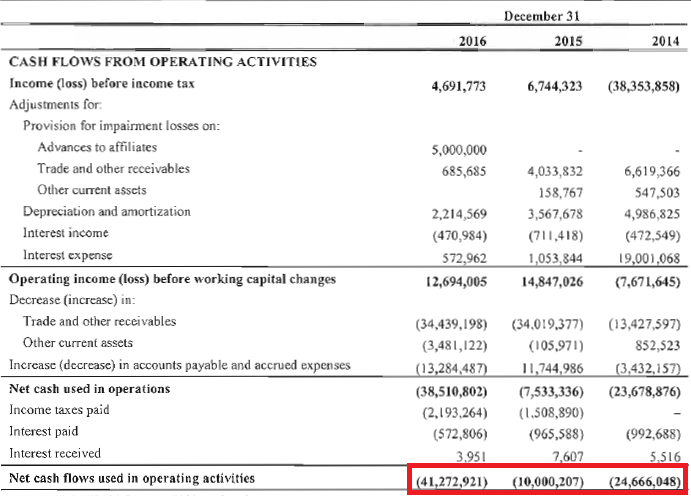

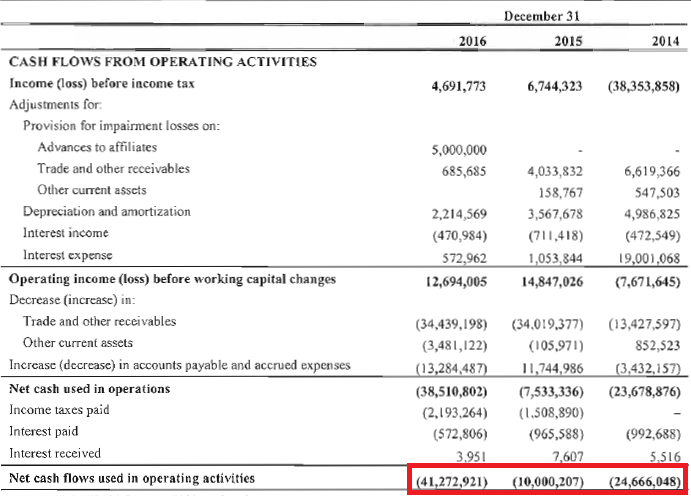

NOW Operating cash flow

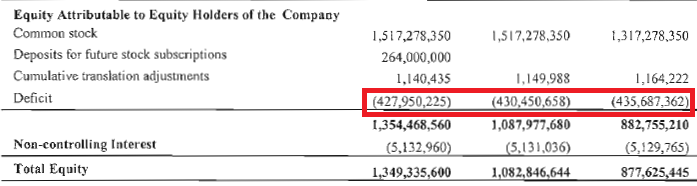

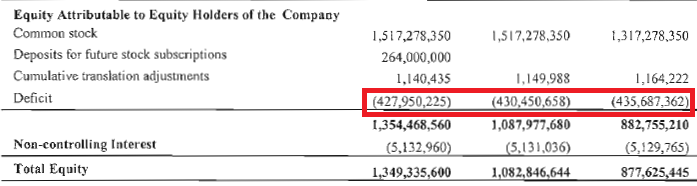

NOW Retained earnings

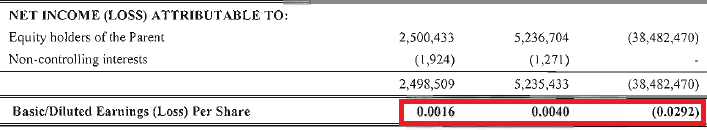

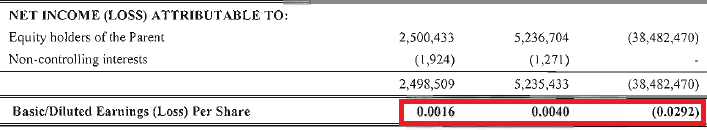

NOW Earnings per share

Key take-away points (red boxes):

Will they be able to give out dividends as promised? I don't know. But with the proceeds they'll get from the offer, it's possible to turn their negative cash flows to the positive territory. But as to how much time it'll take, I really don't know.

But don't worry, the dividends are cumulative. If they missed, then wait for the next payout schedule.

They have to pay the dividends because if not, then they are just milking out their investors.

Final Thoughts

I believe that this offer provides a less risky way of investing in NOW. But all these depends on NOW winning the bid.

If they win, there's a possibility of further price rally. If the price rallies at all time highs, the warrants become valuable... plus you have the dividends.

The disadvantage of this offer is if the price don't come as expected. If NOW loses the bidding, fear will set in causing a sell-off and price will decline.

If the stock further declines below Php 8.50 per share, then I think it's better to buy their common shares instead. At 25% Margin of safety, an ideal buy price would be Php 6.37. Wait for it to appreciate and sell at a profit.

I think there's a correlation between the current price and the warrant's strike price. This, we have to observe in the coming days.

If you believe that the business will:

Then I think you should take the opportunity to participate in this offer.

Got any thoughts on this? I would be happy to hear them in the comments section below.

Happy investing!

Disclaimer: I'm planning to initiate a buy if the common shares drop at my expected price levels or the offer shares comes out. My decision will still depend on the prevailing market sentiment and conditions.

Wow. Amazing. Thumbs up

Where do we buy the preferred shares?

Wait for an announcement. Maybe it will come out on March.

If I already bought NOW stocks prior the Offering – should I buy again to get this warrant and and preferred shares?

What’s your average price in NOW?

6pesos Sir.

Ok. You have a good base there and you’re already in profit. That’s already around 100% return in today’s closing price.

But I don’t know what your goal in that stock is.. Is it to invest or speculate in the ongoing 3rd Telco dev’t?

I think the preferred shares is a less risky way to ‘speculate’ if you understand the logic I’m trying to explain in the post.

Yes Sir, I understand that this stock is highly speculated – but what if the speculation was true? My point here is, how we are entitled to this FOO? because this is my first time. Do we have to buy the shares during the offering even we already have? and if so, do I have to keep my stock until the 3rd yr? Thank you Sir.

1) how we are entitled to this FOO? – Everyone is entitled to participate in the offering. Wait for the disclosure when it will be available. You’ll see that in your broker platform.

2) Do we have to buy the shares during the offering even we already have? – First to explain, I think you’re confusing ‘preferred’ and ‘common’ shares. Regardless of whether you own “common” shares, you can still participate in the preferred offering. To answer, nope, you ‘don’t’ have to buy the shares. But you can buy them if you want if you think that the speculation is true.

3) do I have to keep my stock until the 3rd yr? – You can keep the ‘preferred’ shares as long as you like. But the warrants included can only be exercised at the end of the second year until the end of the third year. If you don’t exercise it, it will expire. If the warrants are ‘in the money’ during that period, then exercise it.

Thank you so much Sir for the answer 😀

Cheers Johann. 🙂